Anecdotal Flags are Waved

“If a shoeshine boy can predict where this market is going to go, then it’s no place for a man with a lot of money to lose.”

It is actually a true story as far as we know – Joseph Kennedy, by all accounts an extremely shrewd businessman and investor (despite the fact that he had graduated in economics*), really did get his shoes shined on Wall Street one fine morning, and the shoe-shine boy, one Pat Bologna, asked him if he wanted a few stock tips. Kennedy was amused and intrigued and encouraged him to go ahead. Bologna wrote a few ticker symbols on a piece of paper, and when Kennedy later that day compared the list to the ticker tape, he realized that all the stocks on Bologna’s list had made strong gains. This happened a few months before the crash of 1929.

Joseph Kennedy in 1914, at age 25 – at the time reportedly “the youngest ever bank president in the US”

Kennedy sold all his stock market investments over the next several months and put the money in what he considered the safest banks. He had already made a fortune in the bull market, and reportedly augmented it later by going short in the bear market. We are pretty sure his meeting with the market-savvy shoe-shine boy wasn’t the only reason for which he decided to sell. He did mention the anecdote later in life though and the experience served to solidify a conclusion he had already arrived at: It was very late in the game and the market was likely to crack badly fairly soon.

We felt reminded of this story when a good friend (who invests for a living) visited us this summer. He inter alia told us about an acquaintance of his, whom he described as an autopilot investor who only very rarely looks at the market and has a record of getting the wrong ideas at the wrong time. His latest idea was noteworthy: he thought it would be a good idea to “sell volatility” (by writing puts, if memory serves). This was in July, just before the VIX reached a new all time low.

In 2008, the VIX hit a high of 90 points, which was in fact the technical target we were eying at the time. In both 2010 and 2011 it jumped to approximately 47 points. In 2014 it made a high at 32 points, and in 2015 it streaked to 52 points. On these occasions put writing was not very popular with the people mentioned above. But they loved the idea with the VIX between 9 and 11.50. Go figure – click to enlarge.

One shouldn’t jump to conclusions from this just yet – if it wasn’t well-known before, it should be by now: the VIX can remain subdued for a very long time. It only tells us that there is very little concern in the market – there is little demand for option hedges and traders are more inclined to sell volatility than to buy it. And similar to how high bullish sentiment during a bull market is not a contrary indicator most of the time, the lack of concern can be well founded for extended time periods.

We have good reason though to suspect though that this particular game is quite long in the tooth as well. We are going to discuss developments in sentiment data in detail in a separate post. Still, here are a few observations in this context. Sentiment has become even more lopsided lately, with the general public joining the party. It may not “feel” like the mania of the late 1990s to early 2000, but in terms of actually measurable data, the overall bullish consensus seems to be even greater than it was back then.

