I apologize for this abbreviated version. I got caught off guard to attend a family event away from home this weekend and have not replaced my laptop yet so could not work when the kids were asleep. I did pick the Top 10 before leaving, but the write is now stating at 7pm Sunday night. Just charts here this week. Back full scale next week.

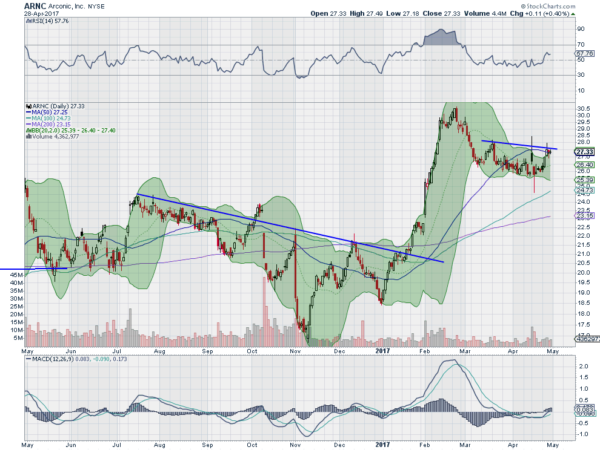

Arconic Inc (NYSE:ARNC)

Arconic, ARNC, is a reversal trade.

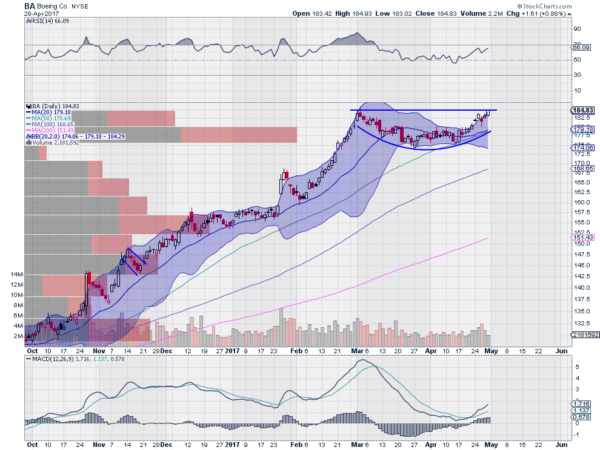

Boeing (NYSE:BA)

Boeing, BA, is a reversal trade.

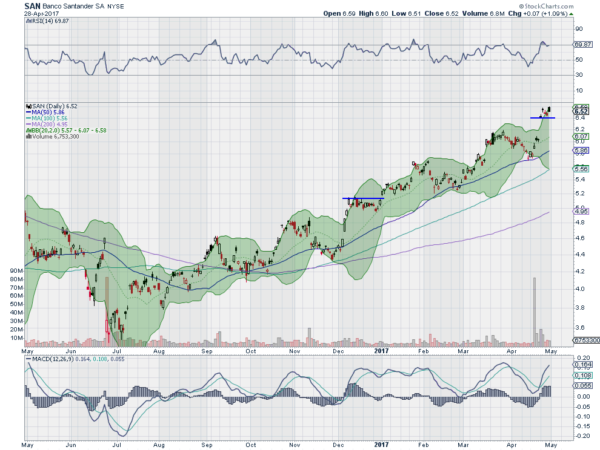

Banco Santander (NYSE:SAN)

Banco Santander, SAN, is a possible breakout trade.

Steelcase Inc (NYSE:SCS)

Steelcase, SCS, is a possible range break trade.

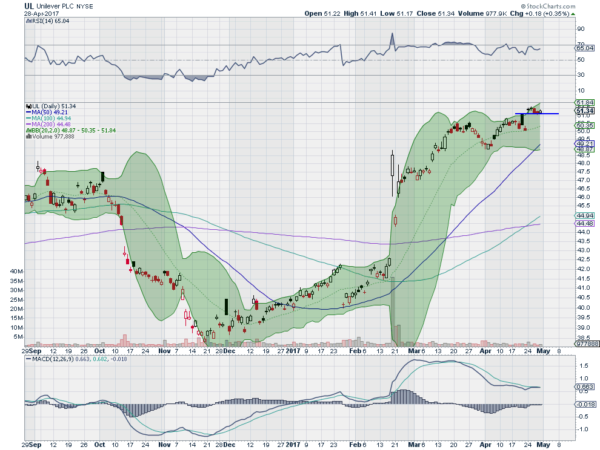

Unilever PLC (NYSE:UL)

Unilever, UL, is a continuation trade.

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which heading into May, sees the equity markets making and testing highs again, but in a mixed fashion with strength shifting to the SPDR S&P 500 (NYSE:SPY) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ) and away from the iShares Russell 2000 (NYSE:IWM).

Elsewhere look for Gold to continue the pullback in its uptrend while Crude Oil consolidates deciding if it is a bottom or just a pause. The US Dollar Index continues to move lower while US Treasuries are biased lower in consolidation. The Shanghai Composite seems to have found support and Emerging Markets are biased to continue higher.

Volatility is back at abnormally low levels and looks to remain very low going forward, keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts show strength in the SPY and QQQ in the short term but the IWM rolling over. On the longer timeframe it is similar with the QQQ leading and the SPY turning up, but the IWM stalling at resistance. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.