Wall Street completed a fabulous 2019 wherein all three major stock indexes witnessed the best yearly performance in six years. The bull run continues in 2020 as these indexes have already broken certain key technical barriers.

Growth investors are primarily focused on stocks with aggressive earnings or revenue growth, which should propel their stock price higher in the future. Although corporate earnings growth were negative year over year in the first three quarters, results were far better than initially anticipated.

Weak Expectations for Fourth-Quarter Earnings

Expectations for fourth-quarter 2019 earnings are far from encouraging at present. Total earnings of the S&P 500 Index are anticipated to be down 3.2% from the same period last year on 3.5% higher revenues.

As of Jan 15, just 31 S&P 500 members reported fourth-quarter earnings results. Total earnings of these companies are down 5.7% from the same period last year on 3.5% higher revenues. Of the total, 77.4% surpassed EPS estimates while 74.2% outpaced revenue estimates. (Read More: Banks Provide Mixed Start to Q4 Earnings Season)

Fourth-Quarter at a Glance

In the fourth quarter of 2019, the Dow gained 6%, the S&P 500 rose 8.5% and the Nasdaq rose 12.2%. The last three months of the year were quite promising for Wall Street as the U.S.-China trade war finally seemed to ease and strong economic data boosted investors’ sentiments.

The U.S. economy is on a stable footing. Strong consumer spending, which constitutes 70% of the GDP, a strong labor market, a historically low-level of unemployment, steady growth in wage rate and a housing-market revival bolstered investors’ sentiments and are likely to reflect on earnings results. Notably, in the first three quarters of 2019, the GDP growth rate was more than 2%.

Moreover, after remaining quiet in the first half of 2019, the central bank reduced the benchmark interest rate by 75 basis points in three equal trenches in the second half of last year. Fed’s timey intervention not only boosted the economy and raised investors’ confidence, but also helped the sagging U.S. housing market to recover with a low mortgage rate.

4 Growth Stocks Set to Beat Earnings Estimates

We have narrowed down our search to four growth stocks slated to release earnings reports this month that have a positive Earnings ESP. Each of our picks carries a Zacks Rank #2 (Buy) and Growth Score of A or B. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Our research shows that for stocks with the combination of a Zacks Rank #3 or better and a positive Earnings ESP, the chance of an earnings beat is as high as 70%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

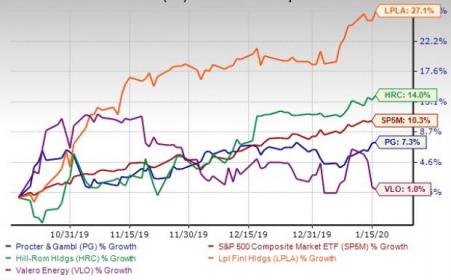

The chart below shows price performance of our four picks in the past three months.

The Procter & Gamble Co. (NYSE:PG) provides branded consumer packaged goods to consumers in North and Latin America, Europe, the Asia Pacific, Greater China, India, the Middle East, and Africa. It operates in five segments: Beauty; Grooming, Health Care, Fabric & Home Care, and Baby, Feminine & Family Care. The company has an Earnings ESP of +0.91% for the second quarter of fiscal 2020.

The Procter & Gamble has an expected earnings growth rate of 9.3% for the current year (ending June 2019). The Zacks Consensus Estimate for the current year has improved 0.2% over the last 60 days. The Procter & Gamble will release earnings results on Jan 23, before the opening bell.

Hill-Rom Holdings Inc. (NYSE:HRC) operates as a medical technology company worldwide. It operates in Patient Support Systems, Front Line Care and Surgical Solutions segments. The company has an Earnings ESP of +1.54% for the first quarter of fiscal 2020.

Hill-Rom has an expected earnings growth rate of 8.9% for the current year (ending September 2020). The Zacks Consensus Estimate for the current year has improved 0.2% over the last 60 days. Hill-Rom will release earnings results on Jan 24, before the opening bell.

Valero Energy Corp. (NYSE:VLO) operates as an independent petroleum refining and ethanol producing company in the United States, Canada, the United Kingdom, Ireland, and internationally. It operates through three segments: Refining, Ethanol, and VLP (Valero Energy Partners LP). The company has an Earnings ESP of +1.60% for fourth-quarter 2019.

Valero Energy has expected earnings growth of 93.4% for the current year. The Zacks Consensus Estimate for the current year has improved 0.5% over the last 60 days. Valero Energy will release earnings results on Jan 30, before the opening bell.

LPL Financial Holdings Inc. (NASDAQ:LPLA) provides an integrated platform of brokerage and investment advisory services to independent financial advisors and financial advisors at financial institutions in the United States. The company has an Earnings ESP of +0.76% for fourth-quarter 2019.

LPL Financial has an expected earnings growth rate of 4.1% for the current year. The Zacks Consensus Estimate for the current year has improved 4.2% over the last 60 days. LPL Financial will release earnings results on Jan 30, after the closing bell.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.6% per year. So be sure to give these hand-picked 7 your immediate attention.

See 7 handpicked stocks now >>

LPL Financial Holdings Inc. (LPLA): Free Stock Analysis Report

Hill-Rom Holdings, Inc. (HRC): Free Stock Analysis Report

Valero Energy Corporation (VLO): Free Stock Analysis Report

Procter & Gamble Company (The) (PG): Free Stock Analysis Report

Original post