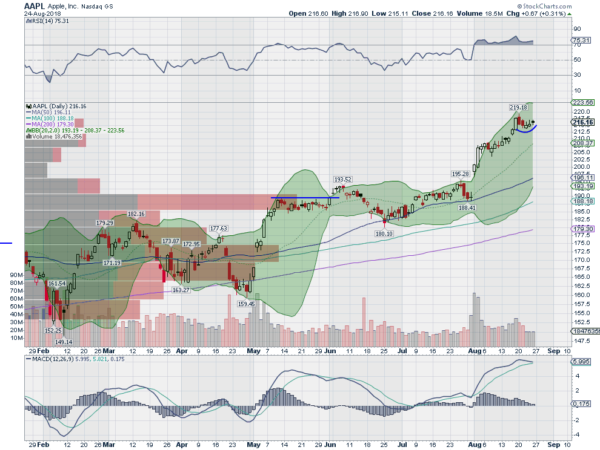

Apple (NASDAQ:AAPL)

Apple, $AAPL, gapped up out of consolidation to start August and continued higher. It met resistance last week and made a shallow pullback, before reversing higher Friday. The RSI is bullish and slightly into overbought territory, but not extreme. The MACD is leveling as it meets the signal line. Look for continuation to participate higher…..

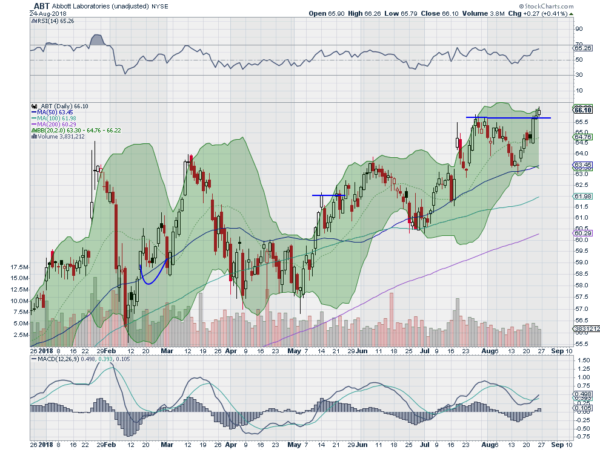

Abbott Laboratories (NYSE:ABT)

Abbott Laboratories, $ABT, started moving up in May along the 50 day SMA. Two weeks ago it touched the 50 day SMA again and started the current leg higher. And Friday it closed at a new high while pushing the Bollinger Bands® open. The RSI is rising and bullish with the MACD crossed up and positive. Look for continuation to participate higher…..

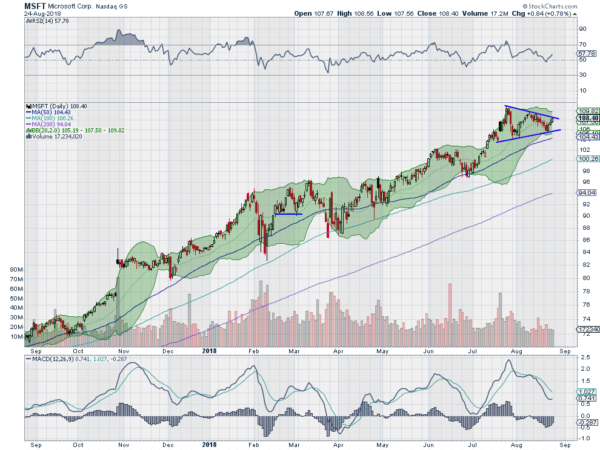

Microsoft (NASDAQ:MSFT)

Microsoft, $MSFT, has had a long steady run higher, with some consolidations along the way. It is currently consolidating in a symmetrical triangle, and poking at the top side on the 5th touch. The RSI is rising and bullish with the MACD turning up and positive. Look for a break higher to participate…..

Netflix (NASDAQ:NFLX)

Netflix, $NFLX, made a top in June and pulled back to its 20 day SMA. It tried to move higher again into July but could not hold up and then confirmed a double top with a gap down mid-month. It continued lower to a bottom in August before bouncing. Friday it made a higher high. It has a RSI that is rising to the bullish zone with the MACD crossed up and rising. Look for continuation to participate higher…..

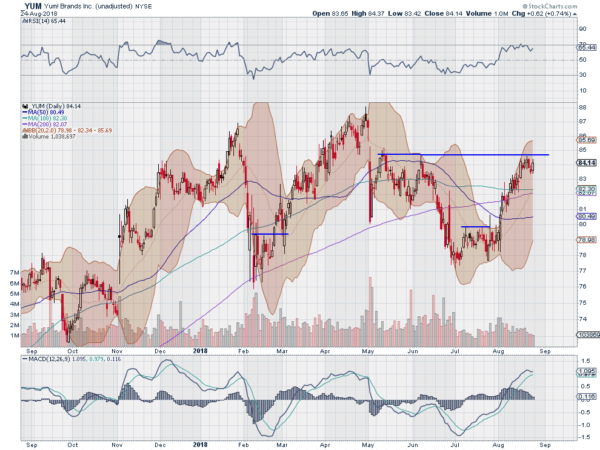

Yum! Brands Inc (NYSE:YUM)

Yum Brands, $YUM, started higher off of a base in July at the beginning of August. Last week it reached the May and June resistance levels and flattened out. As it sits there the RSI is strong in the bullish zone with the MACD flat and positive. Look for a push over the resistance to participate higher…..

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which as the summer winds down with the last week of August coming up sees the equity markets waking up and moving higher.

Elsewhere look for Gold to possibly bounce around in its downtrend while Crude Oil moves higher. The US Dollar Index is stalling in its uptrend while US Treasuries may be on the verge of breaking their consolidation to the upside. The Shanghai Composite continues to look weak and with an easier path lower while Emerging Markets are bouncing in their downtrend.

Volatility looks to remain at very low levels keeping the bias higher for the equity index ETF’s SPY (NYSE:SPY), IWM and QQQ. Their charts are aligned with that view. The shorter daily timeframe shows all 3 back in uptrends, with the QQQ the only one short of its all-time high level. The weekly charts all look fantastic as well and show lots of upside potential. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.