- CPI inflation, start of Q4 earnings season will be in focus this week.

- JPMorgan Chase is a buy with earnings beat on deck.

- Boeing is a sell amid fresh plane safety concerns.

- Looking for more actionable trade ideas to navigate the current market volatility? Members of InvestingPro get exclusive ideas and guidance to navigate any climate. Learn More »

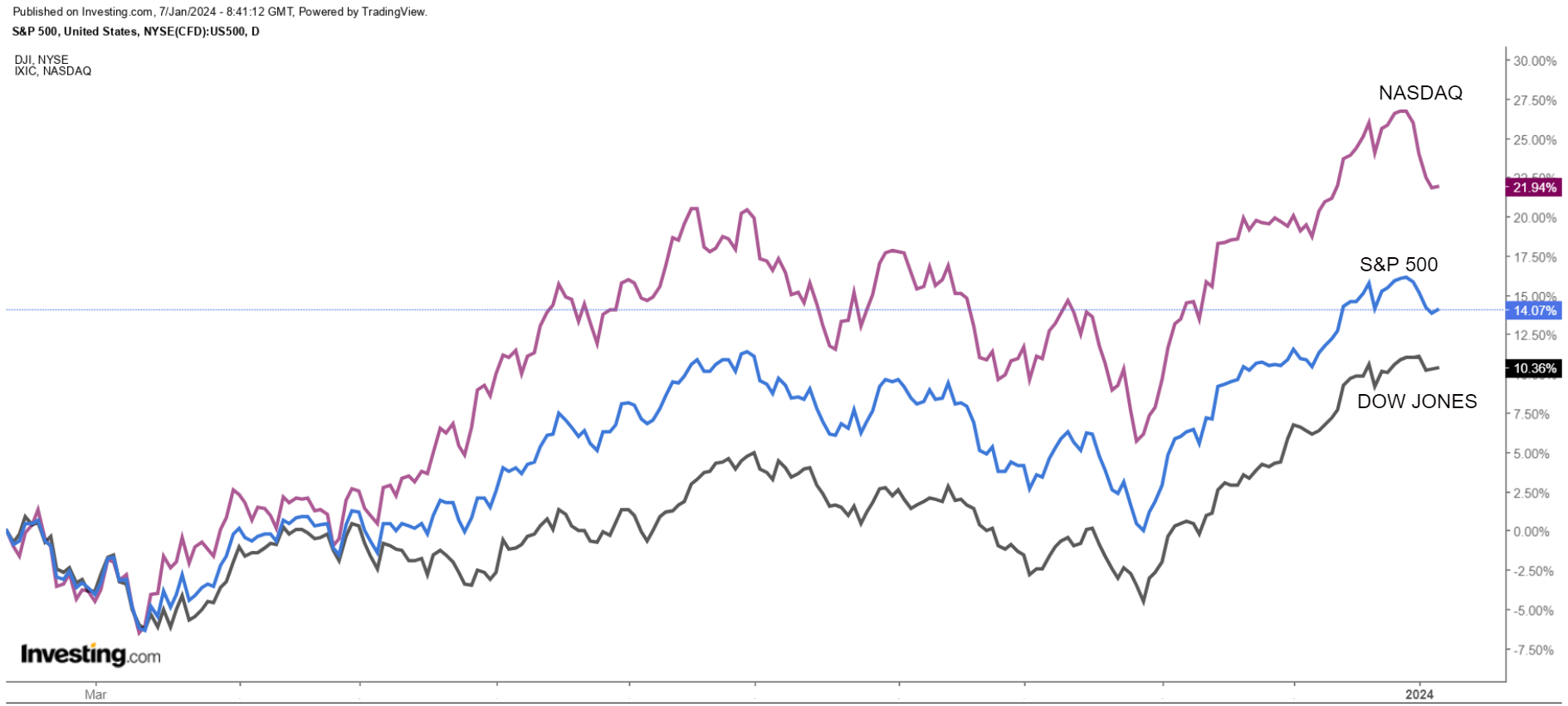

U.S. stocks closed slightly higher on Friday to wrap up the first trading week of 2024, however the major averages suffered their first weekly decline in ten weeks amid growing uncertainty over when the Federal Reserve may begin to cut interest rates.

