Last week, the S&P 500 fell by approximately 0.80%, despite surging by nearly 2% on Friday alone. Apple (Nasdaq:AAPL) and regional banks saw sharp gains, even with a hotter-than-expected job report. As for Friday’s move higher, it was likely due to the market being oversold to some degree, along with the usual Friday volatility selling and 0DTE crowd being out in full force. However, it’s unlikely that this trend will continue next week. Economic data and Fed speakers will deliver plenty of headlines for investors to consider.

Furthermore, the Fed is now officially past the spoon-feeding phase of its monetary policy. Every decision it makes won’t be well-telegraphed, making things tougher for investors. The direction of rates will depend on economic data. If inflation remains elevated and the data is hot, the odds for more rate hikes will be present, while the bar for rate cuts is much higher.

On Monday, we are anticipating the long-awaited senior loan officer survey at 2 PM ET, which will be important in determining whether banks are tightening lending standards. This survey will also help determine whether the credit crunch talked about on TV every five minutes is actually coming or not.

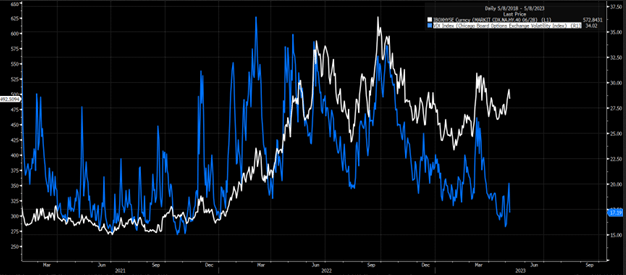

If it is coming, it is well-disguised, as credit spreads don’t seem to be reflecting such a thing. This is especially true when looking at the high-yield credit spread index, which is still below 500 and has yet to make a higher high. It is also not visible in the VIX index, which tends to trade closely with the high-yield credit spread index.

On Wednesday, we are anticipating the April CPI reading, which is expected to show a year-over-year increase of 5% on the headline reading and a gain of 5.5% on the core reading. The crucial thing to watch, of course, is the month-over-month change, which is expected to show a gain of 0.4% on the headline and 0.3% on the core readings.

Both of these numbers are too high to be consistent with a 2% inflation rate. Anything higher would create even more problems for the Fed, especially following the hotter-than-expected non-farm payroll report. Luckily for the Fed, they will get another job report and inflation report before the June FOMC meeting.

1. S&P 500 (SPX)

Since the end of March, the S&P 500 has been stuck between 4,100 and 4,200, and I still believe that the bulls are trapped around the 4,200 region. They have been unable to show the ability to push the index much higher, and the other problem at this point is that peak earnings season has passed.

All of the big names that helped to lift the index higher are probably running out of steam at this point. Additionally, momentum based on the RSI is lower, noted by the lower lows and lower highs, which is a divergence from the higher lows seen in the S&P 500 index since October.

This weakness is also illustrated in the weekly rate of change in the index, which is currently on the zero bound and appears to be heading toward the lower bound. This suggests a potential 200-point drop from current levels in the coming weeks.

2. Nasdaq 100

Meanwhile, the trading range in the Nasdaq 100 is getting tighter and forming a rising wedge pattern, with a bump-and-run pattern forming as well. The consolidation is more apparent in the RSI for the Nasdaq. This suggests that the Nasdaq will remain fairly trapped at current levels and is likely to head lower from here. However, it’s waiting for that decisive break lower.

3. Meta Platforms

Meta Platforms (NASDAQ:META) shares, which have been one of the big leaders in 2023, are seemingly finally running out of steam. The stock has retraced 50% of its losses from its peak in 2021 and has managed to stall at resistance around $236, reaching the upper end of its trading channel.

It still has a significant gap to fill down to around $212. If that gap was an exhaustion gap, which it appears to be, given the stock’s inability to rally further, then it should get filled soon.

4. Alphabet

Meanwhile, Alphabet Class A (NASDAQ:GOOGL) has seemingly run out of steam around $108 and has been unable to push through that resistance level. It appears to be running out of short-term momentum.

5. Tencent

Additionally, we have seen weaknesses start to emerge overseas, such as in Hong Kong technology names like Tencent Holdings (HK:0700). Tencent was a leader in the space off the October lows but has more recently turned sharply lower, despite the Technology ETF (NYSE:XLK) continuing to trend higher. Currently, Tencent is testing its lower support level with a drop below 332 HKD, which is a very clear negative for the entire global technology group.

This week’s FREE YouTube Video:

That’s all, good luck this week.