by Clement Thibault

Once again, China is making headlines. Its equity markets keep melting down, the yuan continues to lose value, and the country’s economic slowdown is expected to worsen. Now that China’s GDP makes up about 16% of the world’s combined GDP, the consequences could potentially be disastrous for global markets. Indeed, there's already been quite a bit of fall-out: a falling stock market in China, an increasingly fragile US stock market, fresh 12-year lows in crude oil prices, and of course, uncertainty and fear regarding what happens next.

But even as investors holding long positions are indeed suffering losses, some market participants and sectors could be—and are—able to take advantage of recent conditions. Here are 4 potential beneficiaries of the recent Chinese turmoil:

1. Short Sellers

Outside of the hardcore trading world this practice is little known, and even less understood. Briefly, short selling is the practice of selling securities that you do not currently own, but which you expect will fall. In a short sale the security is ‘borrowed’ from a broker, with the promise that the short seller will purchase the security later, at an agreed upon lower price. Profit is made from the difference in the original price and the ensuing drop in value.

As with any financial instrument, there is, of course, a risk, and losses would occur in the case of a rise in the price of the shorted security, rather than a drop. The S&P 500 has lost 7.4% since the end of January 2015. Freeport-McMoran (N:FCX), the world’s largest producer of copper, gold and other minerals, has been hit by a slump in copper prices—the worst commodity performer of the year so far—suffering an astonishing loss in value of minus-36% since the beginning of the year. Oil companies have also fared badly, with Marathon Oil (N:MRO) and Anadarko Petroleum (N:APC) both losing over 20% in the past 8 days. Not every security is shortable, but if you’d bet on any of the above, there were handsome profits to be made.

2. Volatility Traders

Volatility trading is the term used to describe trading the size of a stock’s price movement, rather than trading the shares themselves. The profit driver here is not whether the price of the instrument rises or falls, but rather the likelihood of the size and strength movement of the instrument.

Volatility is created when shares shooting up, or crashing down. Trading volatility is done by speculating on the future volatility of an instrument using either options or ETFs, either by being short volatility—speculating that volatility will be low—or long volatility, betting on higher future volatility. The most popular volatility index is the VIX, which tracks the implied volatility of the S&P 500 index options.