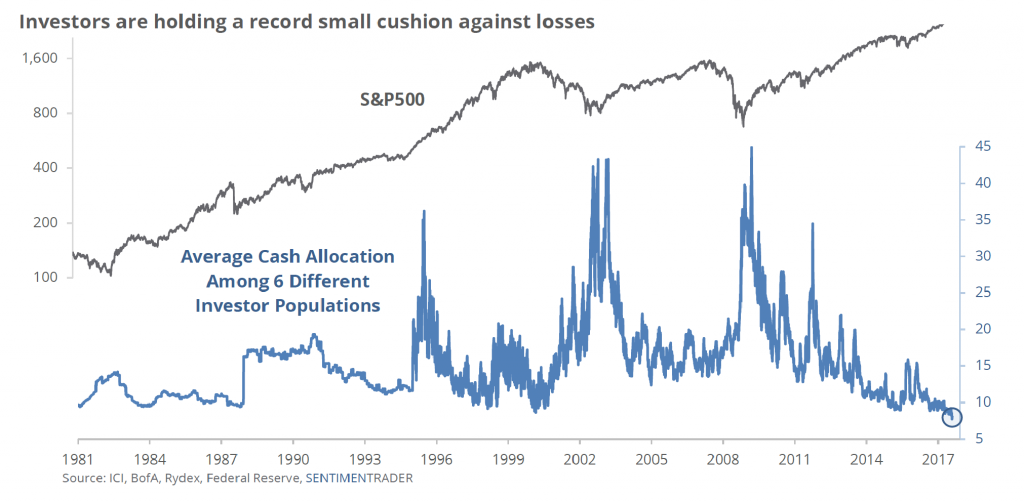

For instance, mutual fund inflows rose to record highs earlier this year. Along similar lines, here is a recent chart that aggregates the relative cash reserves of several groups of market participants (including individual investors, mutual fund managers, fund timers, pension fund managers, institutional portfolio managers, retail mom-and-pop type investors). It shows that there is simply no fear of a downturn:

Cash is still trash – to a record extent. Investors evidently don’t believe the market could possibly go down. Not surprisingly, a few years ago, when the S&P 500 index was nearly 1900 points lower than it is today, they had the exact opposite opinion. As always, keep in mind that this is not a timing indicator. What this indicator shows us is how big the danger is once the market’s trend reverses. As a rule such extremes in complacency precede crashes and major bear markets, but they cannot tell us when precisely the denouement will begin .

With respect to market sentiment we would like to share a remark by renowned Citi credit market analyst Matt King, which strikes us as an example of investors basing their decisions on a wrong premise. It also illustrates why investors should either invest their money on their own, or be very careful which administrators of other people’s money they trust to look after their savings. It also shows that the incentives driving the decisions of fund managers have become hopelessly distorted.

“Indeed, many investors we speak to seem almost to have given up on valuation as a metric. Rather like real estate in London or New York or Hong Kong, they are resigned to it: it may look expensive on paper, but the price is what it is, and they buy anyway. Several told us they would rather lose lots of money in company with the rest of the market than underperform slightly in a continuing rally and then suffer a fall in assets under management as investors move elsewhere.”

This attitude may have implications for the market’s near term prospects.

US Money Supply Growth Continues to Falter Rapidly

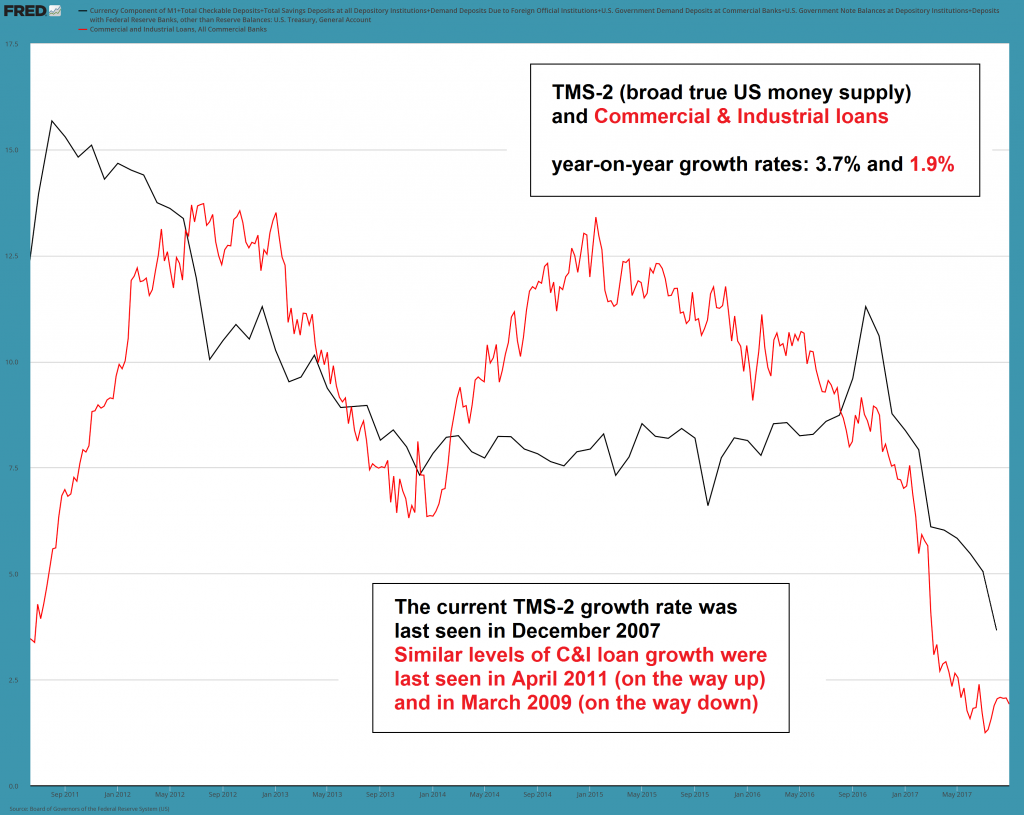

Most of the broad true money supply data for August have been reported, and it seems the slowdown in the year-on-year growth rate of the money supply is accelerating. The annual growth rate of TMS-2 lost a chunky 1.3% in August alone, falling from 5% y/y to 3.7% y/y. Just as we suspected, it is following the steep decline in the growth rate of the narrow money supply measure AMS which we discussed a few weeks ago with a lag.

The year-on-year growth rates of TMS-2 (broad true US money supply, black line) and commercial and industrial loans in the US (red line). Money supply growth is nearly at a 10 year low – click to enlarge.

As we always point out, this is the most important fundamental datum one needs to be aware of. Everything else is secondary, because money supply growth leads both asset prices and economic activity. The current height of asset prices and the current strength of economic data tell us nothing about tomorrow (or only very little, at any rate). When these trends turn, they will do so quite suddenly, with very little warning. Some warning signs will of course be noticeable prior to a major trend change.

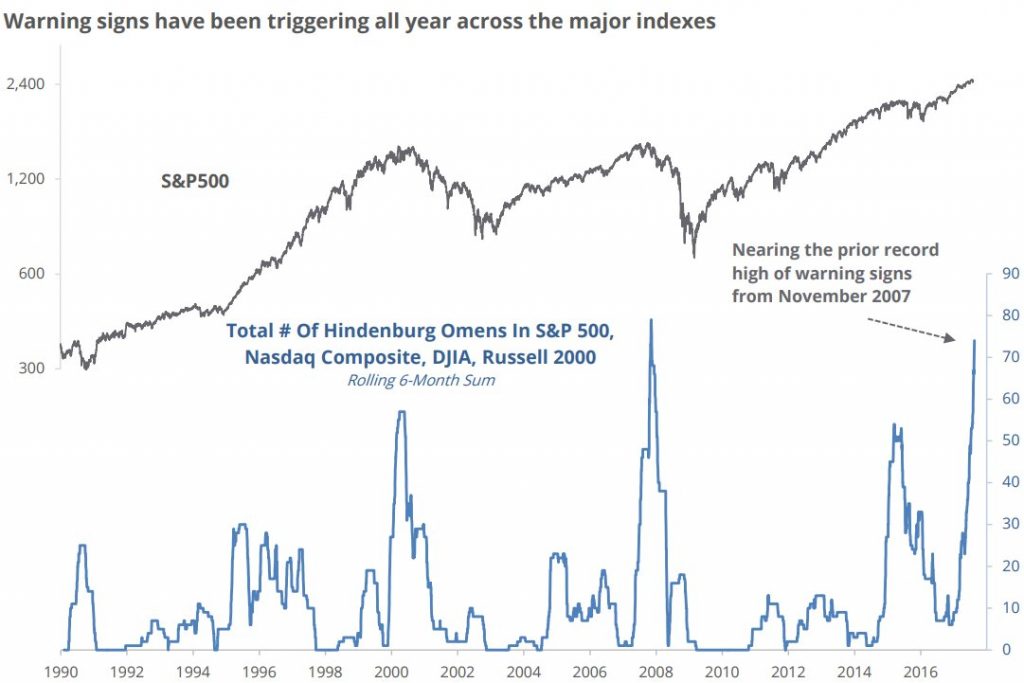

In the stock market we can observe internals, sentiment, certain ratios (e.g. the performance of non-cyclical vs. cyclical sectors) and technical divergences. Note that two so-called “Hindenburg omens” have recently occurred in close succession – the Hindenburg omen mainly gives us an indication of the degree of intra-market correlation, as a major feature of the signal is the fact that it is triggered when the number of new 52-week highs and lows is almost similar despite the indexes trading close to new highs.. Here is the definition of a “confirmed” Hindenburg omen (via Bob Hoye):

- The 50-day moving average of the NYSE must be rising.