For the week, the blue-chip Dow Jones Industrial Average shed 0.6%, the benchmark S&P 500 declined 1.5%, and the tech-heavy Nasdaq Composite slumped 3.3%.

For the S&P 500, it was its worst weekly performance since late October, while the Nasdaq posted its worst week since late September. The first full trading week of 2024 is expected to be a busy one as investors continue to assess incoming economic data to determine when the Fed will start cutting rates.

The first full trading week of 2024 is expected to be a busy one as investors continue to assess incoming economic data to determine when the Fed will start cutting rates.

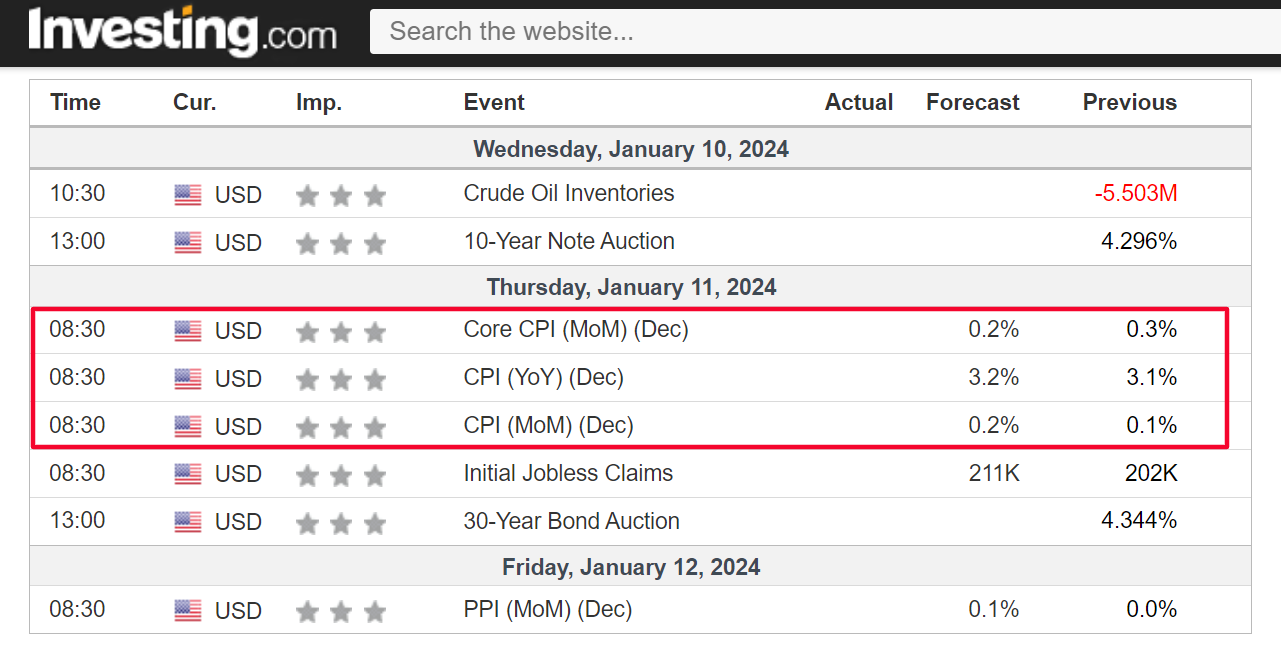

On the economic calendar, most important will be Thursday’s U.S. consumer price inflation report for December, which is forecast to show headline annual CPI accelerating to 3.2% from the 3.1% increase recorded in November.

