Here is your Bonus Idea with links to the full Top Ten:

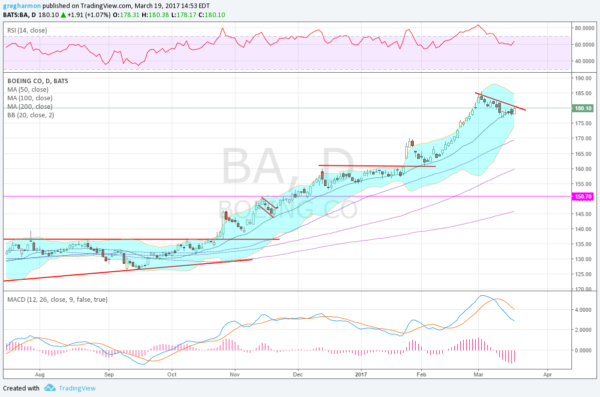

Boeing (NYSE:BA), broke out of a long consolidation in October and started to climb higher. By December it had recovered from its last pullback and was making new all-time highs. It leveled there under 160 until the end of January when it took off again. A short move that retested the 160 level from above before driving higher through February. It peaked at the end of the month and started another pullback.

That pullback found support at the 20 day SMA last week and pushed sideways. With a strong day Friday, the bull flag looks ready to break to the upside. This would give the next upside target to 202. The RSI is turning back higher in the bullish zone after working off a technically overbought condition. The MACD is still falling but remains in positive territory. Finally the Bollinger Bands® are squeezing in, foretelling a move to come very soon.

There is resistance above at 185 and then clear skies above. Support lower stands at 177 and 173.65 followed by 170 and 160. Short interest is low at 2%. The stock pays a 3.15% dividend, but went ex-dividend just over 1 month ago, so about 2 more months before you need to worry about it again. They are expected to report earnings next April 26th.

The options chain for this week shows a high point in open interest from 182.5 to 185 on the call side, and at 180 on the put side. April monthly options show biggest put open interest at 180 and then 175. But on the call side it is large at 195 and 190. The April 28th options, the first after the earnings date, are still building, but the at-the-money straddles suggest that options traders are looking for an $8.75 move in the stock price by then. May monthly options show the majority of open interest lower.

Boeing, Ticker: BA

Trade Idea 1: Buy the stock on a move over 181 with a stop at 176.

Trade Idea 2: Buy the stock on a move over 181 with an April 28 Expiry 177.5/172.5 Put Spread ($1.70) and selling a May 190 Covered Call ($1.62 credit).

Trade Idea 3: Buy the May 175/185 Bullish Risk Reversal (55 cent credit).

Trade Idea 4: Buy the May 180/190 Call Spread ($3.87) and sell the April 175 Puts ($1.58 credit).

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which with the March FOMC meeting and Options Expiration in the rear view mirror, sees the markets to have come through unscathed, although with a new leader.

Elsewhere look for Gold to continue in its short term uptrend while Crude Oil bounces off of support. The US Dollar Index looks to continue lower while US Treasuries are back into consolidation in the downtrend. The Shanghai Composite continues to drift slowly higher and Emerging Markets are fire moving higher.

Volatility looks to remain at abnormally low levels keeping the bias higher for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). The SPY and QQQ look to consolidate on the shorter timeframe just as the IWM is ready to take over leadership to the upside. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.