This post was written exclusively for Investing.com.

Stocks have been on shaky ground since the beginning of May as trade war tensions have weighed on the minds of investors. Now the worries are spreading, and some investors are starting to fear that sinking interest rates are sending dire warnings of a recession that may loom on the horizon. With all the nail biting, investors may be missing the message the semiconductor sector is sending — that the equity market is oversold and due for a sharp rebound.

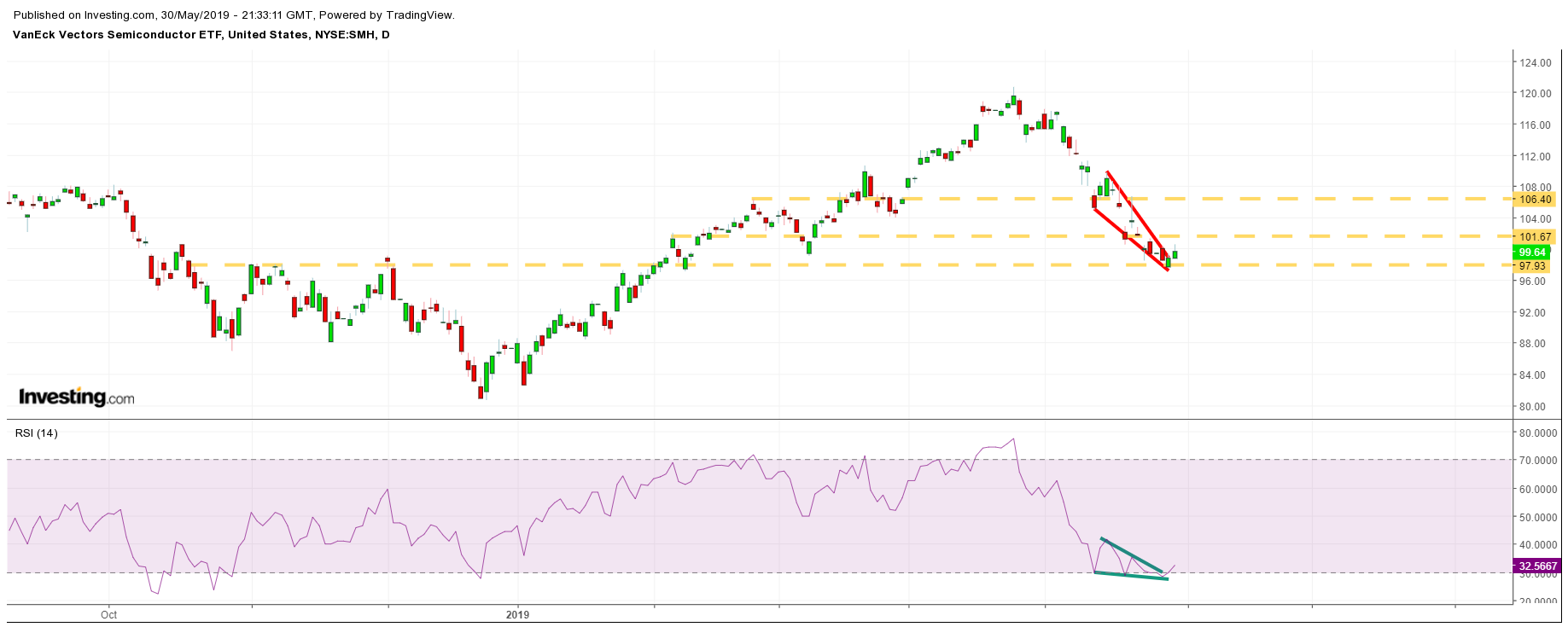

The semiconductor sector, as measured by VanEck Vectors Semiconductor ETF (NYSE:SMH) is suggesting a bottom may be in place for the group and potentially the S&P 500. Since April 24, shares of the SMH have dropped by over 16%. However, in recent days, the technical charts show that a reversal may be in the works and that the group is poised to rise.

Chips Stocks Rising

The technical chart for the semiconductor ETF shows that a bullish reversal pattern known as a falling wedge has formed. It would suggest the steep decline ETF and the broader sector have witnessed is likely to end and potentially reverse. Should the ETF manage to rise above $101, it would create the opportunity for the ETF to break out and increase to a price of around $107. The relative strength index is also suggesting the ETF rises after breaking a downtrend of its own, and is now starting to turn higher, indicating bullish momentum is returning to the ETF and the sector.

Intel Is Bucking The Trend

Another positive sign for the group is that Intel (NASDAQ:INTC) has stopped falling. Intel’s stock fell by almost 25% after providing disappointing second-quarter guidance on April 25. Recently, the stock has been able to stabilize right around a technical level of support at $43. In fact, since May 20 Intel’s stock is unchanged compared to an S&P 500 that is down by around 2.6%—a positive development.

Apple May See Big Reversal

It isn’t only the chip stocks that are showing some signs of life. Apple (NASDAQ:AAPL) has started to show similar trends. The technical chart for Apple reflects the same falling wedge pattern, which indicates the stock may rise to around $182. Should it break out and rise above $182, it has the potential to increase to as high as $195. Apple’s shares have fallen nearly 16% since peaking following its results in early May.

FedEx Nears Bottom

FedEx Corporation (NYSE:FDX) is another stock tied to trade and global growth concerns that has been hammered. However, FedEx has managed to fall and hold technical support at roughly $157. A rebound could lead the shares to advance back to $166.

Oversold?

Why are the recent turn-arounds potentially significant? If these stocks have been falling in reaction to the trade war and the prospects of slower global growth, then a reversal would indicate that perhaps they have become oversold and that a broader stock market rebound may soon follow.

While it may be too soon to call for a rebound back to the market highs, a bottoming process and reversal may very well be starting to take hold. Additionally, it is important to remember that in the case of the chip stocks, the sector started dropping nearly a week before the trade war escalation, and in large part led the stock market lower. Now if the chips begin to show signs of life and start to rise, they could very well be the stocks that lead the broader market out of the recent downturn.

Disclosure: Michael Kramer and the Clients of Mott Capital own shares of AAPL

Disclaimer: Mott Capital Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Past performance is not indicative of future results.