Here is your Bonus Idea with links to the full Top Ten:

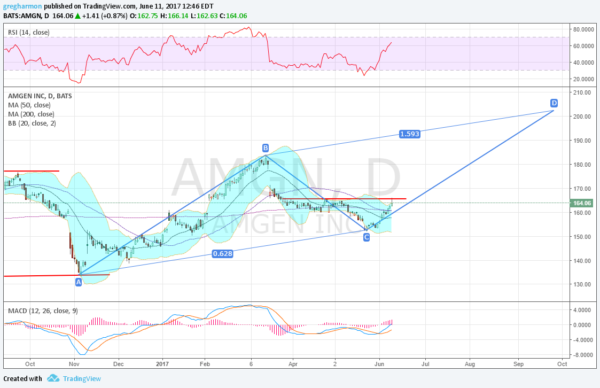

Amgen (NASDAQ:AMGN) started to run higher in November reaching a peak in March. It held there for 1 day before a gap down and then a drift lower to a low in May. Since that low the stock price has been moving higher and ended the week at resistance. It is now over the 50 and 200 day SMA’s, and sees the Bollinger Bands® opening to the upside. Continuation triggers an AB=CD pattern that gives a target to 202.50 in late September.

The RSI is back in the bullish zone while the MACD has crossed up and is moving into positive territory. Both support more upside price action. There is resistance at 165.30 and 170 and hen a gap to fill to 180 then the all-time high at 184.21. Support lower comes at 160 and 156 followed by 152.50. Short interest is low at 1.2%. The company is expected to report earnings next on July 26th.

Options chains show the majority of open interest this week below the current price and on the Put side, but with size at 160 and 165 on the Call side as well. In the July monthly chain open interest is spread around a cent at 155 on the Put side and focused from 160 to 165 on the Call side. The July 28 Expiry only opened last week and open interest is still building. To find bets on earnings we need to look at the September chain. That shows open interest spread from 150 to 160 on the Put side and then again large at 170. On the Call side it is spread from 160 to 175.

Amgen

Trade Idea 1: Buy the stock on a move over 165.50 with a stop at 160.

Trade Idea 2: Buy the stock on a move over 165.50 and add a July 28 Expiry 162.5/155 Put Spread ($3.76) for protection through earnings, selling the July 28 Expiry 170 Calls ($2.00) to lower the cost.

Trade Idea 3: Buy the July/September 170 Call Calendar ($2.60).

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which showed equities mixed heading into the June Options Expiration Week, with the iShares Russell 2000 (NYSE:IWM) and SPY (NYSE:SPY) looking strong but the PowerShares QQQ Trust Series 1 (NASDAQ:QQQ) weak as there was rotation out of the QQQ and into IWM.

Elsewhere look for Gold to continue lower while Crude Oil also looks better to the downside. The US Dollar Index continues to be biased lower while US Treasuries pullback in the uptrend. The Shanghai Composite is back to its upward drift and Emerging Markets are biased to continue higher.

Volatility looks to remain at very low levels keeping the bias higher for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), IWM and QQQ. Their charts show strength in the IWM and consolidation in the SPY short term with the QQQ looking diseased. Longer term all trends remain higher with real strength returning to the IWM. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.