- The US economy should witness a further slowdown in 2023

- With inflation still running hot and the Fed raising rates to battle it, investors need to be prudent with their investment choices

- Here are the two investment options to consider

After a very challenging 2022, early signs show that 2023 won't be a walk in the park either. But there is still hope; even against the backdrop of high inflation, high interest rates, and slowing economic growth, there are interesting investment options that can help you protect your capital and navigate the stock market in better fashion than the average, uninformed investor.

Here are two ideas that can help you lock in some profits while maintaining a low risk exposure:

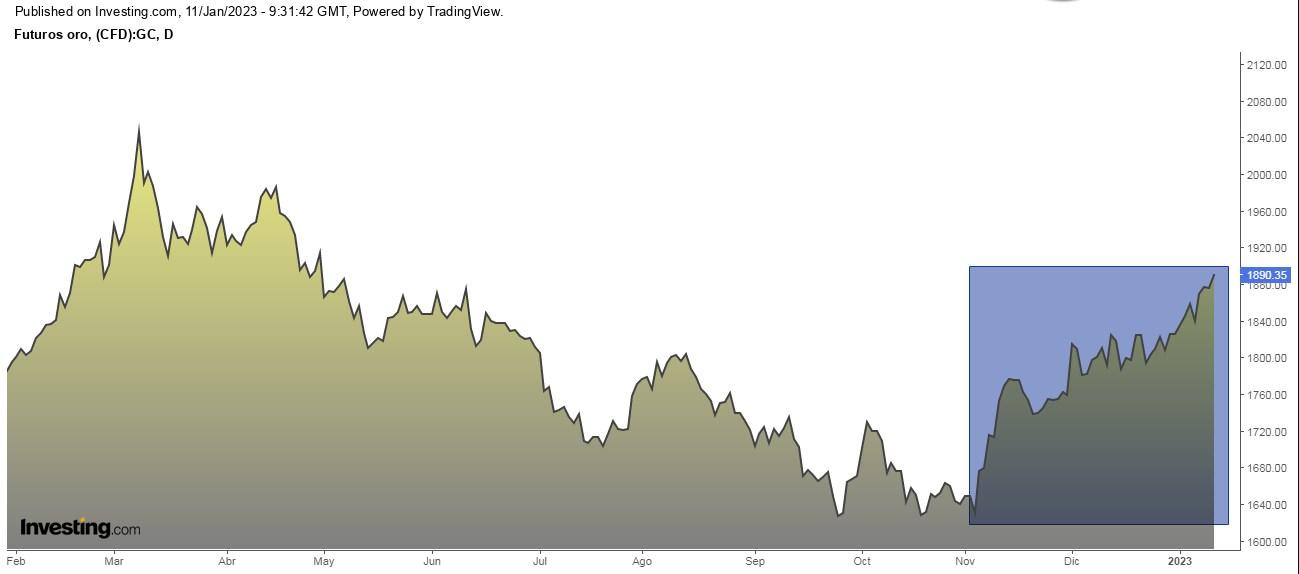

1. Gold

Gold is attractive under certain circumstances. if inflation is higher than usual, and there are fears about the economy in general, or if the US dollar weakens, gold is generally favored.

This implies that in three specific circumstances, gold tends to perform well given it is a safe haven:

- If investors believe that the economy may go into recession, uncertainty arises, which the markets do not like. Investors tend to exit equities buy in such a situation.

- If inflation is higher than usual, investors buy gold to protect their capital and minimize the consequent loss of purchasing power due to the increase in the cost of living.

- When the dollar is weak, gold benefits. This is mainly due to the inverse relationship between the two assets. If the dollar strengthens, gold price suffers, and vice versa.

A combination of all of the above factors could play out in 2023. And we have many reasons to believe that this year could be gold's year.

- Investors are fearing that the overall economy could go into recession this year. All eyes are on the United States, which officially entered recession in 2022. But going by the NBER concept of recession, the economy still hasn't entered a recession. The Bank of America Fund Manager Survey indicated that investors are not very keen on taking risks in the markets. Moreover, this indicator is at levels below those seen in 2008 and in 2020 during the pandemic.

- Inflation remains well above the target of the world's major central banks. The Federal Reserve has its meeting on Jan. 31-Feb. 1 and is expected to continue to raise interest rates by 50 basis points or 25 points. It is noted that 17 of the 19 Fed officials expect rates to rise by more than 5% in 2023, and none of them expect rates to be lowered this year, although the markets believe that at the end of 2023 and throughout 2024, this is a possibility.

- The greenback had a superb 2022, rallying against most currencies. But this year, the pace of rate hikes by the Fed will be slower, and the dollar could lose steam, and the EUR/USD pair could rise to 1.10-1.12.

- China is the world's largest buyer of gold. Its reopening is a breath of fresh air for its economy. And this favors gold since China will look to buy more gold if its economy is doing well, substantially increasing the demand for the metal and, thus, its price.

- Several Central Banks are buying gold. The objective is basically to diversify their reserves and not depend so much on the dollar. Specifically, the Central Banks of China, Russia, and Turkey are buying at a rate not seen in 55 years. In the case of China, it started buying after three years without doing so since December 2019. It increased its reserves by 30 tons in December after 32 tons in November, bringing the country's reserves to a total of 2,010 tons.

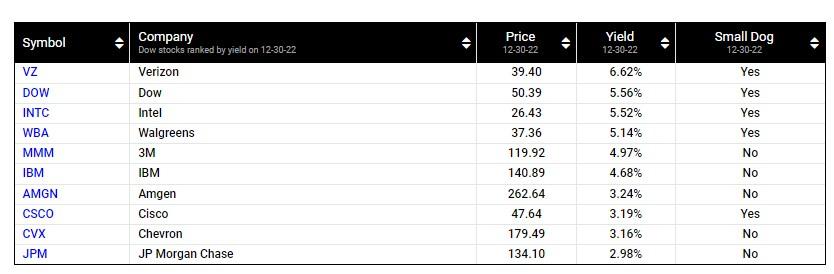

2. Dogs of the Dow

This is a very simple strategy. It consists of taking the 10 companies listed on the Dow Jones Industrial Average (although it also works with any other stock market index), which have the highest dividend yield at the close of the last trading session of the year.

Buy shares of these 10 companies, equally allocate your money between them, and keep them in your portfolio all year long.

Does this strategy work? Yes! If you had followed this strategy in 2022, this is how the outcome would have been:

In 2022, your return would have been 2.2%, which is not bad at all considering that the Dow Jones dropped 8.78%, the S&P 500 19.44%, and the Nasdaq 100 32.91% -- not to mention Europe, with all its indexes ending in the red from 5.56% to 13.31%.

In 2021 your returns would have been 16.30%. From 1957 to 2003, the average annual return was 14%, outperforming Dow Jones, which was 11%.

For 2023, the 10 Dow Jones stocks would be:

- Chevron (NYSE:CVX)

- Amgen (NASDAQ:AMGN)

- IBM (NYSE:IBM)

- Cisco (NASDAQ:CSCO)

- JPMorgan Chase & Co (NYSE:JPM)

- Dow (NYSE:DOW)

- Verizon (NYSE:VZ)

- Walgreens Boots Alliance (NASDAQ:WBA)

- 3M Company (NYSE:MMM)

- Intel (NASDAQ:INTC)