Short-Term Options Traders Are Unusually Call-Skewed On SWKS, AVGO

Apple (NASDAQ:AAPL) will kick off its annual World Wide Developers Conference (WWDC) on Monday, June 4, with updates to its iOS and macOS software expected. Ahead of the highly anticipated event – and the more imminent Memorial Day weekend – two Apple suppliers are giving off bullish signals.

Skyworks Stock Could Break Past Key Trendline

Skyworks Solutions (NASDAQ:SWKS) recently found itself on Schaeffer's Senior Quantitative Analyst Rocky White's list of the best-performing stocks on the S&P 500 index during Memorial Day week. Over the past 10 years, SWKS has averaged a gain of 2.7% in the four days following the holiday, and has been positive 80% of the time.

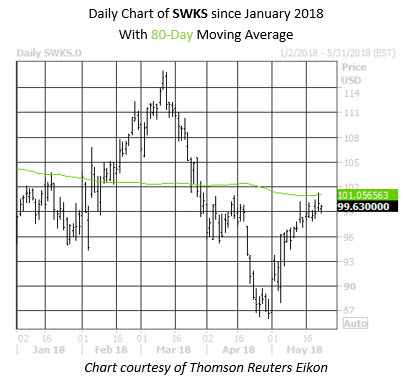

A move of similar proportion next week would push SWKS shares past resistance at their 80-day moving average, a trendline that has stifled breakouts since late March. The security has gained 16% since falling to an annual low of $86.13 on April 30 to trade at $99.63.

In the options pits, SWKS' Schaeffer's put/call open interest ratio (SOIR) of 1.17 ranks in the low 5th percentile of its annual range. In other words, speculative players have rarely been more skewed toward calls over puts, looking at options that expire in the next three months -- even as puts outnumber calls on an absolute basis.

Those that are purchasing premium on Skyworks are in luck, too. The stock's Schaeffer's Volatility Index (SVI) of 24% ranks in just the 7th annual percentile, suggesting short-term options have rarely been cheaper, from a volatility standpoint.

AVGO Could Get A Shot In The Arm Next Week

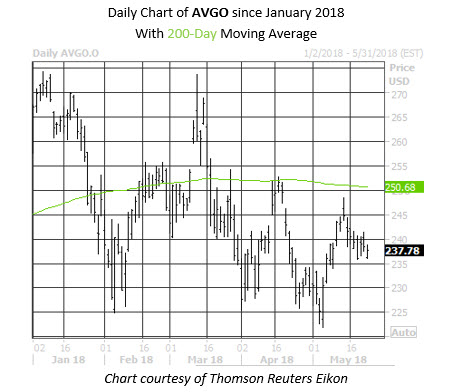

Fellow Apple supplier Broadcom (NASDAQ:AVGO) also found itself on White's list of Memorial Day week outperformers. The stock boasts an average weekly return of 3.13%, finishing positive three-quarters of the time. However, Broadcom shares have struggled recently, shedding 13% in the last six months to trade at $237.78, with breakout attempts in March and April thwarted by their 200-day moving average.

Despite the stock's struggles, analysts remain committed. Of the 25 brokerages covering AVGO, 23 rate it a "buy" or "strong buy," with not a single sell on the books. In addition, the equity's average 12-month price target of $310.65 sits well above its current perch.

In the option pits, short-term options traders are more call-skewed than usual. The security's Schaeffer's put/call open interest ratio (SOIR) of 0.50 ranks in just the 9th percentile of its annual range.