- A rate cut will favor stocks in general, but some sectors will see a bigger boost than others.

- In this piece, we'll discuss stocks from sectors that stand to benefit the most.

- We will also take a look at a couple of ETFs alongside the stock picks.

- For less than $8 a month, InvestingPro's Fair Value tool helps you find which stocks to hold and which to dump at the click of a button.

The Fed Chairman's Jackson Hole speech confirmed what many expected: a rate cut is on the horizon.

This marks a significant shift in monetary policy, especially considering the timing. The last time the Fed cut rates so close to a presidential election was during the 2008 financial crisis.

With lower interest rates anticipated, investors are naturally curious about which sectors and stocks are poised to benefit.

Falling interest rates make borrowing cheaper, enabling companies to invest more in their operations and potentially boost profitability.

Lower rates also encourage consumer spending by making it easier to finance big purchases like homes and vehicles.

Sectors likely to benefit from lower interest rates include:

-

Dividend-paying companies: Utilities and other dividend-heavy sectors often see gains.

-

Consumer discretionary (NYSE:XLY): With cheaper credit, consumers are more likely to spend on higher-ticket items, boosting revenues for companies in this sector.

-

Technology (NYSE:XLK): Lower rates reduce capital costs, allowing tech companies to invest more in research, development, and expansion.

-

Real estate (NYSE:XLRE): Reduced borrowing costs can increase demand for property, benefiting real estate companies.

In light of this, we'll consider stocks and ETFs from the above-mentioned sectors, starting with the former.

3 Stocks That Could Benefit from Lower Interest Rates

1. Amazon

Amazon (NASDAQ:AMZN) is the world's most valuable retail brand according to the BrandZ index.

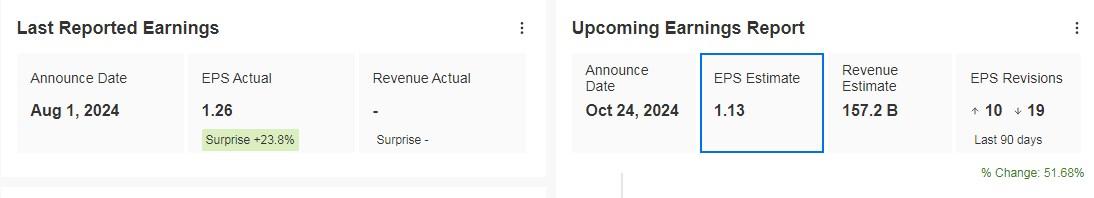

It will present its results on October 24 and is expected to report an increase in EPS (earnings per share) by 51.68%.

Source: InvestingPro

The market applauds its policies to reduce strategic costs and achieve greater operational efficiencies. In addition, it has managed to reduce shipping costs per unit from $4.11 in Q2 2022 to $3.64 in Q2 2024.

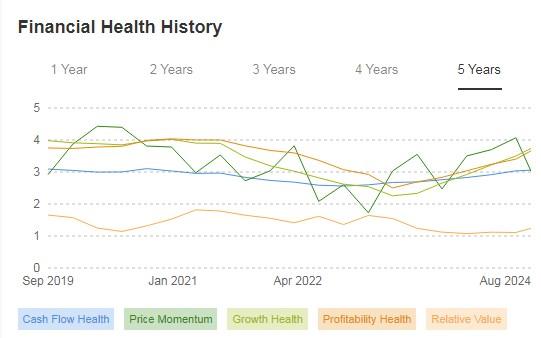

Its financial health is optimal as can be well illustrated in the following graph.

Source: InvestingPro

The market gives it a potential at $218.97.

Source: InvestingPro

2. Microsoft

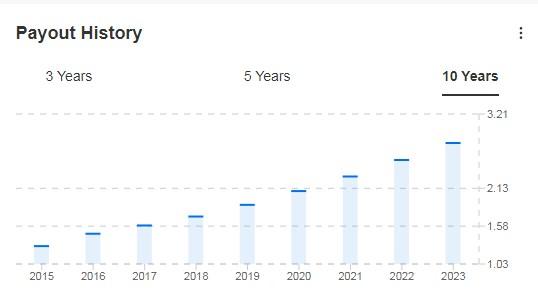

Microsoft (NASDAQ:MSFT) has gained 10% year-to-date and offers a modest dividend yield of 0.72%. With 19 years of consistent dividend increases and a low payout ratio of 25.4%, the company has plenty of room to grow its dividends further.

