Alcoa (NYSE:AA)

Alcoa, AA, rose from a low near 21 after the company split and found resistance in Mid-November. It consolidated under that resistance for 2 months until pushing higher in January. Last week it pulled back and printed a doji Thursday. It reversed Friday to the upside and has support for more from a bullish RSI and MACD. Look for continuation to participate…..

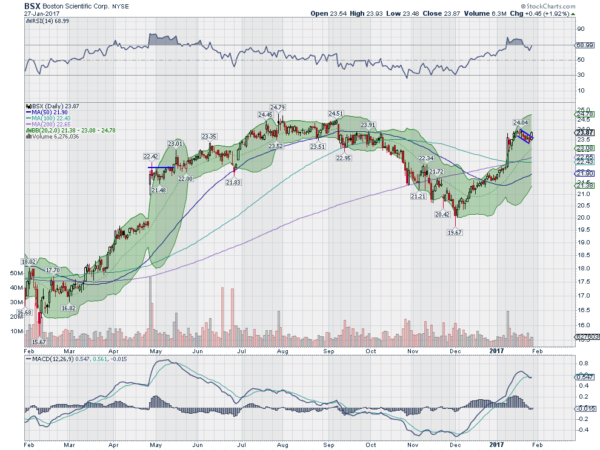

Boston Scientific (NYSE:BSX)

Boston Scientific, BSX, rounded out a top over the summer, pulling back to a low at the beginning of December. Following the drop, it printed a hammer and was confirmed higher to start December. It has trended up ever since. Friday it broke a small bull flag and started higher. The RSI is bullish and rising while the MACD is level after a cross down. Look for a follow through Monday to participate to the upside…..

Cerner Corporation (NASDAQ:CERN)

Cerner, CERN, started moving lower in August, finding a bottom in November. It consolidated there for 2 months until pushing higher earlier this month. It came back to retest the break out before moving back higher last week. The RSI is rising in the bullish zone and the MACD moving higher, both supporting more upside…..

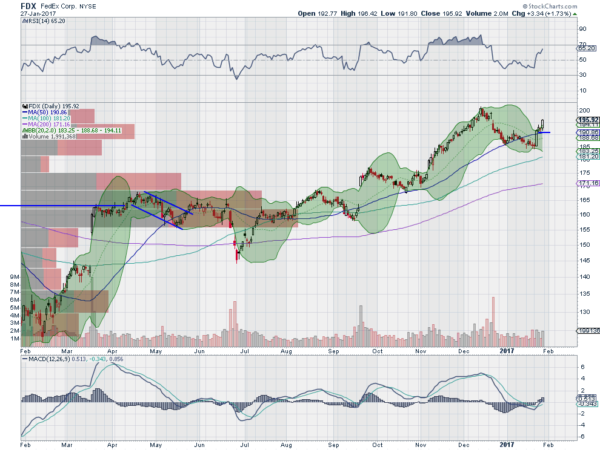

FedEx (NYSE:FDX)

FedEx, FDX, started higher in a couple of steps out of consolidation in September. It found a top in December and pulled back, making a higher low at the start of last week. Now moving higher it enters the week at the support level before the pullback, with a RSI rising and bullish and a MACD crossed up and moving higher. Look for continuation to participate to the upside…..

Yum! Brands Inc (NYSE:YUM)

Yum Brands, YUM, had a strong run higher from a February low. It stalled in September though and had a mild pullback before bouncing just above its 200 day SMA, and returning to resistance. Friday it pushed above and it has support for more from a rising and bullish RSI and MACD. Look for continuation to participate…..

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which heading into February saw the Equity markets continuing to look strong, especially on the intermediate charts.

Elsewhere look for Gold to continue lower while Crude Oil churns over support. The US Dollar Index continues lower but may be bottoming while US Treasuries are biased lower. The Shanghai Composite is resuming its drift higher, but will be closed until Friday while Emerging Markets work higher.

Volatility looks to remain at abnormally low levels keeping the bias higher for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts show real strength continuing in the intermediate term. Shorter term the QQQ has been the leader but is getting a bit overheated, while the SPY and IWM may be ready to start higher out of consolidation. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.