As of Sunday morning, financial markets see a 32% chance of the Fed holding rates at current levels at its March meeting, according to Investing.com’s Fed Rate Monitor Tool, and a 68% chance of a quarter-percentage point rate cut.

Meanwhile, the earnings season officially kicks off on Friday with JPMorgan Chase, Bank of America (NYSE:BAC), Wells Fargo (NYSE:WFC), Citigroup (NYSE:C), BlackRock (NYSE:BLK), Delta Air Lines (NYSE:DAL), and UnitedHealth Group (NYSE:UNH) all scheduled to release quarterly results.

Regardless of which direction the market goes, below I highlight one stock likely to be in demand and another which could see fresh downside.

Remember though, my timeframe is just for the week ahead, Monday, January 8 - Friday, January 12.

Stock To Buy: JPMorgan Chase

After closing at a new all-time high on Friday, I expect another strong performance from JPMorgan Chase (NYSE:JPM) this week as the financial services giant’s latest financial results will easily top estimates thanks to a robust performance across its key business segments.

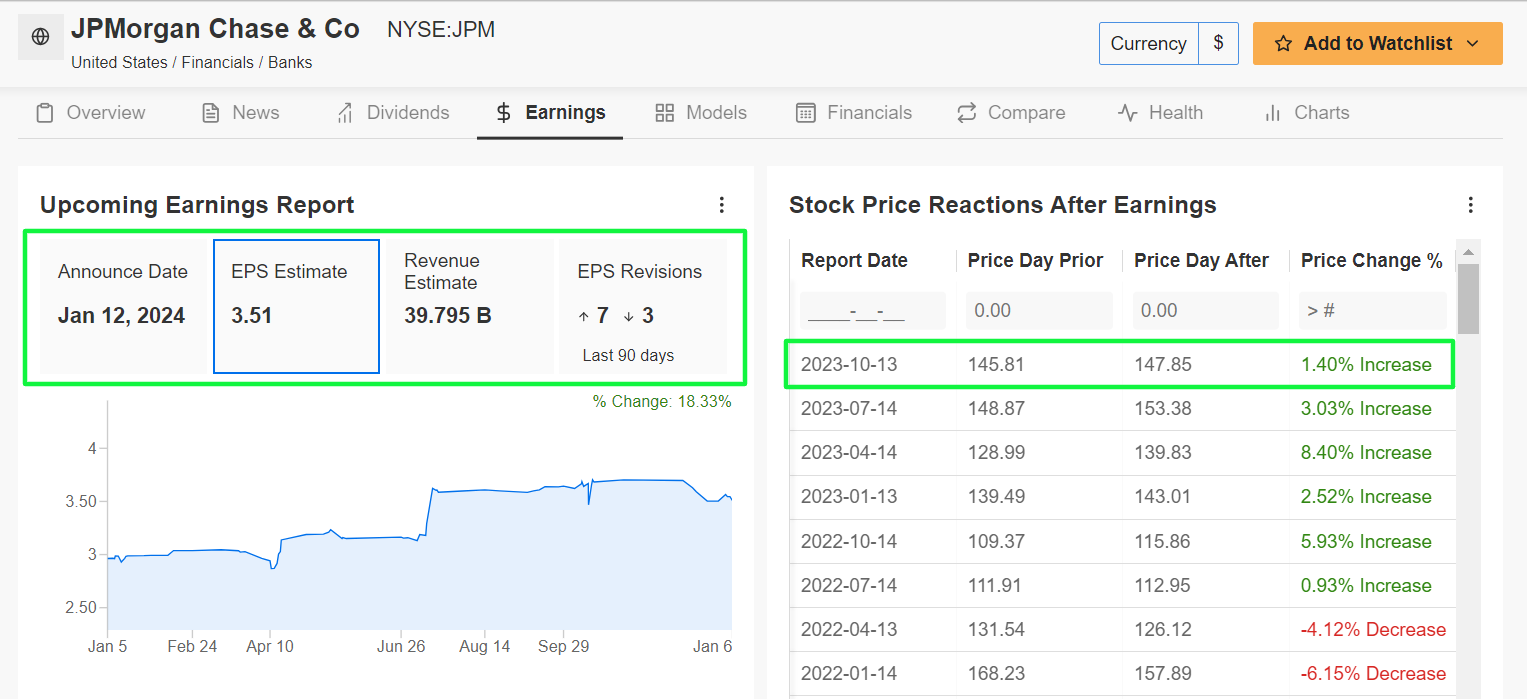

JPMorgan is scheduled to deliver fourth quarter earnings ahead of the opening bell on Friday at 7:00AM EST, with both analysts and investors growing increasingly optimistic about the banking powerhouse’s prospects.

Market participants expect a possible implied move of around 3% in either direction in JPM shares following the print. The stock rose 1.4% after its last earnings report in mid-October. Wall Street sees the Jamie Dimon-led bank earning $3.51 per share, a tad lower than EPS of $3.57 in the year-ago period. It should be noted that profit estimates have been revised upward seven times in the last 90 days, according to an InvestingPro survey, compared to three downward revisions.

Wall Street sees the Jamie Dimon-led bank earning $3.51 per share, a tad lower than EPS of $3.57 in the year-ago period. It should be noted that profit estimates have been revised upward seven times in the last 90 days, according to an InvestingPro survey, compared to three downward revisions.

