Bristol-Myers Squibb Company (NYSE:BMY)

Bristol-Myers Squibb, BMY, moved steadily higher from a low in February until reaching a top in July. It paused there moving sideways and then gapped much lower in early August. From that gap down it ran another 20% lower before finding a bottom in October. Since then it has made 2 higher highs and higher lows and finds the price back at resistance after a strong move up Friday. The Bollinger Bands® have squeezed in, often a precursor to a move, and the RSI is in the bullish zone and rising. The MACD is falling but positive. Look for a push over resistance to participate to the upside…..

eBay Inc (NASDAQ:EBAY)

eBay, EBAY, moved sideways out of a falling wedge in March but did nothing until July. That is when the price took off to the upside and even gapped up to 31.50 before a stall, a move of 35%. It made a couple of marginally higher highs after that but then gapped down in October. It printed a ‘W’ like consolidation since that gap down, touching the 200 day SMA with the last bottom, and is now pushing back into the gap. The RSI is in the bullish zone and rising, while the MACD is rising and about to cross to positive. Look for continuation to participate to the upside…..

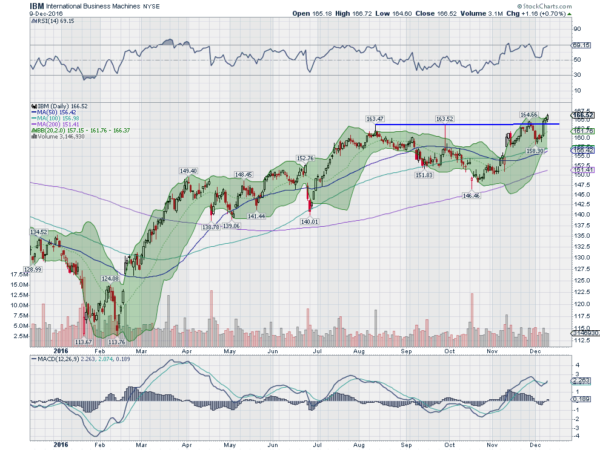

IBM (NYSE:IBM)

IBM, made a high in August with a spike up over 163. It spiked to there again in September but continued to move lower. It eventually came back to its 200 day SMA in October and made yet another assault on the high. It failed again but had only a shallow pullback before reversing up again last week. Friday saw a close over the resistance area with support for more from a bullish and rising RSI and MACD. Look for continuation Monday to participate to the upside…..

Nasdaq Inc (NASDAQ:NDAQ)

Nasdaq, NDAQ, ran higher the first 3 months of the year, then morphed into a sideways consolidation. It jumped out of that in July and made a double top, falling back in September. The price found support at a higher lower and consolidated again. Friday saw a push above that consolidation. The RSI is in the bullish zone and rising with the MACD crossed up and bullish as well. Look for continuation to participate to the upside…..

Och Ziff Capital Manage Grp (NYSE:OZM)

Och-Ziff Capital Management, OZM, went through a long fall, finding a bottom in April printing a long tailed hammer. It consolidated from there for 5 months before a quick spike higher. That put it over the 200 day SMA for the first time since June 2015. But it could not holdup. A Dark Cloud Cover pattern continued lower with 3 Black Crows, eventually finding a bottom in November. It bounced and failed, pulling back to a possible double bottom and then reversed again. It finds the price entering the week at resistance, with a move higher confirming a double bottom. The RSI is bullish and rising while the MACD is also bullish. Look for a push over resistance to participate to the upside…..

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. This week’s list contains the first five below to get you started early. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which heading in to December Options Expiration and the FOMC meeting sees US Equities looking strong but perhaps extended on the short term.

Elsewhere look for Gold to continue its downtrend while Crude Oil continues to move higher. The US Dollar Index also looks better to the upside while US Treasuries continue to be biased lower. The Shanghai Composite and Emerging Markets both are biased to the upside with risk Emerging Markets being only a short term move.

Volatility looks to remain subdued and abnormally low keeping the bias higher for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their short term charts suggest possible exhaustion as they are over sold, but longer term they look very strong. The exception is the QQQ which has been stuck in a range but is now at the top end. Perhaps it will benefit from a pullback in the other index ETFs. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.