Bitcoin took a hit a couple of weeks ago after news Broke that China has started the process of clamping down on cryptocurrencies with a ban on ICOs. I consider the crackdown on initial coin offerings a precursor to China's attempt to reduce the volume of speculation in the cryptocurrency market. Unfortunately, the ban on ICOs didn’t augur well for Bitcoin and other cryptocurrencies because the news triggered a selloff from uncommitted investors.

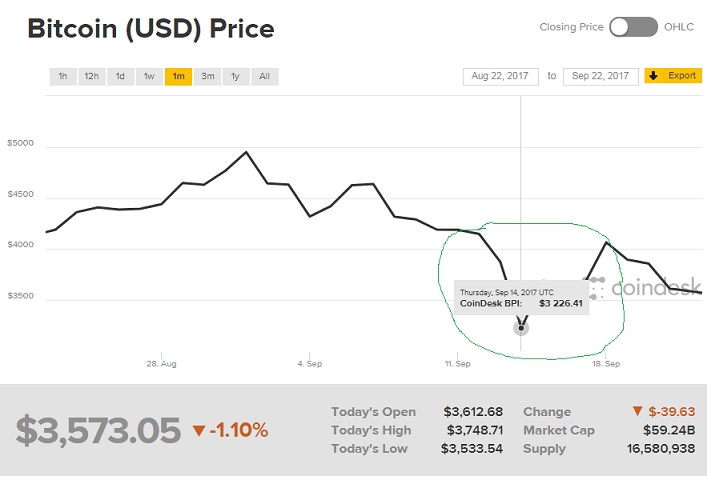

The news of China's ban on ICOs sent Bitcoin spiraling 41% from a record high above $4,950 on September 1 to a gut-wrenching low of $3,226.41 on September 14 as seen in the chart below.

The cryptocurrency markets was still grappling with the ripple effects of China's ban on ICO when JPMorgan's James Dimon came out to add more fuel to the fire of fear on Bitcoin. He opined that he considered Bitcoin a fraud that is "worse than tulip bulbs … it will be the emperor with no clothes” Dimon's negativity echoes the words of Wall Street and conservative investors that cryptocurrencies are in a speculative bubble.

However, irrespective of what governments, regulators, and Wall Street conservatives think; it is safe to note that cryptocurrency is here to stay. Below are three reasons you may want to go against Wall Street to bet on the long-term survival of cryptocurrencies.

Investors will always desire speculative boost in investments

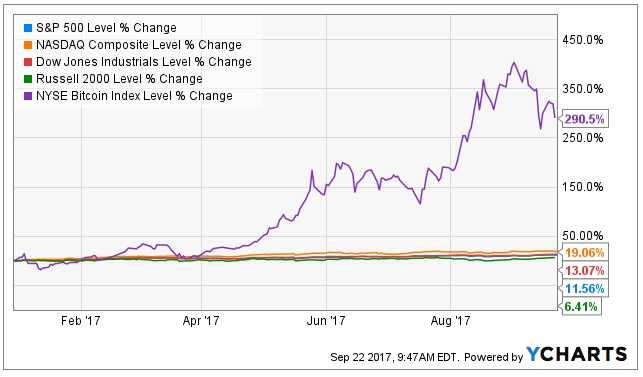

The fundamental law of demand and supply is probably the biggest, yet overlooked driver of growth in the cryptocurrency markets. Bitcoin is exponentially volatile than stocks and other assets; yet, its volatility has helped it deliver outsized performances that could make a difference in any investment portfolio. In the year-to-date period, U.S. small caps in the Russell 2000 index have gained 6.41%, the S&P 500 has gained 11.56%, the Dow Jones is up 13.07% and the NASDAQ Composite has gained decent 19.06%.

Interestingly, the NYSE Bitcoin Index has booked gains of almost 300% despite the fact that Bitcoin and other cryptocurrencies have suffered a massive amount of volatility this year. In essence, while it doesn’t make sense to hold all or a bulk of your investments as cryptocurrency, there's no denying the fact that your portfolio could enjoy positive boosts if you have some cryptocurrency investments.

Cryptocurrency is evolving

Chinese regulators decided to clamp down on ICOs as part of efforts to sanitize the cryptocurrency market. The reckless proliferation of 'shitcoins' and the fact that many investors are buying cryptocurrencies without fully understanding the risks is enough reason for regulators to increase their scrutiny. However, it is somewhat immature to follow the footsteps of Dimon to denounce Bitcoin and other cryptocurrencies because the cryptocurrency industry is constantly evolving.

For instance, Legolas, a new cryptocurrency exchange is offering a solution to the biggest problem that keeps institutional investors out of the cryptocurrency market. The Legolas exchange, built by people with deep backgrounds in finance and IT seeks to be the first theft-proof, provably fair, and guaranteed cryptocurrency exchange. Hence, regulators have fewer reasons to be worried that a cryptocurrency investment can disappear into thin air because an exchange was engaged in front running and market manipulation.

Bitcoin is growing and other cryptocurrencies are addressing some of the deficiencies of Bitcoin. When Bitcoin launched, it had a quasi-privacy that made it practically impossible to trace transactions; hence, it wasn’t surprising that Bitcoin the stock in trade for illegal activities on Silk Road. Now, Bitcoin transactions no longer have that kind of anonymity and a determined investigator can find out who owns what Bitcoin at any time.

The definition of a bubble is relative

When people say Bitcoin is in a bubble, what they are really expressing is an opinion of how overbought they think Bitcoin is. Yet, such opinions on overvaluation are always subjectively biased without giving enough weight to underlying fundamentals. History is filled with stories of many conservative investors calling each new innovation a bubble; yet, such 'bubbles' have survived on to create a paradigm shift for humanity.

In the 19th century at the start of the railway revolution, many leading voices of the day were mostly skeptical and they considered the railway system a bubble. For instance, Heinrich Heine wrote that railroads produced, "tremendous foreboding such as we always feel when there comes an enormous, an unheard-of event whose consequences are imponderable and incalculable."

The same can be said for the Internet, which was exhilarating for believers and frightening for detractors. We can still remember how fortunes were made and lost during the dotcom bubble; yet, there's no denying the fact that the Internet has forever changed the world as we know it. Granted, some people lost fortunes during the dotcom bubble, but the underlying principle that made the Internet a disruptive were not eroded even after the bubble burst.

Hence, when people say Bitcoin is in a bubble, they are only stating a perception that is not necessarily an absolute. Bitcoin's price seemed to be crazy when it reached $600, and then it jumped to $1000. It crossed the $2000 mark, and cynics were waiting for a massive crash until it jumped all the way to $4000. Perhaps Bitcoin at $5,000 is a bubble, maybe the bubble starts at $20,000, and nobody knows if Bitcoin will reach $100,000 before it enters a bubble.

Final words

There's currently more than $200 trillion invested gold, bonds, and stocks; yet, Bitcoin still have a valuation of around $59 billion and Ethereum is worth $24 billion in terms of market capitalization. You can expect the value of Bitcoin and other cryptocurrencies to continue to soar as cryptocurrencies become more acceptable in the mainstream market.