Meanwhile, revenue is anticipated to jump 15.2% year-over-year to $39.8 billion, reflecting solid growth in its retail banking division. In addition, I anticipate fixed income trading revenue, equity trading revenue, and investment banking revenue to all top estimates as the Wall Street behemoth benefits from increased trading activity, higher interest rates, and an improving IPO market.

Despite a challenging operating environment, JPMorgan has topped Wall Street’s top and bottom-line estimates in all the previous five quarters, highlighting the strength of its business and strong execution across the company. JPM stock ended Friday’s session at $172.26, above the prior record high close of $172.08 from January 2. At current levels, the New York-based megabank has a market cap of roughly $498 billion, earning JPM the status of the most valuable bank in the world.

JPM stock ended Friday’s session at $172.26, above the prior record high close of $172.08 from January 2. At current levels, the New York-based megabank has a market cap of roughly $498 billion, earning JPM the status of the most valuable bank in the world.

Shares gained 1.3% in the first trading week of 2024 after scoring an annual increase of roughly 27% in 2023. In addition to its strong earnings outlook, JPMorgan also stands to benefit from its involvement in the potential approval of a spot Bitcoin ETF, which could come in the week ahead.

Stock to Sell: Boeing

Boeing (NYSE:BA) shares are likely to see increased selling pressure in the week ahead after a piece of fuselage tore off a brand-new Boeing 737 Max 9 jet during a U.S. flight on Friday night, forcing an emergency landing in a potentially "tragic" incident.

The plane, carrying 171 passengers and six crew, landed safely with a gaping hole in its side after being in service for just eight weeks.

It is worth mentioning that the fuselage for Boeing 737s is made by Kansas-based aerospace supplier Spirit AeroSystems (NYSE:SPR). According to media reports, Spirit manufactured and installed the particular plug door that suffered the blowout, but Boeing also has a key role in the usual completion process.

The near-tragic accident prompted the Federal Aviation Administration (FAA) on Saturday to ground 171 Boeing 737 MAX 9 jetliners for safety checks before the planes could resume flights. The FAA did not rule out further action.

