A moderately busy day of economic releases awaits on Wednesday, including the monthly update on money supply numbers from the European Central Bank. We’ll also see two updates for the US housing market: the weekly numbers on new applications for mortgages and the monthly release of the pending home sales figures for last month.

Eurozone: Money Supply (0900 GMT) The Financial Times published a widely discussed article on Sunday that raised questions about the potential for blowback in Europe in the wake of higher interest rates in the US. The Federal Reserve’s plan to gradually but consistently raise rates in the year ahead, building on this month’s first increase in nine years; the plan “could prove a mixed blessing” for the euroarea, the FT explains.

There are grounds for optimism about US housing, with a recent fall in existing home sales seen as a one-off, and the slow pace interest rate hikes unlikely to curb demand.

On the bright side: higher US rates are expected to keep downward pressure on the euro, which in turn should supports the region's exports. But tighter Fed policy could create ongoing trouble for emerging markets, delivering negative spillover effects for the Eurozone. “The big uncertainty,” said Markit’s chief economist, “is whether higher US interest rates cause knock-on effects, such as a corporate bond, or an emerging market crisis, which would clearly have a material impact on [the] Eurozone and global economies.”

All of which feeds into uncertainty about growth and inflation for countries that share the euro. On Tuesday, Natixis noted that “Eurozone growth is picking up, but probably not fast enough for inflation to rise because of the level high of unemployment.” As a result, there’s a “possibility that the ECB may switch to an even more expansionary monetary policy.”

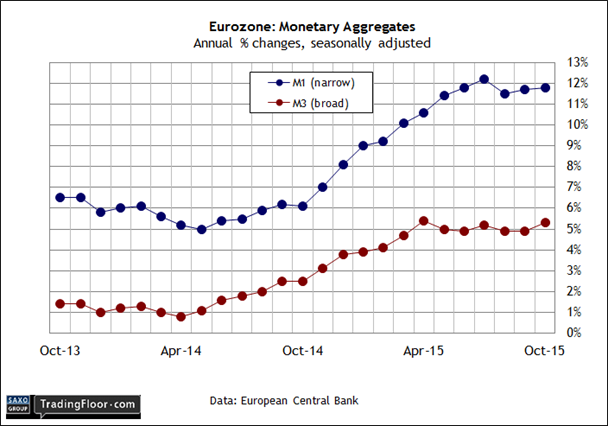

Hold that thought as we look to today’s monthly update on money supply from the ECB. Recent history suggests that the central bank is increasing the level of stimulus after briefly taking its foot off the pedal in late summer. As a result, the annual rates of growth for narrow and broad measures of money supply have ticked up in recent months, approaching previous peaks in the October release.

Meantime, the Fed is still expected to tighten policy in the months ahead. Until or if that changes, it would be surprising to discover that the ECB’s reversing its comparatively aggressive stimulus programme.

US: Mortgage Applications (1200 GMT) How’s the US real estate market holding up as 2015 draws to a close? As usual for much of the year just passed, the answer depends on the data set under the microscope.

The November report on existing home sales raised new concerns on news that transactions stumbled to the lowest level in well over a year. But new home sales perked up again last month, touching the highest level in nearly six years. Construction activity has been firmer lately, too, and yesterday’s update on prices for existing homes in October posted healthy gains.

"Generally good economic conditions continue to support gains in home prices," said David Blitzer, chairman of the index committee at S&P Dow Jones Indices, which publishes the S&P/Case-Shiller US Home Price Index. But he added that the arrival of higher rates in the US is raising questions about how the tighter monetary policy will affect demand for housing. But with expectations for a slow pace of hikes, Blitzer advised that "potential home buyers need not fear runaway mortgage interest rates."

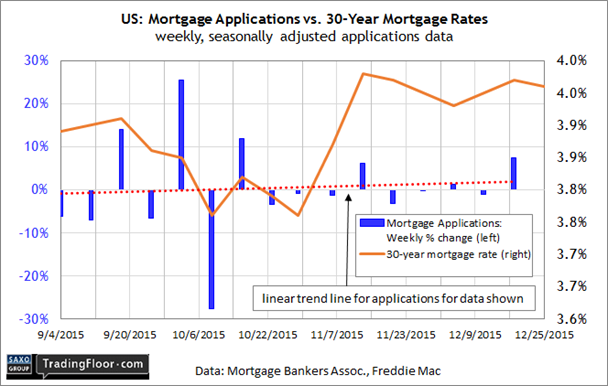

Today’s weekly update on mortgage applications will put Blitzer’s optimism in a fresh light. Last week’s report was certainly supportive of an upbeat outlook for demand. Total applications surged 7.3 percent for the week through December 18—the biggest weekly increase since August.

Weekly numbers are noisy, however, and so it remains to be seen how the trend will fare in the weeks ahead. Another possible glitch at the moment is the holiday factor, which may distort the numbers. Nonetheless, there’s a gently rising trend across the last several months, as shown in the chart below. The key question for today, and in the weeks ahead: Will demand for mortgages hold up if mortgage rates inch higher?

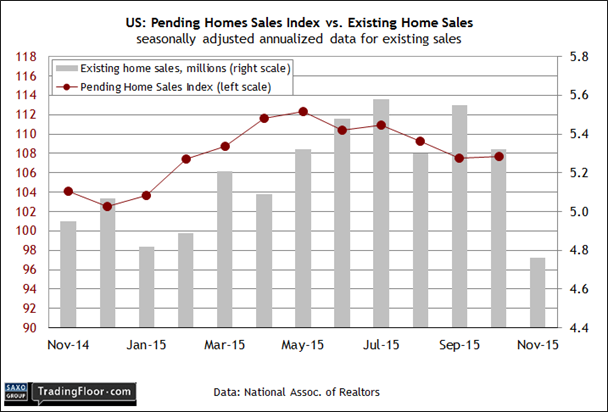

US: Pending Home Sales Index (1500 GMT) As noted above, existing home sales are the weak spot in the otherwise upbeat set of numbers for the residential housing market. Given the relative strength elsewhere for housing, is it reasonable to expect that last month’s weak print for existing sales is an outlier and that the data will soon rebound?

The crowd will be looking for a clue in today’s update on the pending sales data, which are considered a leading indicator for existing sales. Note that in the last update for pending sales the index inched higher in October. The 0.2% monthly increase still left this benchmark close to its lowest level in months, but more relief is coming, according to analysts.

Econoday.com’s consensus forecast sees pending home sales rising 0.5% in November. If so, the news will send a signal that the surprising stumble in existing sales last month was a one-time affair that will soon give way to firmer comparisons.

In fact, that’s the view Lawrence Yun, chief economist at the National Association of Realtors, the group that publishes the existing and pending sales data. “Signed contracts have remained mostly steady in recent months, and properties sold faster in November,” he said last week. “Therefore it's highly possible the stark sales decline [last month] wasn't because of sudden, withering demand.”

Disclosure: Originally published at Saxo Bank TradingFloor.com