- Best Buy last month cut its profit and sales outlook; it blamed high inflation, which is eroding consumers' spending power.

- Chewy gave a weaker revenue forecast for the current year as it navigates through escalating costs and supply-chain disruptions.

- Investors will be keen to know whether Broadcom is facing a slowdown in demand in line with the broader market trend.

The stock market is again under pressure after the U.S. central bank’s clear warning last week that its fight against inflation is far from over and that investors should brace for some pain.

Stocks reversed their upward trend after comments from Federal Reserve Chairman Jerome Powell on Friday, who said at the Jackson Hole, Wyo., conference that the policymakers plan to keep higher rates in place to fight inflation. The markets had expected a Fed pivot in which it might slow down hikes before eventually reversing course and cutting rates in the latter part of next year.

The S&P 500 fell 3.4% for a weekly loss of 4%, and the tech-heavy NASDAQ Composite was hit even harder, down 3.9% Friday and 4.4% for the week.

Aside from monetary policy direction, investors will also be watching earnings releases from some important U.S. companies, among the last to report in the current cycle. Here are three we're following:

1. Best Buy

Best Buy (NYSE:BBY), the big-box electronics and technology chain with stores throughout the U.S. and Canada, will release Q2 earnings on Tuesday, Aug. 30 before the market opens. The retailer is expected to report $1.29 per share profit and $10.29 billion in revenue, according to analysts’ consensus estimate.

Best Buy last month cut its profit and sales outlook. The company blamed high inflation, which is eroding consumers' spending power and demand for electronics.

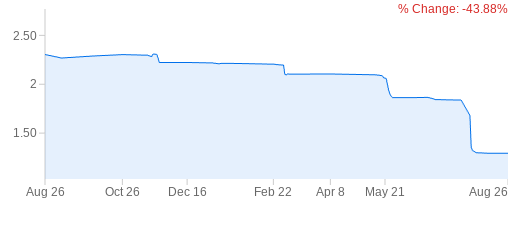

Source: InvestingPro+

“As high inflation has continued and consumer sentiment has deteriorated, customer demand within the consumer electronics industry has softened even further,” CEO Corie Barry said in the statement on the guidance cut last month.

According to the retailer, operating income should only be about 4% of revenue in the current fiscal year based on “current planning assumptions,” down from the 5.2% that was earlier expected. Comparable sales are expected to tumble 11%, versus an earlier forecast that the figure would fall no more than 6%. Best Buy stock, which has dropped more than 25% this year, closed Friday at $74.15.

2. Chewy

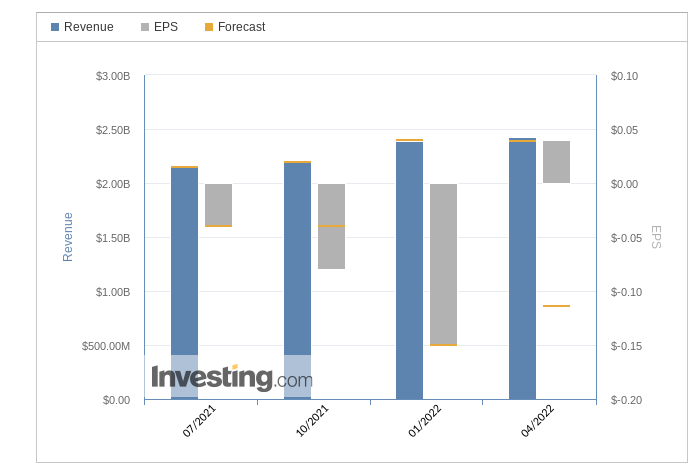

Online pet-products retailer Chewy (NYSE:CHWY), will also report its latest quarterly earnings on Tuesday before the market open. Analysts are predicting a $0.12-per-share loss on sales of $2.45 billion.

Chewy gave a weaker revenue forecast for the current year as it navigates through escalating costs and supply-chain disruptions that have led to more items being out of stock.

Source: Investing.com

This sharp reversal in the company’s fortunes comes after two robust years that saw sales of pet food and related items surge due to the pandemic as people spent more on their puppies and cats while stuck in their homes.

Given the uncertainty in Chewy’s outlook, its stock has been under pressure over the past year, falling close to 60%. Shares closed Friday at $38.10.

3. Broadcom

The final big chipmaker to release earnings this current season is Broadcom (NASDAQ:AVGO). The company will report its fiscal 2022 third-quarter results after the market closes on Thursday, Sept. 1. Analysts are expecting a $9.56-per-share profit with projected sales of $8.41 billion.

Source: Investing.com

In the company's latest earnings release, investors will be keen to know whether Broadcom is facing a demand slowdown in line with the broader market weakness.

After a massive run-up during the COVID pandemic, the chip industry is bracing for widespread weakness. World Semiconductor Trade Statistics, a nonprofit group that tracks shipments, just lowered its market outlook to 13.9% growth this year from the previous 16.3%. In 2023, it sees chip sales rising just 4.6%, the weakest pace since 2019.

Broadcom is one of the world’s largest chipmakers, with lines of business spanning smartphone parts, key components of networking equipment, and semiconductors that run home Wi-Fi gear and set-top boxes.

Broadcom shares, which closed at $520.86 on Friday, have lost more than 20% of their value this year.

Disclosure: The writer doesn’t own stocks mentioned in this report.

***

Interested in finding your next great idea? InvestingPro+ gives you the chance to screen through 135K+ stocks to find the fastest growing or most undervalued stocks in the world, with professional data, tools, and insights. Learn More »