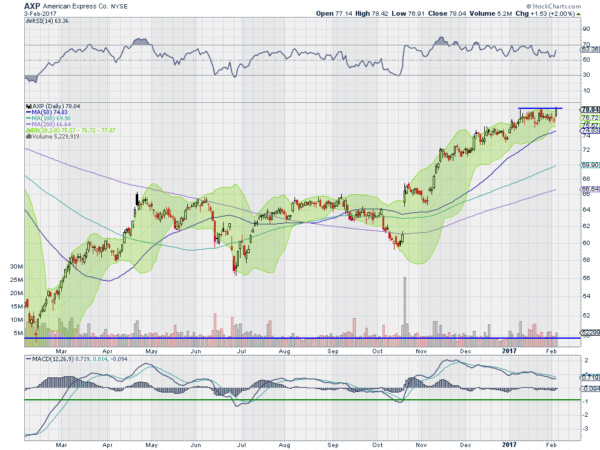

American Express (NYSE:AXP)

American Express, AXP, gapped up in October and after a brief digestive move, started higher. It made a top in early January and has been consolidating since. As it marks time the RSI has reset from overbought, remaining bullish, while the MACD has moved lower. Both now have room to run. Look for a move over resistance to participate to the upside…..

DexCom Inc (NASDAQ:DXCM)

DexCom, DXCM, gapped higher at the start of January, moving out of its Bollinger Bands®. It pulled back from that move quickly, into those Bollinger Bands, and has now stabilized. The RSI has also pulled back from an overbought condition and the MACD retrenched from an extreme. Both remain in bullish territory. The move up off of support Friday is a signal to participate in the upside….

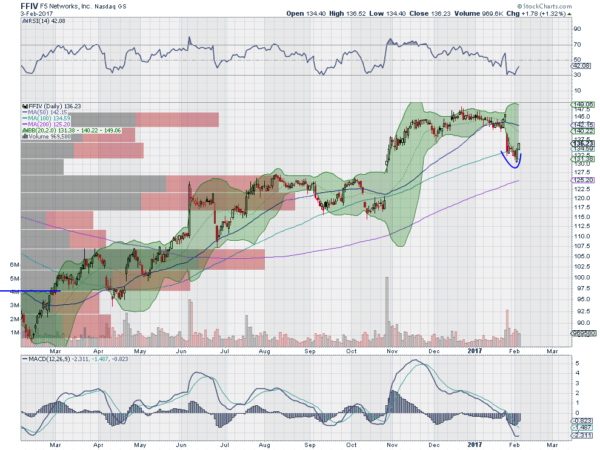

F5 Networks (NASDAQ:FFIV)

F5 Networks, FFIV, went through a long consolidation before gapping higher in November. That move continued until a top in mid-December. It consolidated there for a month as the Bollinger Bands® squeezed and then dropped at the end of January. It ran lower for a few days on declining volume in a pennant before catching a bid Friday and reversing higher. The RSI turned back up as well and the MACD stopped falling. Look for continuation to participate higher…..

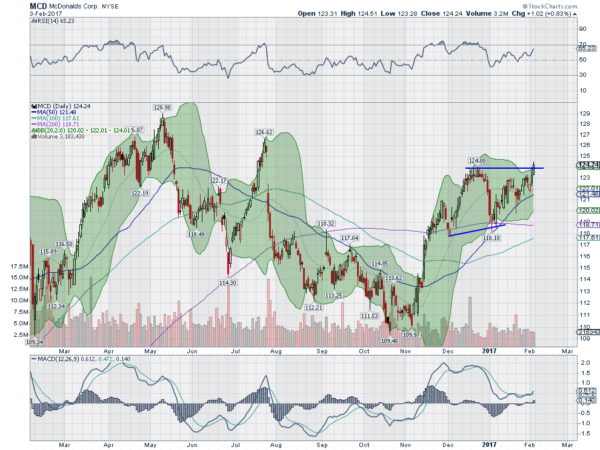

McDonald’s Corporation (NYSE:MCD)

McDonald’s, MCD, was a Top 10 pick at the start of the year and if you are still holding from then congratulations! The move higher places the price at the December high now and a push over that is bullish. The RSI is bullish and rising while the MACD is crossing up and rising as well. Look for continuation to participate higher…..

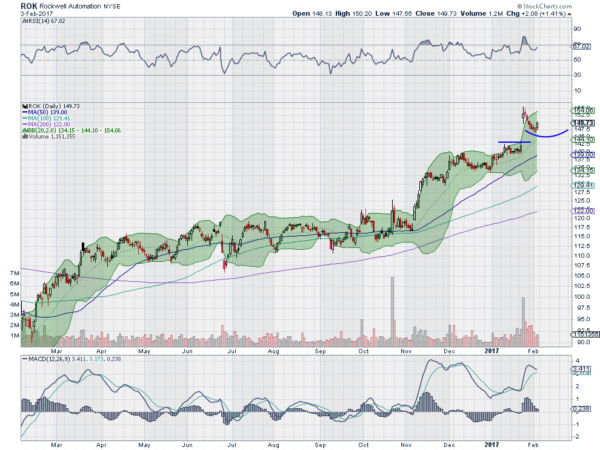

Rockwell Automation (NYSE:ROK)

Rockwell Automation, ROK, moved higher out of consolidation in November, and then slowed the pace into January. It broke above resistance a couple of weeks ago and gapped higher. That took the price out of the Bollinger Bands® and it has drifted back lower since, into the Bollinger Bands. Friday it started back higher, ending the retracement. The RSI is also reversing higher with the MACD still falling. Look for continuation to participate to the upside…..

Elsewhere look for Gold to continue in its short term uptrend while Crude Oil churns with more sideways price action. The US Dollar Index looks to continue to the downside, although it is at a good support area should it want to reverse, while US Treasuries are biased lower.

The Shanghai Composite looks to continue to drift around resistance but higher and Emerging Markets look to continue their recent strength. Volatility looks to remain at exceptionally low levels keeping the bias higher for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts all look strong on the weekly timeframe and are at the edge of breaking out of ranges on the daily timeframe. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.