5 Trade ideas excerpted from the detailed analysis.

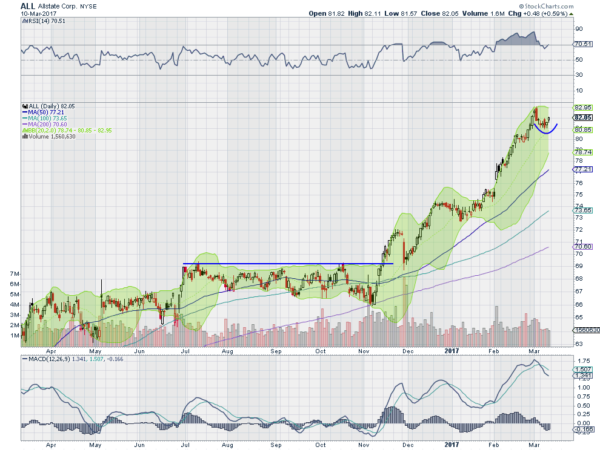

Allstate Corporation (NYSE:ALL)

Allstate, started higher from a long consolidation after the election in November. It reached a shorter plateau in December but then continued higher at the start of February. At the beginning of March it met resistance and pulled back in the shallow curve shown. Friday saw a move higher, starting a new leg up. The RSI is bullish and the MACD slowing its descent. Look for continuation to participate higher…..

BioTelemetry Inc (NASDAQ:BEAT)

BioTelemetry started higher off of its 200 day SMA at the beginning of November, hitting a pause in mid-December. It started back higher again in January and met resistance again at the end of February. It has consolidated since. Friday saw it move to the top of the range with the RSI turning back up in the bullish range. The MACD is also turning up towards a bullish cross. Look for a push over the range to participate to the upside…..

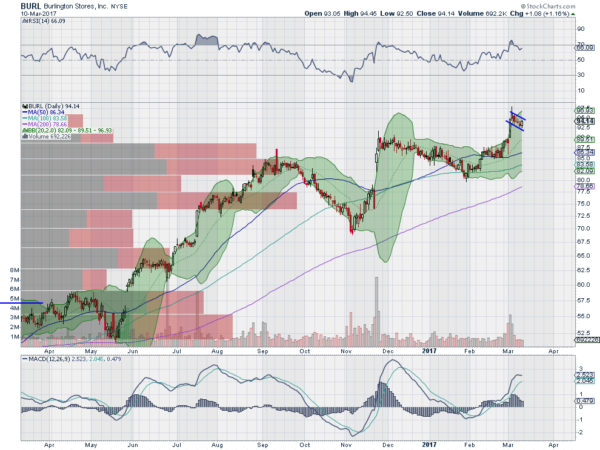

Burlington Stores Inc (NYSE:BURL)

Burlington Stores pulled back into a low in early November. From there it jumped $20 quickly over 2 weeks and then consolidated for over 3 months. It was not until mid-February that it started to drift higher and then accelerated into the beginning of March. It has pulled back since in a perfect bull flag, with price moving slowly lower on declining volume. The RSI is bullish and strong with the MACD flat after a big move up. Look for a break of the flag to the upside to participate higher…..

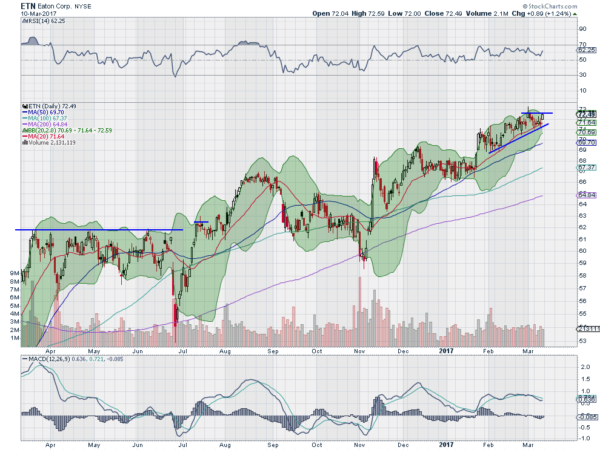

Eaton Corporation PLC (NYSE:ETN)

Eaton, stated to move higher in November. A quick $9 in a week and then it pulled back. The reversal from a higher low made a higher high and then consolidated for 6 weeks before starting higher again. Now it is consolidating against resistance as it rides the 20 day SMA higher. The RSI is in the bullish zone while the MACD is about to cross up. Look for a push to a new high to participate in the upside…..

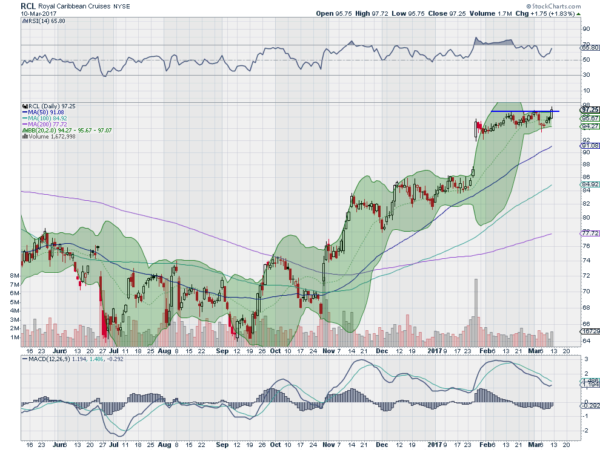

Royal Caribbean Cruises Ltd (NYSE:RCL)

Royal Caribbean,, started higher out of a bottoming process at the beginning of November. Through a couple of steps it has moved higher to the recent plateau at about 97.25. Friday saw a push to the top of the 2 month consolidation with support for more upside from the rising and bullish RSI and MACD turning back up. Look for a push to a new high to participate to the upside…..

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which Heading into March options Expiration week, sees the Equity markets have completed their reset after the most recent leg higher.

Elsewhere look for Gold to continue in its downtrend while Crude Oil also continues lower. The US Dollar Index looks to continue to pullback while US Treasuries are biased lower, possibly ready to break consolidation. The Shanghai Composite is pulling back in the uptrend and Emerging Markets are biased to the downside.

Everything lower so far. Volatility looks to remain at abnormally low levels, keeping the wind at the backs of the equity index ETF’s SPY (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts show the SPDR S&P 500 (NYSE:SPY) and QQQ reversing short term pullbacks and the IWM arresting its drop. Longer term the SPY and QQQ remain strong, while the IWM has cracked and moved lower. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.