5 Trade ideas excerpted from the detailed analysis and plan for premium subscribers:

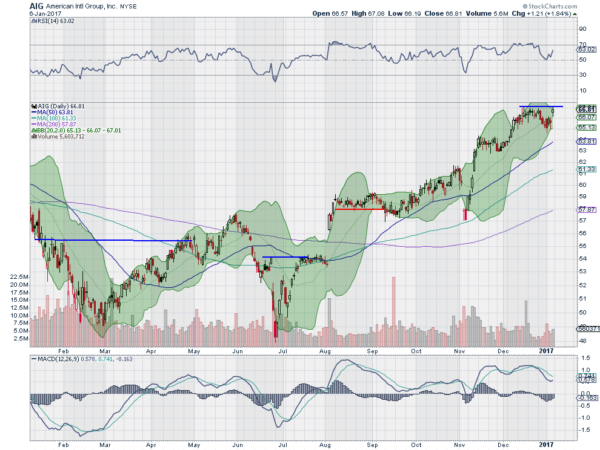

American International Group Inc (NYSE:AIG)

AIG, gapped higher to start August and then stalled for 2 months. In October it started higher but fell back as November started, to the bottom of the prior consolidation. But since then it has returned over 17%. It met resistance in early December and pulled back. Friday saw it push back higher to that resistance though. The RSI is rising in the bullish zone and the MACD is turning back higher. Look for a move over resistance to participate in the next leg up…..

CME Group Inc (NASDAQ:CME)

CME, ran higher at the start of November. That two week run left it outside of the Bollinger Bands®, and it retrenched for the rest of the month. It started a second run higher near the end of the month that became overbought a bit faster and then that also was followed by a pullback. Last week it started higher again. The RSI is turning back up and the MACD level after falling. Look for continuation to participate to the upside…..

Honeywell International Inc (NYSE:HON)

Honeywell, HON, started higher a gap down in October. It paused at resistance later in the month and pulled back, before a second move higher at the start of November. That also pulled back from resistance and started higher in the beginning of December. It has pulled back from resistance a third time now and retraced back to it to start January. With the RSI bullish and rising and the MACD about to cross up look for a push through resistance to participate to the upside…..

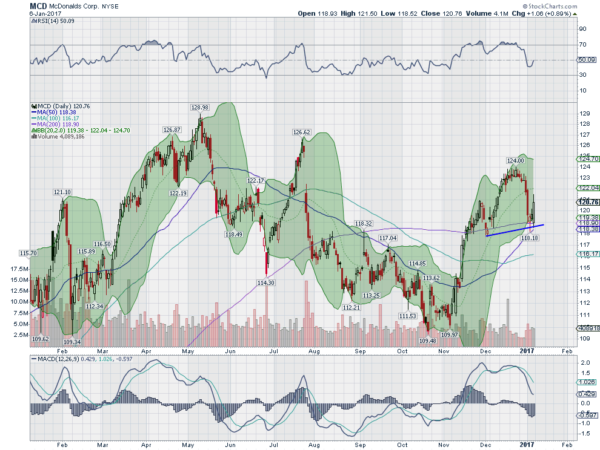

McDonald’s Corporation (NYSE:MCD)

McDonald’s, MCD, made a lower high in July and started a trend lower that did not end until early November. That left the stock nearly 15% lower. But since then it made a strong run up to a high near thanksgiving and then with a shallow pullback to a higher high in December. That was followed by a higher low last week and a strong finish Friday. The RSI is moving higher and back over the mid line while the MACD is still falling, but positive. Look for continuation this week to participate to the upside…..

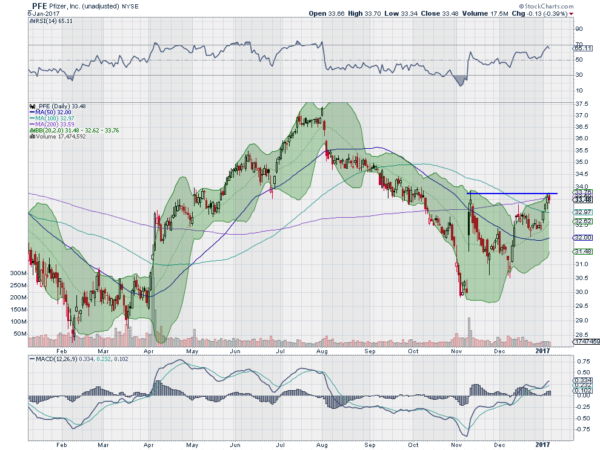

Pfizer (NYSE:PFE)

Pfizer, PFE, broke a short consolidation with a thrust higher to begin August. The next day though it opened lower and went on a more than 3 month trip lower, losing nearly 20% of its market cap. It made a low in early November and gapped higher following the election. That did not last though as it retraced nearly filling the gap. A second move higher stalled in the same area and a shallower pullback has now reversed to that same resistance. The RSI is in the bullish zone and the MACD is rising and bullish. Look for a push through resistance to participate to the upside…..

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which heading into the first full week of 2017 sees the equity index ETF’s looking strong, as if they had a restful holiday break.

Elsewhere look for Gold to continue the bounce in its downtrend while Crude Oil continues higher. The US Dollar Index may continue to digest its break out while US Treasuries continue their bounce in the downtrend. The Shanghai Composite is resuming its uptrend and Emerging Markets are biased to continue higher short term as well.

Volatility looks to remain at abnormally low levels keeping the bias higher for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts all look great for more upside on the longer timeframe. On the shorter time frame the QQQ looks to be the leader moving higher while the SPY is not far behind and the IWM consolidates. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.