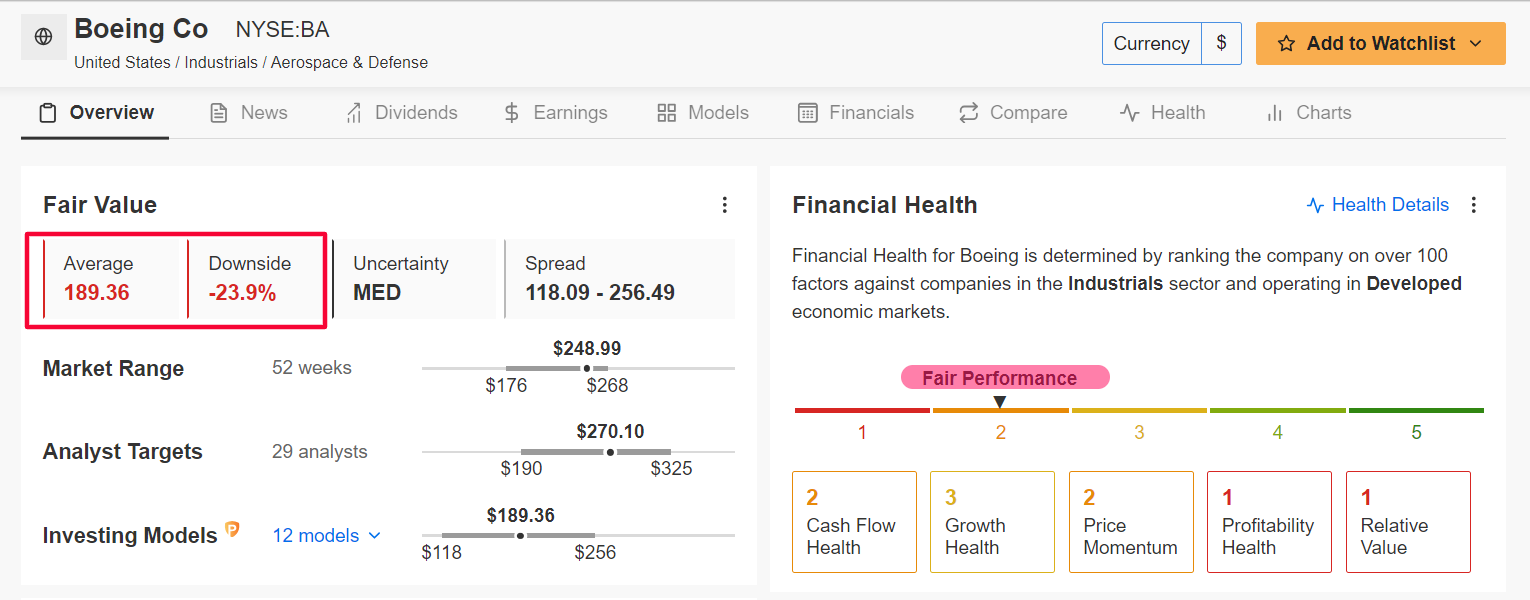

The news serves as a fresh blow to Boeing as it tries to recover from back-to-back crises in recent years over the safety of its planes and the negative impact of the COVID-19 pandemic under heavy debt. As such, it should come as no surprise that Boeing currently has a below average InvestingPro ‘Financial Health’ score due to concerns over profitability, growth, and free cash flow prospects. In addition, the ‘Fair Value’ price target implies potential downside of 23.9% over the next 12 months.

As such, it should come as no surprise that Boeing currently has a below average InvestingPro ‘Financial Health’ score due to concerns over profitability, growth, and free cash flow prospects. In addition, the ‘Fair Value’ price target implies potential downside of 23.9% over the next 12 months.

BA stock closed at $248.99 on Friday, continuing to pull back from a recent 52-week peak of $267.54 reached on December 21. The Arlington, Virginia-based aerospace giant has a market cap of $150.6 billion.

Shares have gotten off to a downbeat start to the new year, falling 4.5% in the first week of 2024 after ending 2023 with a gain of 36.8%.

Shares have gotten off to a downbeat start to the new year, falling 4.5% in the first week of 2024 after ending 2023 with a gain of 36.8%.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. As with any investment, it's crucial to research extensively before making any decisions.

InvestingPro empowers investors to make informed decisions by providing a comprehensive analysis of undervalued stocks with the potential for significant upside in the market.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK). I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.