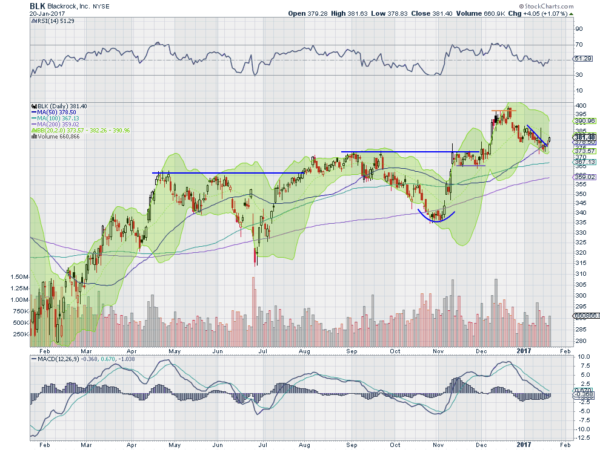

BlackRock Inc (NYSE:BLK)

BlackRock, BLK, had a strong start to 2016, moving higher into resistance in April. It pulled back into June and then made a run to a higher high in September. Another pullback to a higher low was followed by a two step move up to a new high in December. The pullback from the December high touched the 50 day SMA last week and started back higher. The RSI is also turning back higher after holding near the mid line in the pullback. The MACD has stopped falling as well. Look for continuation to participate to the upside…..

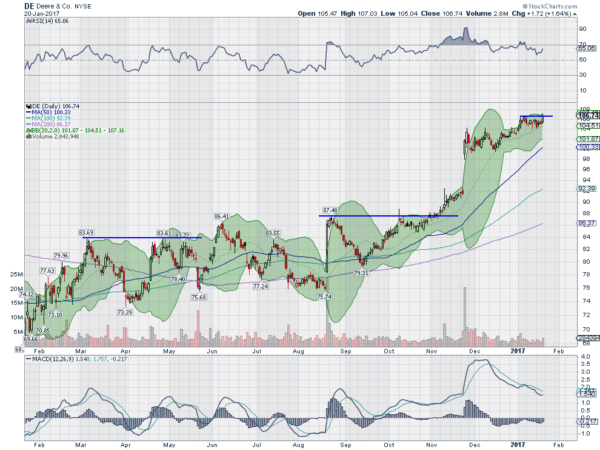

Deere & Company (NYSE:DE)

Deere, DE, went through a long drawn out wide range consolidation from March until November. But then it started higher. It gapped up and met resistance at the end of the month and paused for 3 weeks before another move higher. This too met resistance and consolidated. Friday saw the price back at resistance and the Bollinger Bands® opening up. The RSI is turning back up in the bullish range and the MACD is trying to level. Look for a push over resistance to participate to the upside….

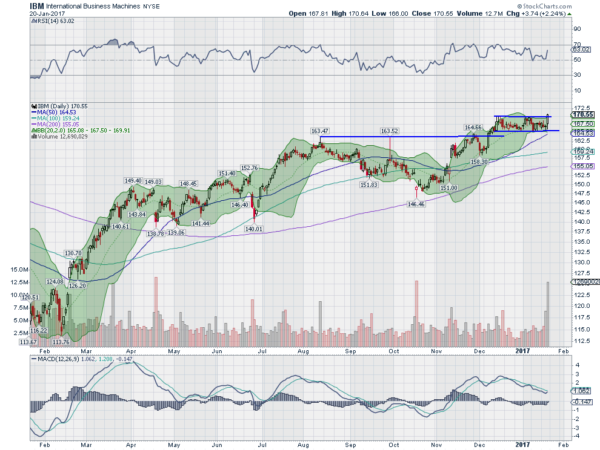

IBM (NYSE:IBM)

IBM started a drift lower in August. It was shallow and by October it had found support about 10% lower. From there it moved back up and met resistance at the same top initially. After a smaller pullback it reversed back higher and to a new high in December. But then it sat in a range until Friday. That is when following its earnings report it broke the range to the upside. The RSI is bullish and moving higher now while the MACD is possibly trying to cross up. Look for continued upside to participate higher…..

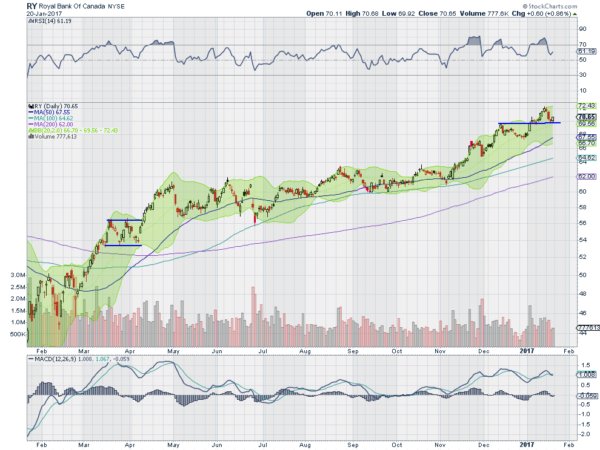

Royal Bank Of Canada (NYSE:RY)

Royal Bank of Canada, RY, was in a long slowly rising trend from May through to early November. But then it woke up and started higher at a faster pace. It has made a series of higher highs and higher lows since then. Friday saw a move back higher, confirming another higher low. The RSI is bullish and rising again while the MACD has crossed down. Look for continuation to the upside to participate…..

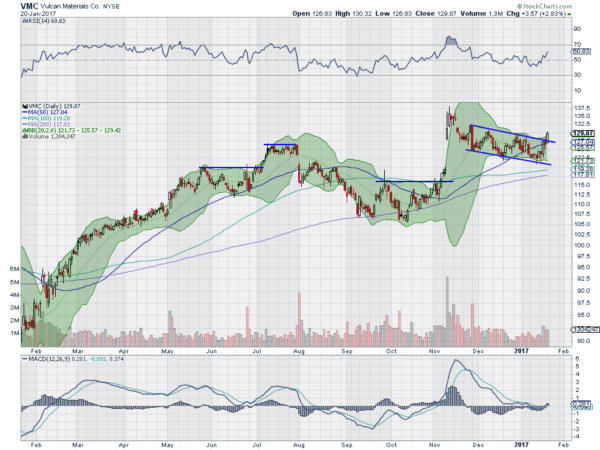

Vulcan Materials Company (NYSE:VMC)

Vulcan Materials, VMC, moved higher from a February low to consolidation in May. With a slight pullback the stock found support at its 200 day SMA and then moved back higher starting in October. It gapped up in November, out of its Bollinger Bands®, and has been pulling back in a bull flag since. Friday saw a break of that flag to the upside. The RSI is bullish and rising and the MACD crossing up, both supporting continued upside. Look for continuation to participate higher…..

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which with the Inauguration and January Options Expiration in the rearview mirror, sees the equity markets holding up very well and remaining strong on the longer timeframe.

Elsewhere look for Gold to consolidate its uptrend or pullback while Crude Oil moves sideways in a range. The US Dollar Index looks better to the downside in the short run while US Treasuries are resuming their move lower. The Shanghai Composite is stuck at 3100 and does not look to change that soon while Emerging Markets look tied in their move higher and ready for a pullback.

Volatility should remain at abnormally low levels keeping the bias higher for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts show the QQQ remaining the short term leader as it creeps to new all-time highs, while the SPY and IWM consolidate moving sideways in the short run. In the longer timeframe all 3 look strong. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.