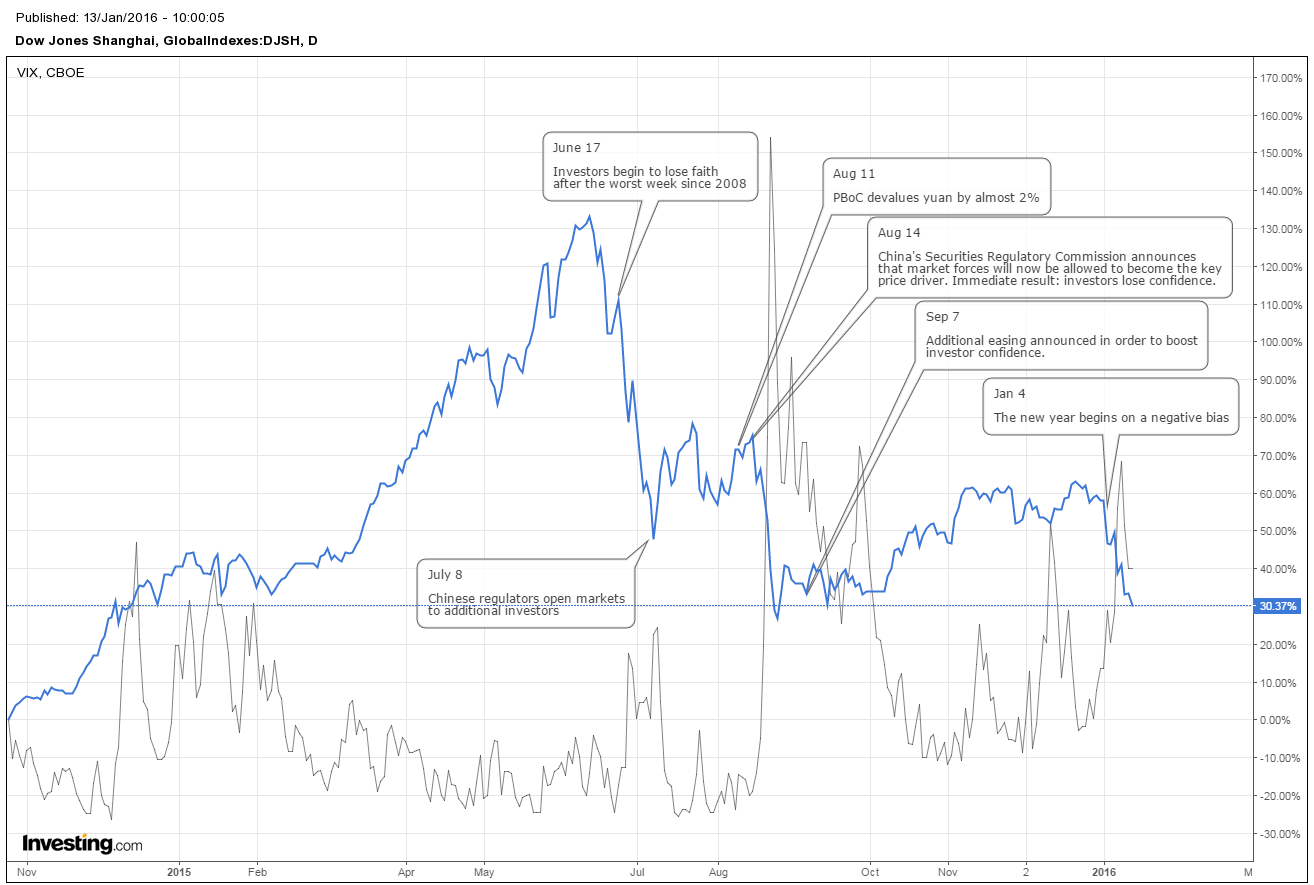

The chart below shows the VIX response to the past year's moves on the Shanghai Composite. It clearly illustrates that the VIX has been inversely mirroring the Shanghai's price movements. When Shanghai drops the VIX soars, and vice versa:

ETFs that trade volatility include the iPath S&P 500 VIX Short-Term Futures Exp 30 Jan 2019 (N:VXX), ProShares VIX Short-Term Futures (N:VIXY) and VelocityShares VIX Short Term Fut Exp 4 Dec 2030 (O:VIIX). Periods of turmoil are especially beneficial for long volatility trades, as the odds of drastic movement in instruments are higher than in a steady, soothing market. The chart below,of VXX's price (grey line), in reaction to Shanghai's movements (blue line) displays the correlation:

3. US Importers and Retailers

Because of current conditions in the Chinese economy, the PBoC has let the yuan slide versus the dollar. Part of the rationale for this could be an attempt by Chinese officials to aid struggling local exporters. But for every exporter there's an importer somewhere, and a stronger dollar would allow US importers to buy more merchandise for the same amount of dollars, efficiently cutting back importers’ and retailers’ cost of sold goods. For example, Wal-Mart (N:WMT), the largest US bricks-and-mortars retailer, could now lower its costs and improve its profits, at least until a recession hits the US. Even then, a decline in the wealth and disposable income in the US could bring more customers to the low cost world of Wal-Mart. The same, of course, is true for other major discounters such as Costco (O:COST) and Target (N:TGT).

4. US Real Estate

The volatility and risk in Chinese market could signal good news for the US real estate market. As Spencer Levy, CBRE's head of research for the Americas says, "global instability often leads to more foreign capital flows to the safe havens, notably London and the U.S".

The love affair between Chinese investors and US real estate has grown stronger over the past year, reaching $8.6 billion in purchases of commercial real estate assets, quadrupling the 2014 number. As the stock markets—both Chinese and American—grow weaker; investors will look to return to basic, physical investments.

Gold is generally known as the safe haven in times of trouble, but in China, US real estate is the investment of choice during risk-off periods. This sector should therefore become popular should the instability continue.