Here is your Bonus Idea with links to the full Top Ten:

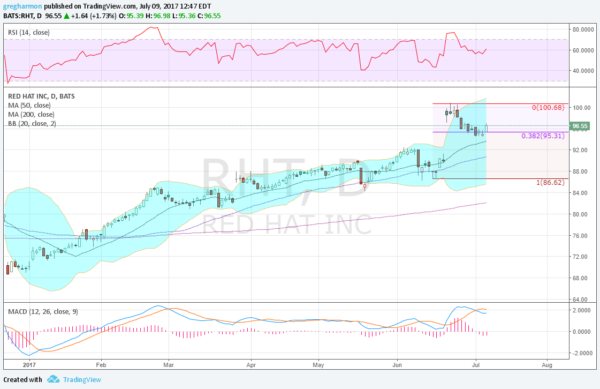

Red Hat Inc (NYSE:RHT) traded in a sideways range for 2 years before it finally broke the range to the upside. That move began in December with a steady run higher. It pushed over the 50 and 200 day SMA’s at the end of January and kept going. A small gap up in March was followed by a slowing pace higher until a gap after earnings in June sent it to touch 100. It fell back from 100, retracing 38.2% of the move up and seems to have found support. Friday saw a move higher confirm a reversal pattern, making it time to get interested.

The momentum indicators support a reversal as well. The RSI is turning back higher in the bullish zone while the MACD is positive and leveling after a minor retracement. There is support at 94.65 and 92.15 then a gap to fill to 91.19 and support lower at 86.60. There is no resistance above 100, but a Measured Move higher would give a target of 109. Short interest is moderate at 2.6% and the company is expected to report earnings next September 21st.

The July options chain show the largest open interest below the current price at the 95 strike on the call side. This could stall a move next week. The August options open interest is building but biggest at the 110 strike on the call side, looking for upside. September options show biggest open interest at the 90 call strike. December options, the first after the next earnings report, show smaller open interest but biggest at the 97.5 put strike.

Trade Idea 1: Buy the stock with a stop at 94.

Trade Idea 2: Buy the stock now and add a July 96/94.5 Put Spread (65 cents) as protect in the short term. Sell the July 28 Expiry 100 Covered Call (60 cents) to pay for it.

Trade Idea 3: Buy the July 96/95 1×2 Put Spread (30 cent credit) looking for the stock to draw back to 95 for an entry.

Trade Idea 4: Buy the August/December 100 Call Calendar ($4.00).

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which heading into the last quiet week before earnings season sees the equity markets have weathered a short term drizzle (SPDR S&P 500 (NYSE:SPY)) and iShares Russell 2000 (NYSE:IWM)) or mild rainstorm (PowerShares QQQ Trust Series 1 (NASDAQ:QQQ)) and look solid on the longer timeframe.

Elsewhere look for Gold to move lower as it breaks support while Crude Oil also continues lower short term. The US Dollar Index continues to look weak and better to the downside while US Treasuries continue to move lower. The Shanghai Composite looks to continue the trend higher as Emerging Markets mark time sideways in the uptrend.

Volatility looks to remain at very low levels keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Longer term their charts agree. Short term they are all consolidating and holding over support zones. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI