Here is your Bonus Idea with links to the full Top Ten:

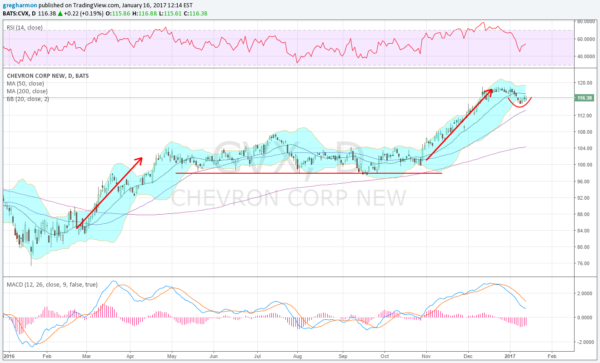

Chevron (NYSE:CVX), came off of a bottom in February, rising to a consolidation in May around 100. That consolidation lasted for 6 months before it started higher again. The price met resistance at the Measured Move at about 118 in the middle of December and pulled back. That pullback was very shallow and now looks to be reversing to the upside. A Measured Move to the upside would give a target to 135.

As it does, the Bollinger Bands® are squeezing in, often a precursor to a bigger move (see late October squeeze). The RSI has also reversed to the upside in the bullish range, and the MACD is slowing its fall. A Measured Move to the upside gives a target to 132, just shy of the all-time high at 135. The big picture shows a bearish Bat harmonic building as well, with a Potential Reversal Zone (PRZ) at 127.63.

Chevron Corporation (NYSE:CVX)

There is resistance at 119 and 120 followed by 125 and 129.45 before 132.75 and 134.75. Support lower comes at 114.75 and 112 followed by 107.75 and 104.25 then 100 and 98. Short interest is low at under 2%. The company is expected to report earnings next on January 27th.

Options chains show large open interest for this week at the 115 Strike nearby, but bigger lower at the 110 Strike. For the earnings next week there is little open interest, but skewed to the upside towards 120. The February monthly options are largest at the 115 Strike and longer dated expiries show no bias either direction.

Trade Idea 1: Buy the stock with a stop at 114.

Trade Idea 2: Buy the stock and add a February 3 Expiry 114 Put ($1.12) and sell a February monthly 120 Covered Call (98 cent credit).

Trade Idea 3: Buy the February/June 120 Call Calendar ($2.47) and sell the June 100 Put ($1.61 credit).

Trade Idea 4: Buy the February 110/120 Bullish Risk Reversal (15 cents).

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which heading into January Options Expiration and on a short Holiday week, sees the Equity Indexes looking healthy and consolidating if not outright bullish.

Elsewhere look for the bounce in Gold to meet some resistance and possible stall out while Crude Oil churns sideways. The US Dollar Index is poised to continue lower, pulling back in its uptrend, while US Treasuries run the same risk as Gold, finding resistance in the bounce and dropping.

The Shanghai Composite looks to continue to bounce in a tight range mainly sideways as Emerging Markets break to the upside. Volatility looks to remain non-existent keeping the bias higher for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts remain positive with the IWM and SPY in consolidation while the QQQ marches higher. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.