- The S&P 500 has been charging higher of late.

- Despite the recent pause, the bulls have all the reasons to believe that the rally will resume.

- In this piece, we will take a look at 3 reasons the bull run is set to continue.

- Invest like the big funds for under $9/month with our AI-powered ProPicks stock selection tool. Learn more here>>

The S&P 500 is on a tear, surging 14%+ YTD and repeatedly shattering records, currently hovering just below 5,500 points.

The driving force? The booming AI revolution, fueling profits and stock prices of tech giants like Nvidia (NASDAQ:NVDA), which recently became the world's most valuable company by market cap.

But with each record high comes a nagging question: how long will this bull run last? Is another bubble inflating before our very eyes?

Today, we explore 3 reasons why the bulls might stay dominant in the latter half of 2024.

Reason 1: Avoiding a Recessionary Tailspin

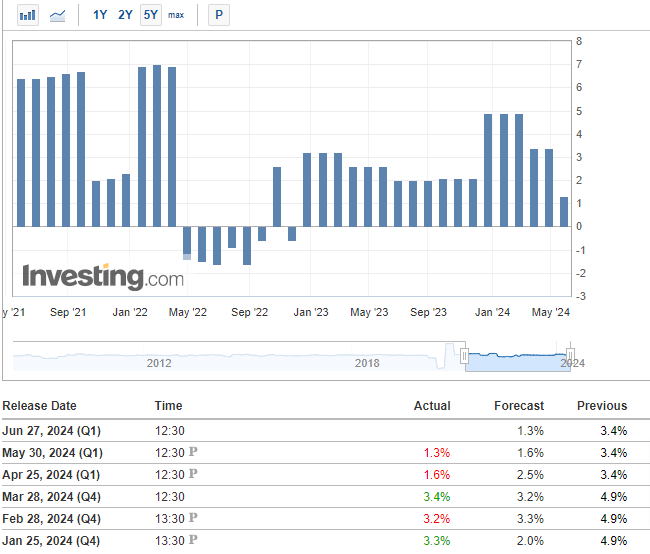

The economy may be slowing down, but there's no sign of a deep recession on the horizon. One key indicator, GDP growth, historically precedes major stock market downturns.

For example, the 2022 correction began in April, coinciding perfectly with the first negative year-over-year GDP reading of that cycle. However, it wasn't a collapse – just a correction, followed by a clear rebound.

Despite recent worrisome readings, the data does not suggest an impending collapse of the U.S. economy.

Encouraging signs from the labor market bolster the scenario of a soft landing, with the unemployment rate remaining low and the number of new non-farm jobs increasing steadily.

This robust labor market is a critical indicator to watch, as its performance could precede declines in the stock market if it turns negative.

Reason 2: M2 Growth Could Pave the Way for Higher S&P 500

When analyzing the S&P 500's potential, it's crucial to consider the money supply (M2).

The M2 aggregate includes all components of the M1 aggregate—cash, checks, and demand deposits—plus savings deposits, time deposits, and balances in retail money market mutual funds.

Interestingly, comparing the S&P 500's performance to M2 growth reveals significant room for further expansion.

The current index level appears more attractive than the Nasdaq when viewed through this lens.

This comparison reveals significant upward potential, suggesting that the S&P 500 could still surpass its previous historic peaks.

Reason 3: Tech Titans' Strong Fundamentals Support Continued Gains

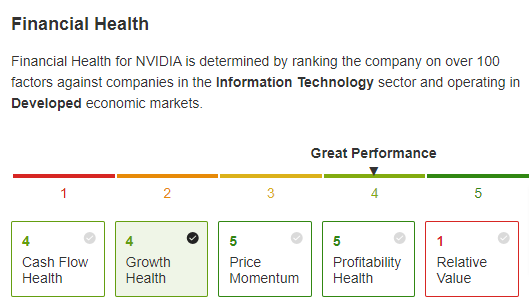

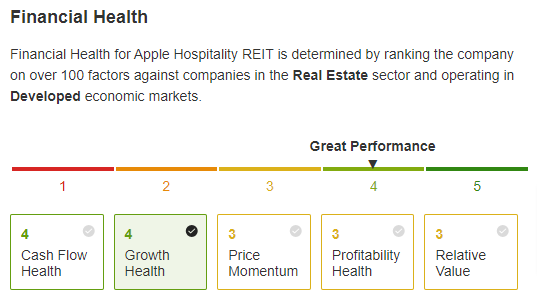

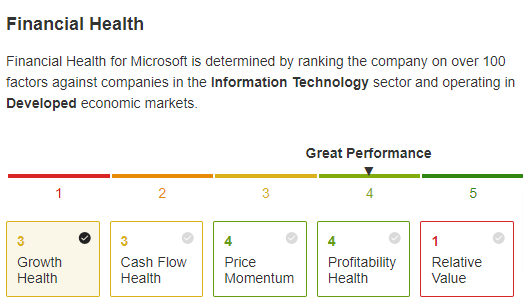

The upcoming Q2 2024 earnings season will be a pivotal test for the S&P 500. All eyes will be on tech giants like NVIDIA, Apple (NASDAQ:AAPL), and Microsoft (NASDAQ:MSFT).

If these companies maintain their current momentum in both profits and revenue, surpassing analyst expectations for future quarters, the bull run is likely to continue.

Source: InvestingPro

Their strong financial health, as evidenced by InvestingPro's high ratings, further bolsters this optimism.

While some fair value models suggest a potential pullback – a natural occurrence in any trend – it could present a buying opportunity to join the prevailing trend at a more attractive price point.

***

Become a Pro: Sign up now! CLICK HERE to join the PRO Community with a significant discount.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.