Microsoft has been a model of consistency by increasing its dividend for 18 consecutive years.

Source: InvestingPro

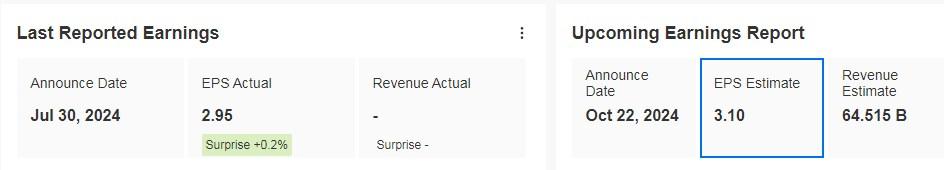

It will present its accounts on October 22. It reported last month that artificial intelligence provided further momentum for Azure in the quarter and expects growth to accelerate in the second half of the year.

Source: InvestingPro

Its beta is 0.89, which implies that its shares are moving in the same direction as the market, albeit with less volatility.

Source: InvestingPro

The market gives it a potential at $499.49.

Source: InvestingPro

3. Affirm

Affirm (NASDAQ:AFRM) is a fintech company founded by PayPal (NASDAQ:PYPL) co-founder Max Levchin in 2012. It is a leader in the buy now, pay later sector.

It continues to innovate with its BNPL solutions, catering to consumers seeking flexible payment options.

The company's attempts to grow are evident through strategic partnerships with other companies (Apple (NASDAQ:AAPL), Amazon, and Shopify (NYSE:SHOP)) and expansion into new markets.

The fintech firm faces challenges due to high interest rates. As a non-bank entity, it relies on external banks for loans, and these elevated rates increase its borrowing costs.

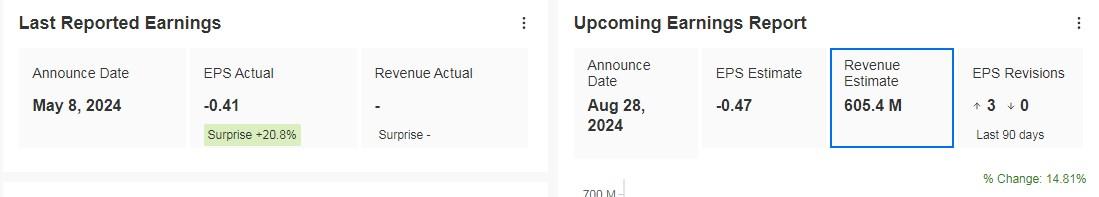

On August 28 we will know its accounts for the quarter. Actual revenues are expected to increase by 14.81%.

Source: InvestingPro

The price target given by the market consensus stands at $35.90.

Source: InvestingPro

2 Funds to Take Advantage of Lower Interest Rates

1. Vanguard High Dividend Yield Index Fund ETF Shares

Vanguard High Dividend Yield Index Fund ETF Shares (NYSE:VYM) owns shares of dividend-paying companies, some of which belong to the select group of Dividend Aristocrats.

The expense ratio is 0.06%.

The 10-year yield is 10.07%, the 5-year yield is 10.62% and the 3-year yield is 9.01%.

The main positions are: Broadcom (NASDAQ:AVGO), JPMorgan Chase (NYSE:JPM), Exxon Mobil (NYSE:XOM), Johnson & Johnson, Procter & Gamble, The Home Depot (NYSE:HD), AbbVie (NYSE:ABBV), Walmart (NYSE:WMT), Merck, Bank of America (NYSE:BAC).

2. Virtus Infracap REIT Preferred ETF

InfraCap REIT Preferred ETF (NYSE:PFFR) tends to prefer REITs, a way to gain exposure to the real estate sector.

With an expense ratio of 0.45%, this ETF has been around for just over six years. Despite its relatively short track record, it has achieved a notable yield of 11.23% over the past year.

The main positions are: DigitalBridge, UMH Properties (NYSE:UMH), AGNC Investment (NASDAQ:AGNC), Kimco Realty (NYSE:KIM), Hudson Pacific Properties (NYSE:HPP), SL Green Realty (NYSE:SLG), Vornado Realty Trust (NYSE:VNO).

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor's own risk. We also do not provide any investment advisory services. We will never contact you to offer investment or advisory services.