For months, I have been discussing the likely implications of deteriorating market breadth. For instance, fewer and fewer components are holding up the Dow, the S&P 500 and the NASDAQ. Only a small number of industry sectors are keeping the popular benchmarks in the plus column. Similarly, half of the stocks in the S&P 500 currently demonstrate bearish downtrends. And declining stock issues are significantly pressuring advancing stock issues for the first time since July of 2011.

Historically, when a handful of stocks like Amazon (NASDAQ:AMZN), Apple (NASDAQ:AAPL), Facebook (NASDAQ:FB), Gilead (NASDAQ:GILD), Google (NASDAQ:GOOGL) and Walt Disney Co (NYSE:DIS) account for all of the gains for a major index like the S&P 500 – when 250 of the index constituents show bearish patterns – the narrow breadth tends to drag the benchmark’s price downward. To be fair to the bull case, the major indices have held up so far. Nevertheless, U.S. equities in the Dow and the S&P 500 have been churning sideways for the better part of seven months.

What about the prospect for underperforming sectors of the economy contributing to widespread market gains? I wouldn’t hold my breath on the possibility of wider breadth in the near term. Materials and resources-related companies continue to be plagued by slumping oil and weak commodity demand around the globe. Most economists believe that while the rout in commodities may conceivably abate, a significant increase in global demand or a sharp decline in global supply is unlikely. In the same manner, the manufacturing segment’s pullback may be structural, not cyclical. Miners, industrial conglomerates and utilities probably won’t be getting wind at their back anytime soon.

For better or worse, the primary hope for continued appreciation in the U.S. indices rests atop the shoulders of the healthcare juggernaut, dot.com usage and the iPhone-oriented consumer. Indeed, investors have been remarkably willing to pay almost any price for the growth of the “Facebooks” and “Gileads” of the world.

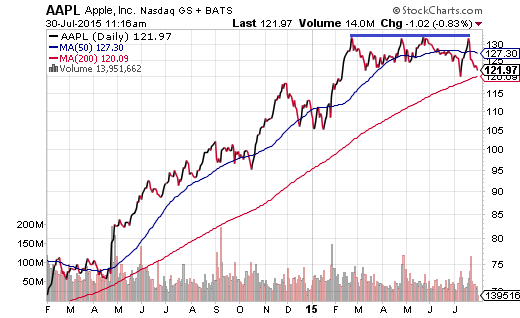

On the flip side, can the market-cap behemoths do any wrong? Of course they can. It wasn’t so long ago that Facebook shares face-planted for a 50% loss out of the IPO gate. Similarly, Apple tumbled 45% at the tail-end of 2013. Even at this moment, questions about the viability of the iWatch and the corporation’s ability to grow at a rapid pace in future quarters is keeping the shares of the largest company on the planet from breaking through resistance.

For the time being, however, lets assume that the “Big Six” identified earlier maintain their proverbial cool. And lets assume that the narrow breadth in the U.S. benchmarks (as well as sky-high stock valuations) are not enough to dent the positive impact provided by health care and retail/consumer stocks. Is it possible that waning enthusiasm for foreign equities might couple with the weakness in U.S. market internals and sky-high valuations to eventually topple the major U.S. benchmarks?

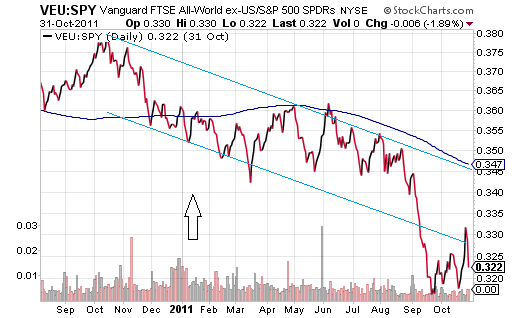

Looking back to the last stock market smack-down might provide some clues. Specifically, in 2009 and 2010, stocks throughout the world staged a revival. What’s more, in the same manner as they had in the previous decade, foreign stocks significantly outpaced U.S. stocks in 2009 and 2010. In fact, the global growth theme that dominated the initial decade of the 21st century remained in the driver’s seat. The dominance ended in October of 2010, however. Not only were the “emergers’ emerging at a slower pace, particularly China, but central bank stimulus supplanted the global growth story altogether.

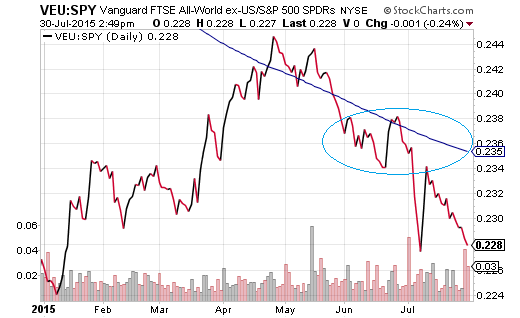

Consider the Vanguard FTSE All-World ex US (NYSE:VEU):S&P 500 SPDR Trust (ARCA:SPY) price ratio below. VEU:SPY began descending in the 4th quarter of 2010. The fading relative strength for VEU:SPY cemented itself early in 2011, when 200-day trendline support shifted to resistance. Not only did the weakness in U.S. market internals matter in July 2011 via the NYSE Advance Decline (A/D) Line, but relative weakness in foreign stocks also mattered. Fewer and fewer U.S. stocks were participating in the rally by July of 2011, and fewer and fewer international stocks were participating in the worldwide equity rally.