- The number of new 52-week lows must be at least 2.2% of all issues that traded and changed in value.

- The new 52-week highs must also be at least 2.2% of all issues that traded and changed in value.

- The McClellan Oscillator ($NYMO) must be negative on the day.

- A confirmed signal occurs when a second signal is given within 36 days.

There was a confirmed signal in May/June. Another signal has occurred in the NYSE index ($NYA) in mid August on the heels of a close shave in early August (on a less strict definition, the early August signal would have counted as an “omen” as well).

The number of Hindenburg signals across major indexes has soared this year – click to enlarge.

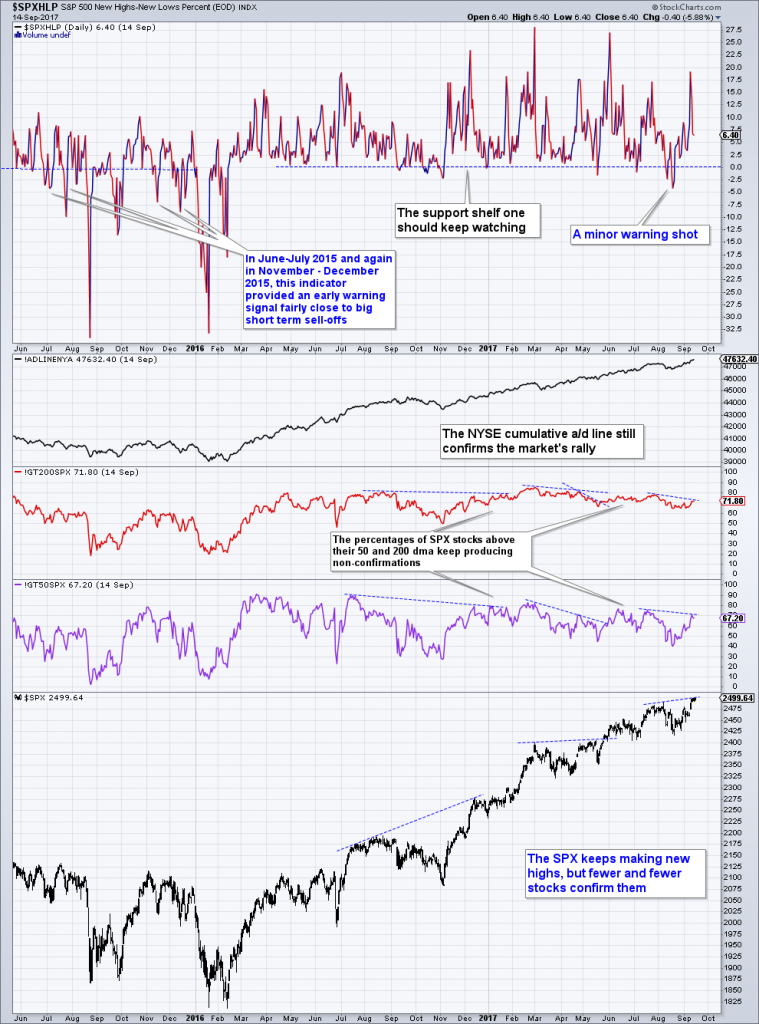

The most recent rally has resulted in an improvement of market internals – but their divergence with prices remains firmly in place. Here are some internals of the S&P 500 Index as an example – the SPX is the strongest index in terms of internals, as big cap stocks have significantly outperformed small and medium cap stocks this year (note that the NYSE cumulative a/d line still looks fine, but it is a lone exception):

Fewer and fewer stocks support rallies to new highs – click to enlarge.

