5 Trade ideas excerpted from the detailed analysis and plan for premium subscribers:

Exelixis Inc (NASDAQ:EXEL)

Exelixis, $EXEL, rose in June through the 50 and 100 day SMA’s into a Diamond consolidation in July. Friday it broke out of that Diamond and pushed up to prior resistance. The RSI is rising and bullish and the MACD is crossed up and rising. Look for continuation to participate higher…..

L3 Technologies Inc (NYSE:LLL)

L3 Technologies, $LLL, rose out of a consolidation in July continuing to a top in October. After a pullback in a bull flag it started higher again to the November peak just under 200. A shallow rounding has it back at the peak coming into the week. The RSI is rising and bullish and the MACD is trying to cross up after resetting lower. Look for a new high to participate higher…..

Bank of the Ozarks (NASDAQ:OZRK)

Bank of the Ozarks, $OZRK, pulled back from a March high, finding support finally in September. It rose from there to prior resistance and the 200 day SMA before falling back. It found support at a higher low and has moved up now to a higher high, near the April peak. The RSI is in the bullish zone and rising with the MACD moving up and bullish. Look for continuation to participate higher…..

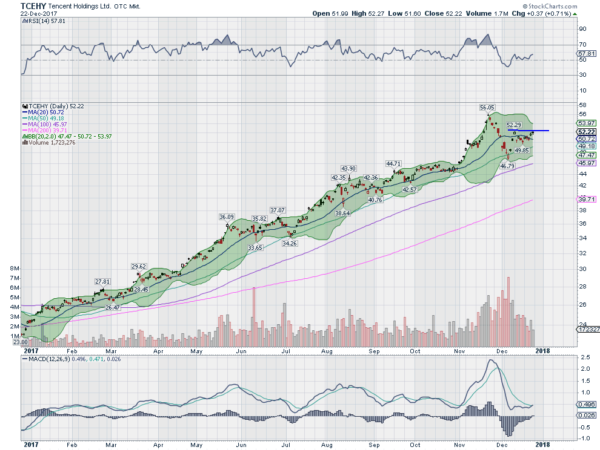

Tencent Holdings Ltd ADR (OTC:TCEHY)

Tencent, $TCEHY, has had a steady ride higher in 2017 until the peak in November. It pulled back to the 50 day SMA and has since consolidated against resistance just under the top. The RSI has reset lower and remained bullish while the MACD also reset lower and is now crossing up. Look for a push through resistance to participate higher…..

Whirlpool (NYSE:WHR)

Whirlpool, $WHR, moved lower from a top in July. Along the way it left two open gaps before making a bottom in November. Coming into the new week it is back at downtrending resistance and horizontal resistance. The RSI is pushing into the bullish zone and the MACD is crossing up. Look for a push over resistance to participate higher…..

Up Next: Bonus Idea

Elsewhere look for Gold to continue higher in its uptrend while Crude Oil also forges higher. The US Dollar Index looks to continue to mark time sideways while US Treasuries are biased lower. The Shanghai Composite and Emerging Markets are looking to stay in consolidation mode.

Volatility looks to remain very low keeping the bias higher for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts agree, especially in the longer timeframe, but may have a quiet week in the short run. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.