Abbott Laboratories (NYSE:ABT)

Abbott Laboratories, ABT, had a strong move higher in July, stalling at 45. From then it started a long trend lower retracing nearly the entire run up by the beginning of December. The move into January saw price make its first higher high and it continued until it reached the 200 week SMA last week and stalled. The RSI is in the bullish range and the MACD is rising and bullish. Look for a move over the consolidation to participate in the next leg higher…..

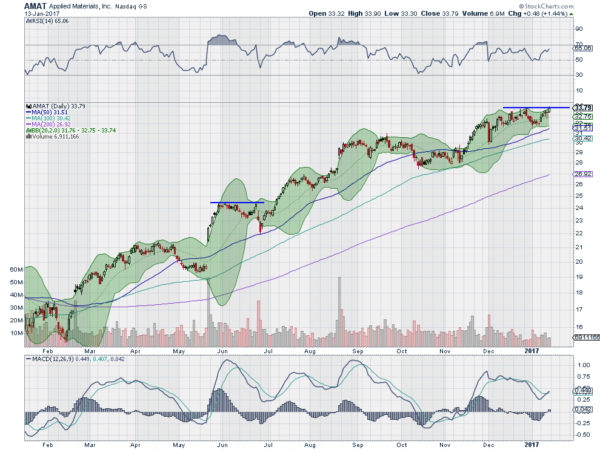

Applied Materials (NASDAQ:AMAT)

Applied Materials, AMAT, has trended higher since February. Often it is said that stocks like these do not give you a chance to get in, never giving a pullback. But this has been consolidating under resistance since December. Friday saw it move back to the top of resistance with support from a rising RSI in the bullish zone and a MACD that has crossed up, a buy signal. The Bollinger Bands® are squeezing, often a precursor to a move. Look for a push over resistance as your opportunity to participate to the upside…..

Citrix Systems (NASDAQ:CTXS)

Citrix Systems, CTXS, started higher from a 2 month base in November. That move made a top in early December and pulled back. The price has now rounded out of that pullback and is approaching the prior high. As it does the RSI is in the bullish zone and rising with the MACD about to cross up. Look for a push over resistance to participate to the upside…..

Graco Inc (NYSE:GGG)

Graco, GGG, had a slow and steady pull back running from April to mid-October. Since then it has reversed back higher, meeting resistance in December and consolidating. The price broke that consolidation to the upside last week and has support for more from a rising and bullish RSI and a MACD that has crossed up and bullish. Look for a hold over the break out to participate to the upside…..

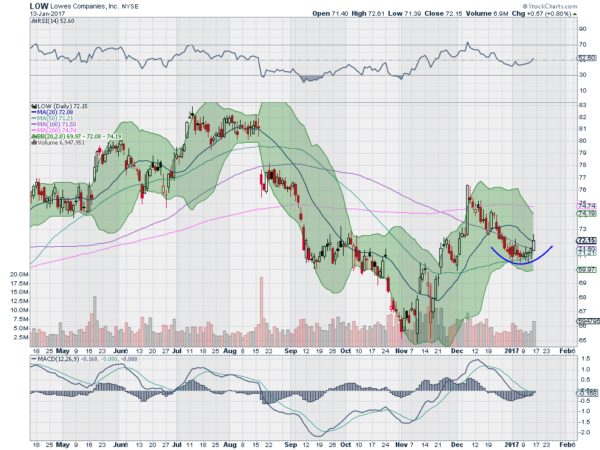

Lowe’s Companies Inc (NYSE:LOW)

Lowe’s, LOW, ran lower in a couple of steps from the middle of August, finding support in November, 20% lower. It ran higher from there, breaking its 200 day SMA in early December before a pullback to its 50 day SMA. Friday saw a push to the upside, rounding out of a bottom. With the RSI holding bullish and turning back higher and the MACD about to cross up a reversal could be building. Look for continued upside to participate…..

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which heading into January Options Expiration and on a short Holiday week, sees the Equity Indexes looking healthy and consolidating if not outright bullish.

Elsewhere look for the bounce in Gold to meet some resistance and possible stall out while Crude Oil churns sideways. The US Dollar Index is poised to continue lower, pulling back in its uptrend, while US Treasuries run the same risk as Gold, finding resistance in the bounce and dropping.

The Shanghai Composite looks to continue to bounce in a tight range mainly sideways as Emerging Markets break to the upside. Volatility looks to remain non-existent keeping the bias higher for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts remain positive with the IWM and SPY in consolidation while the QQQ marches higher. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.