Our point is that the ice is getting quite thin. The Fed is reportedly set to announce the beginning of “quantitative tightening” at the upcoming FOMC meeting, which is bound to pressure money supply growth even more. It should be obvious that this cannot be bullish, even if the process will be a very gradual one.

And yet, even with free liquidity weakening, sentiment at extremes and internals dubious, the market is consolidating close to all time highs in mid September – which is statistically the weakest month of the year. It seems therefore possible that the investors Matt King referred to (see above) will once again pile into stocks with whatever cash reserves they have left, so as to “make their year”.

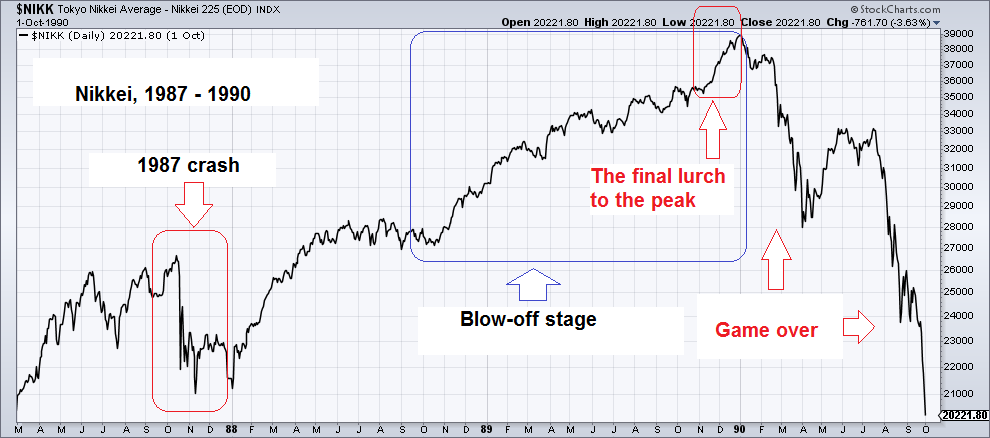

This is what happened in Japan in 1989, when the Nikkei streaked to a final high at the end of the year despite an inverted yield curve, sharply rising interest rates and deteriorating liquidity. Nine months later it traded below the low of the 1987 crash. What the chart below doesn’t show: after a five month bounce off the 1990 crash low, the index was absolutely crushed over the next twelve months. By mid 1993 it had lost 65% from the peak. In March 2009 it was a full 83% below its peak of 30 years earlier – n.b., in nominal terms, while the BoJ was on QE5 or QE6 (depending on how one counts its QE programs).

The Nikkei’s late 80s – early 90s blow-off and crash – note the “final lurch to the peak” .

Back in the late 1980s, when the Nikkei index seemed invincible, Japanese mutual fund managers – similar to the ones Matt King heard from recently – “had given up on valuation as a metric”. They went down with the ship big time, and eventually lost more than 90% of their AUM. And Japanese investors learned that “buy and hold stocks for the long term” is a potentially quite dangerous mantra. Oh well, at least they still have time before they beat the record long bear market of 1721 – 1789.

Conclusion

It is clear that since our last “heads-up” when it became obvious that growth in the domestic USD money supply was slowing rather dramatically, the situation has deteriorated further – hence asset prices are on even thinner ice than before. Other warnings signs continue to proliferate as well.

We wish we could tell you in which month the exhaustion point will be reached and the denouement will commence, but we can’t. There are too many moving parts; in the euro area, money supply growth (narrow money M1) is at a still hefty 9% y/y (down from a near 15% y/y peak) and while that can do nothing directly for assets priced in dollars, it underpins sentiment by keeping European high yield bonds well supported.

Could a final blow-off move be in the offing? It is possible, but a crash over the coming eight weeks is at least just as likely. Since the interim peak in money supply growth in November 2016 there has been a massive decrease in the growth of money and credit. Perhaps the coming announcement of the partial reversal of QE will serve as a “trigger” (since no-one seems to be taking it very seriously). We don’t know of course, but we suspect the exhaustion point is now very close.

Footnotes:

*of course, when he graduated in 1912, economic science wasn’t yet fully pressed into the service of the State, so it was comparatively free of arrant nonsense.