5 Trade ideas excerpted from the detailed analysis and plan for premium subscribers:

Cincinnati Financial (NASDAQ:CINF)

Cincinnati Financial, CINF, had a strong move higher through early 2016 until reaching a plateau in July. It held there for nearly 4 months until dropping back to the 200 day SMA at the beginning of November. Since then it has had a wild ride with a fast move higher into early December followed by a quick down move into January and now a second strong bounce.

Into the new week it is at minor resistance with the RSI moving into the bullish range and the MACD crossed up and rising, both supporting more upside. Look for a break over resistance to participate higher…..

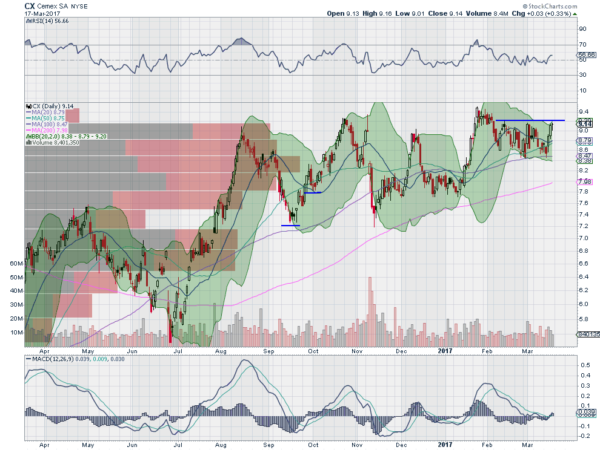

Cemex SAB de CV (NYSE:CX)

CEMEX, CX, moved up from a June 2016 low, stalling in August. Since then it has made a series of higher highs and higher lows, leading to the current consolidation since mid-February. Friday saw the price back at resistance with the RSI moving up and bullish while the MACD has crossed up. Look for a push through resistance to participate to the upside…..

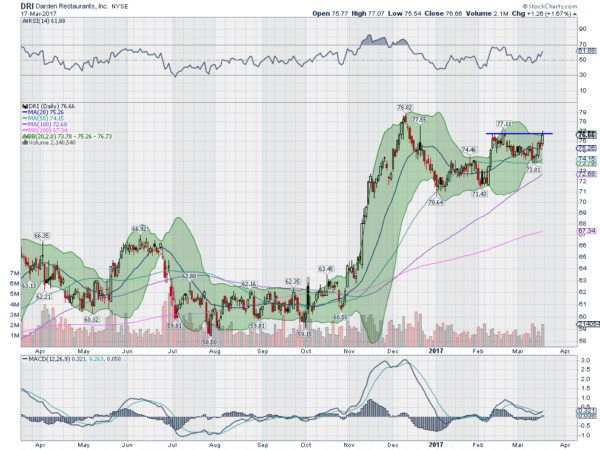

Darden Restaurants (NYSE:DRI)

Darden Restaurants, DRI, rose out of consolidation in November and quickly moved higher to a peak in early December 25% higher. It pulled back from there into the end of the year and had a weak bounce before retesting the pullback low and reversing higher.

It made a higher high, confirming a double bottom and then made a shallow pull back. Last week it pushed higher out of the pullback and ended the week at resistance. The RSI is moving up in the bullish zone while the MACD is crossing up. Look for a push over resistance to participate higher…..

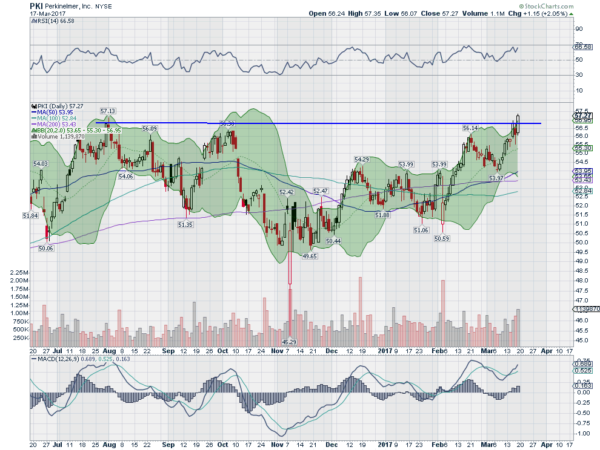

PerkinElmer (NYSE:PKI)

PerkinElmer, PKI, went through a strong trend higher from 2011 until starting a broad consolidation in 2015. That broke to the upside in June 2016, but did not move very far, stalling in late July. Just a new consolidation range slightly higher with support roughly below the 200 day SMA.

Since a bottom in November though it has been moving higher and ended last week at a new all-time high close, and over resistance. The RSI is bullish and rising and the MACD is moving up as well. Look for continuation to participate higher…..

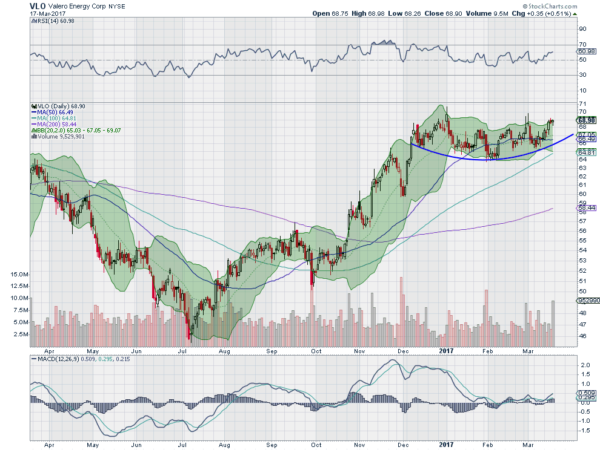

Valero Energy (NYSE:VLO)

Valero Energy, VLO, moved higher off of a low in July last year, reaching a top in December. Since then it has consolidated moving mostly sideways. But since February began it has made higher highs and higher lows, a possible change of character to the upside. The RSI is rising and bullish while the MACD is crossed up and rising. Look for continuation to participate higher…..

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which with the March FOMC meeting and Options Expiration in the rear view mirror, sees the markets to have come through unscathed, although with a new leader.

Elsewhere look for Gold to continue in its short term uptrend while Crude Oil bounces off of support. The US Dollar Index looks to continue lower while US Treasuries are back into consolidation in the downtrend. The Shanghai Composite continues to drift slowly higher and Emerging Markets are fire moving higher.

Volatility looks to remain at abnormally low levels keeping the bias higher for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). The SPY and QQQ look to consolidate on the shorter timeframe just as the IWM is ready to take over leadership to the upside. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.