It is worth noting that the deterioration of the VEU:SPY price ratio over the last three months of 2015 may be another headwind to U.S. benchmark gains. Historically, all stock assets typically exhibit positive correlations. It follows that, if foreign stocks are faltering at a time as when half of U.S. stocks are in their own downtrends, it may be reasonable to assume that the major U.S. benchmarks could buckle.

By way of review, there are a number of headwinds that are likely to bring about a substantive correction to the Dow, S&P 500 and NASDAQ in the near-term:

1. Federal Reserve and the Rate Hike Quagmire. By itself, a bump up in overnight lending rates may not be a big deal. Conversely, participants may perceive inaction (an unwillingness to do anything) or too much activity (back-to-back rate hikes on wishy-washy data) as a major policy mistake.

2. Extremely High Valuations and Eroding Domestic Internals. High valuations alone can always move higher; excitement can turn to euphoria. Yet, history has rarely been kind to the combination of stock overvaluation and narrowing leadership (i.e., bad breadth).

3. Fading Effects Of Quantitative Easing/Other Stimulative Measures In Foreign Stocks. Both Europe and Japan had seen their prices surge shortly after confirmation of asset purchases. Over the last three months, those fortunes have cooled relative to the U.S. In some instances, as has been the case in China, stimulative measures that didn’t work eventually turned to direct (as opposed to indirect) market manipulation. Is the world losing faith in its central banks?

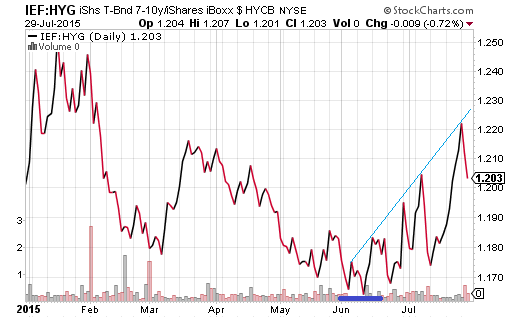

4. The Return of Credit Risk Aversion In Bonds. Seven months into 2015 and the widely anticipated jump in 10-year yields is nowhere to be seen. In fact, the 10-year at 2.25% is roughly in the exact same place as it was when the year started. It has been lower (much lower); it has been higher, not far from 2.5%. Yet the bottom line is that treasuries via iShares 7-10 Year (ARCA:IEF) are rising in relative strength when compared with a high yield bond proxy like iShares High Yield Bond (ARCA:HYG).

5. Economic Weakness in the U.S. and Across the Globe. Latin America, Asia, Europe. Name the region and the economic deterioration is palpable. In contrast, many portray the U.S. economy in a positive light. Headline unemployment is low, home prices are high and Q2 GDP at 2.3% is faster than what we witnessed in Q1. Yet labor force participation (employment) is at 1977 levels, home ownership is at the lowest levels since 1967 and GDP has grown at an anemic 2% over the last six years. That’s not what a recovery typically looks like. It is no wonder that revenue (sales) at U.S. corporations will be negative for the second consecutive quarter. And when both the quality of job growth as well as the weakness in revenues are tallied, nobody should be surprised at the snail’s pace of wage growth either (2%).

In spite of parallels that one can draw between the previous correction and/or prior bear markets (e.g., eroding domestic market internals, extremely high domestic stock valuations, near-term foreign stock weakness, etc.), the observations are not synonymous with prediction of disaster; rather, the observations lead me to conclude that a reduction of risk asset ownership is warranted for tactical asset allocation strategists.

Practically, then, if you typically have 65% in equity (split between foreign and domestic, large and small) and 35% in income (investment grade and high yield), you might want to reduce the overall exposure to riskier assets until a significant correction transpires. How might I do it? I might have 55% in equity (mostly large-cap domestic), 25% allocated to income (mostly investment grade) and 20% cash/cash equivalents. Not only will you have reduced the amount of equity, you will have reduced the type of equity. Not only will you have reduced the income, but you will reduced the type of income. The efforts should assist in weathering the probable storm, as well as allow one to raise risk exposure at more attractive pricing.

Is it possible that a tactical asset allocation shift might move further away from riskier assets? Like 35% equity, 25% income and 40% cash/cash equivalents? Yes. However, one would need to see a further breakdown of technicals and fundamentals beforehand.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.