Here is your Bonus Idea with links to the full Top Ten:

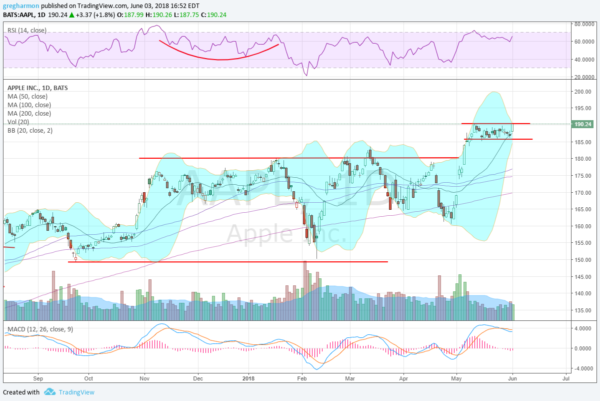

Tim Cook knows which way Apple (NASDAQ:AAPL) stock is going. Apple, $AAPL, had been moving sideways, consolidating, for over six months as May started. But then the stock started to move higher off of its 200 day SMA. It broke the consolidation range to the upside just 4 days into the month and then slowed. Since then it has been moving in a very tight range between 186 and 190.

Friday the stock had a strong move up to the top of the range and closed at an all-time high. The Bollinger Bands® have squeezed in, often a precursor to a move in the stock. The RSI is turning up in the bullish zone and the MACD has crossed down but is nearly flat. A Measured Move to the upside on a break out would give a target to 212, raising the market cap up over $1 trillion. There is support lower at 186 and 180 then 175.75 and a gap to fill to 170 followed by 162.25. Short interest is low under 1% and the company is expected to report earnings next on July 30th.

The June options chain shows the biggest open interest at the 185 strike on the put side and ranging from 185 to 200 on the call side. In the July chain it is very large at the 150 put and then tails to 190. The call side rises from 170 to a peak at 200. The August options, the first to cover the earnings report, show size from 155 to 190 on the put side and 180 to 215 on the call side.

Trade Idea 1: Buy the stock on a move over 190.50 with a stop at 185.

Trade Idea 2: Buy the stock and add a July 190/180 Put spread ($3.00) as protection, also selling the July 200 Call ($1.37) to lower the cost.

Trade Idea 3: Buy the August 195/July 200 Call Diagonal ($3.83).

Trade Idea 4: Buy the July 190/200 Call Spread ($3.83) and sell the July 180 Puts ($1.37).

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which as June begins sees the equity markets looking stronger with small caps and tech leading the way higher.

Elsewhere look for Gold to continue to move lower while Crude Oil joins it continuing its drop. The US Dollar Index continues to show strength, but pausing in its move higher while US Treasuries are biased lower in a channel. The Shanghai Composite is drifting lower as are Emerging Markets, with the former closing in on a new 52 week low while the latter is just retesting a major break out.

Volatility looks to remain subdued keeping the bias higher for the equity index ETF’s SPY (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). The IWM has shown strength making new all-time highs while the QQQ looks to be ready to takeover leadership for the short run. The SPY however is holding at resistance. A break out would be a major spark to the broad market. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.