Aflac Incorporated (NYSE:AFL)

Aflac, $AFL, has had a long steady run higher. In January that run hit resistance and pulled back, first to the 50 day SMA and then through it. It bounced back to that resistance level but failed to break through each time. The pullbacks have made higher lows though as it consolidates. The price is moving back higher as we start the week with the RSI rising in the bullish zone and the MACD moving higher and positive. Look for a push to new highs to participate…..

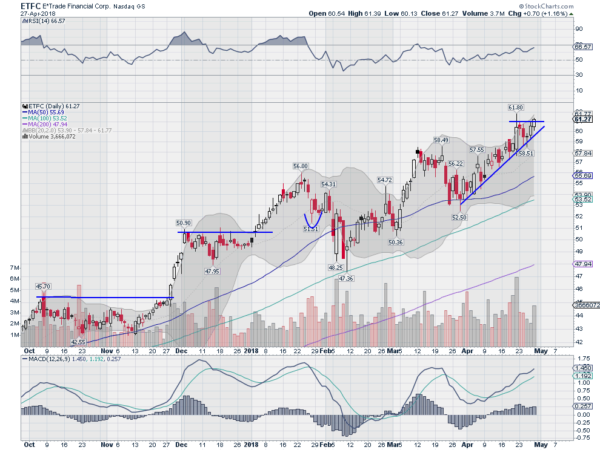

E-TRADE Financial Corporation (NASDAQ:ETFC)

E*Trade, $ETFC, rose out of consolidation in November and made a top in January. It pulled back with the market into February, touching its 100 day SMA before reversing. Then it made a higher high into March before a second pullback, this one to a higher low. It settled on the 50 day SMA and was rising steadily until last week. A minor pullback met the rising trend and it reversed higher again. The RSI is rising and bullish with the MACD moving higher. Look for continuation to participate to the upside…..

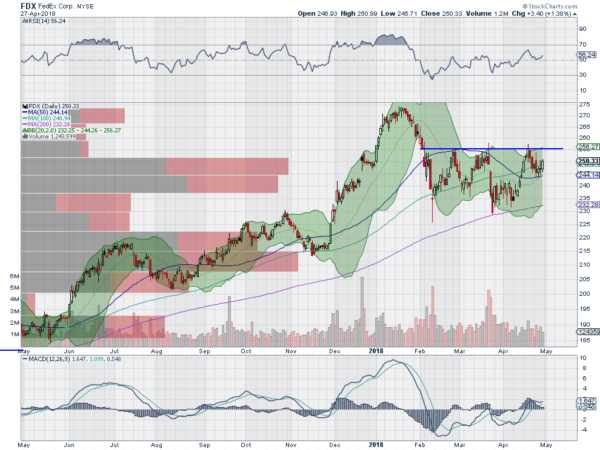

FedEx (NYSE:FDX)

FedEx, $FDX, ended its move higher in January and pulled back into consolidation. It touched its 100 day SMA and then moved sideways under resistance and over the 100 day SMA into late March. It then dropped harder, testing the 200 day SMA and bounced again, back to the same resistance. A weaker pullback found support at the 50 day SMA last week and turned back up. The RSI is also turning up form a higher low with the MACD avoiding a cross down and turning higher. Look for a push through resistance to participate higher…..

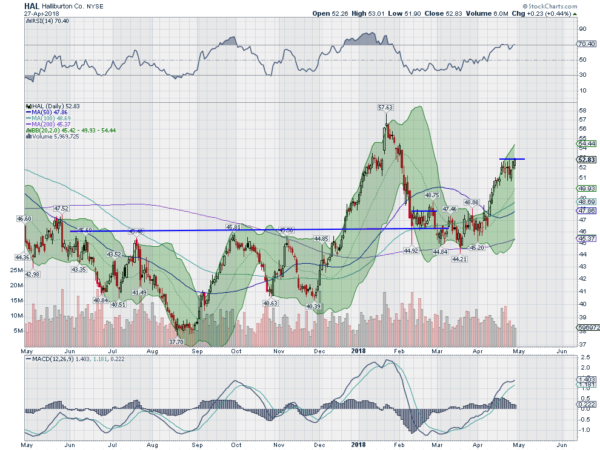

Halliburton (NYSE:HAL)

Halliburton, $HAL, broke above resistance in December on its way to a top at the end of January. The Shooting Star at the top was confirmed as a reversal and then it pulled back to retest the break out. A slight overshoot and then it settled. It started back higher 3 weeks ago and paused briefly before turning back up at the end of last week. The RSI is bullish and rising with the MACD flat but positive. Look for continued upside to participate higher…..

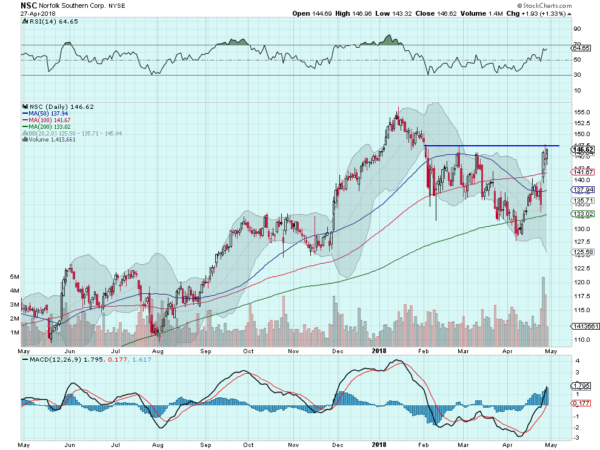

Norfolk Southern (NYSE:NSC)

Norfolk Southern, $NSC, started moving higher in August, and broke out of consolidation at the end of the month. It continued higher to a pause in October then a second step to the top in January. From there it pulled back through the 200 day SMA and found support at the beginning of April. It reversed from there and is now at resistance coming into the week. The RSI is rising and bullish with the MACD moving higher and positive. Look for a push over resistance to participate higher…..

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which with the calendar about to turn from April to May sees the equity markets are floundering. They could sure use some May flowers after all the spring rain. Elsewhere look for Gold to continue its broad consolidation while Crude Oil remains in an uptrend. The US Dollar Index is showing signs of life and attempting to reverse higher while US Treasuries are bouncing in their downtrend.

The Shanghai Composite looks weak and possibly on the verge of a big move lower while Emerging Markets continue to churn at the highs. Volatility looks to drip lower and out of the nearly 3 month range, which would be a positive for equities. The equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ), all seem stuck in tightening consolidation and holding over important support on the longer timeframe. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.