Akamai Technologies (NASDAQ:AKAM)

Akamai Technologies, Ticker: $AKAM, started higher in August and progressed in a steady trend higher. In December it gapped up and then started to move sideways. it pulled back in early February to the 50 day SMA and then reversed again to the upside. It ended last week breaking through resistance to a new 52 week high. The RSI is rising and bullish with the MACD also moving higher. Look for continuation to participate…..

Activision Blizzard (NASDAQ:ATVI)

Activision Blizzard, $ATVI, lifted off its 200 day SMA in December and then rose out of a long consolidation. It made a top at the end of January and pulled back touching the 50 and then 100 and SMA’s, before reversing back higher. Now it is back at the prior high with the RSI in the bullish zone and the MACD rising. Look for a break through to participate higher…..

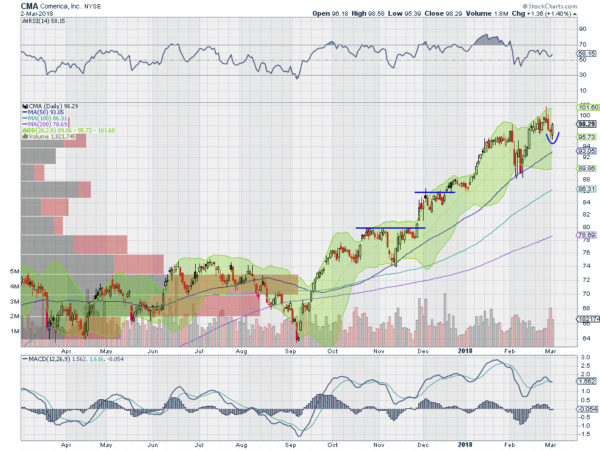

Comerica (NYSE:CMA)

Comerica, $CMA, rose off of a bottom in September and stepped higher. It has pulled back to find support at the 50 day SMA a couple of times along the way, with the latest being in February. Last week it had a minor pullback and then closed with a strong move higher Friday. The RSI is in the bullish zone and the MACD is avoiding a cross down. Look for continuation to participate higher…..

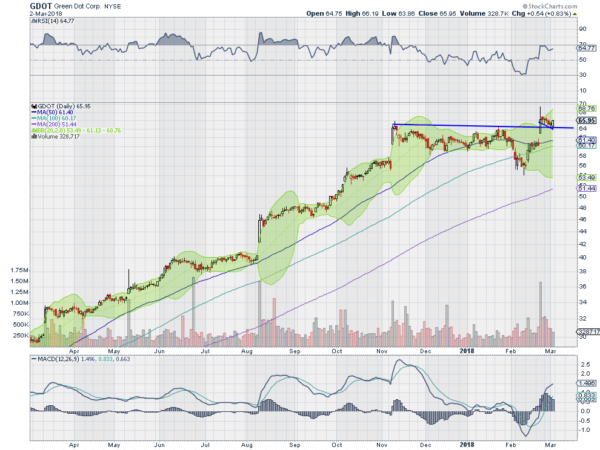

Green Dot Corporation (NYSE:GDOT)

Green Dot, $GDOT, went through a long move higher that turned into consolidation in November. It continued sideways for 3 months before a dip lower and then rebound up to the prior consolidation. It gapped higher 2 weeks ago and came back to retest the break out last week, holding over it. Friday saw a stronger candle, boding for a reversal higher. The RSI is bullish and rising with the MACD moving up. Look for a move higher to participate…..

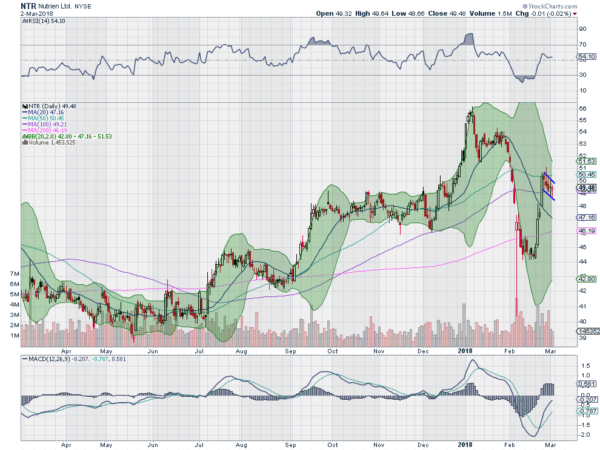

Nutrien Ltd (NYSE:NTR)

Nutrien, $NTR, has only been trading for 2 months, the result of a merger, but with price history implied moving backward. The stock took a dive following the merger and then quickly recovered, only to plummet into early February. Since then though it has found support and moved back higher. It consolidated last week after the quick move higher with the RSI turning up toward the bullish zone and the MACD rising. Look for a break higher to participate…..

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. This week’s list contains the first five below to get you started early. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which as the calendar turns to March sees the equity markets again looked weak only to finish with a strong Friday, like February 9th.

Elsewhere look for Gold to continue to consolidate in a broad range while Crude Oil may pause in its short term downtrend. The US Dollar Index continues to consolidate sideways while US Treasuries are consolidating after their move lower. The Shanghai Composite is biased to the downside short term and Emerging Markets look to tighten their broad consolidation at the recent top.

Volatility looks to remain elevated keeping the bias lower for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts showed big moves lower this week and then strength on Friday suggesting a possible reversal. The weekly charts are not as optimistic with red candles at lower highs. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI