- U.S. inflation data, retail sales, and more earnings will drive markets in the week ahead.

- Deere) shares are a buy amid strong profit and sales growth.

- Palantir stock set to underperform amid sluggish results and weak outlook.

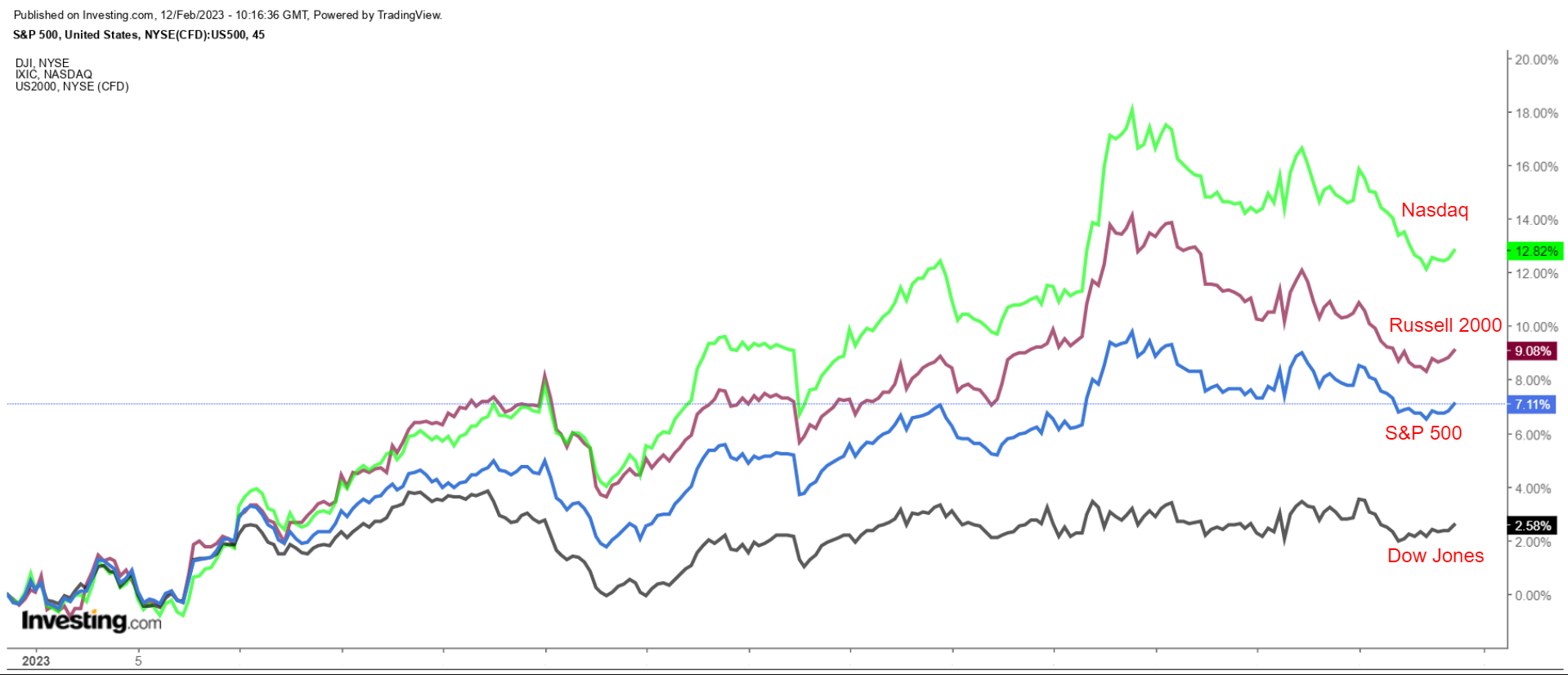

Stocks on Wall Street ended mixed on Friday, as the S&P 500 suffered its worst week in two months as investors continued to assess the Federal Reserve's aggressiveness in future interest rate hikes.

For the week, the blue-chip Dow Jones Industrial Average dipped 0.2%, while the benchmark S&P 500 and the tech-heavy Nasdaq Composite slumped 1.1% and 2.4%, respectively, in what was their worst week since December. Meanwhile, the small-cap Russell 2000 lost 3.4%.

The blockbuster week ahead is expected to be a busy one filled with several market-moving events as investors continue to gauge the outlook for inflation, the economy and interest rates.

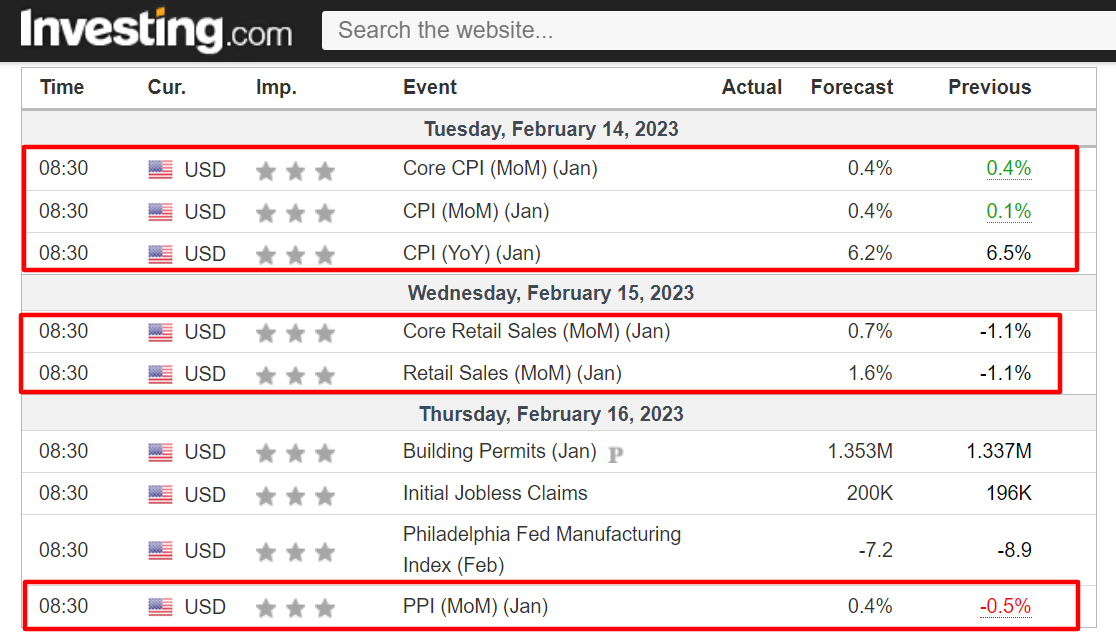

On the economic calendar, most important will be Tuesday’s U.S. consumer price inflation report for January, which is forecast to show headline annual CPI cooling to +6.2% from the +6.5% increase seen in December.

Reports on producer price inflation, retail sales, initial jobless claims and multiple manufacturing reports are also on the agenda.

The economic data will be accompanied by a heavy slate of Federal Reserve speakers, which will surely add to the debate on the pace of rate hikes.

Currently, markets overwhelmingly expect a 25-basis point rate hike in March and May. Meanwhile, the odds of another quarter-point increase in June have risen to about 40%, according to Investing.com’s Fed Rate Monitor Tool.

Elsewhere, the corporate earnings season continues, with Shopify (NYSE:SHOP), Airbnb (NASDAQ:ABNB), Roku (NASDAQ:ROKU), DraftKings (NASDAQ:DKNG), Cisco Systems (NASDAQ:CSCO), Applied Materials (NASDAQ:AMAT), Arista Networks (NYSE:ANET), Coca-Cola (NYSE:KO), Kraft Heinz (NASDAQ:KHC), DoorDash (NYSE:DASH), and Paramount (NYSE:PGRE) all on the docket.

Some of the other notable reporters include Roblox (NYSE:RBLX), The Trade Desk (NASDAQ:TTD), Twilio (NYSE:TWLO), Datadog (NASDAQ:DDOG), Upstart Holdings (NASDAQ:UPST), Devon Energy (NYSE:DVN), and Barrick Gold (NYSE:GOLD).

Regardless of which direction the market goes, below we highlight one stock likely to be in demand and another which could see further downside.

Remember though, our timeframe is just for the upcoming week.

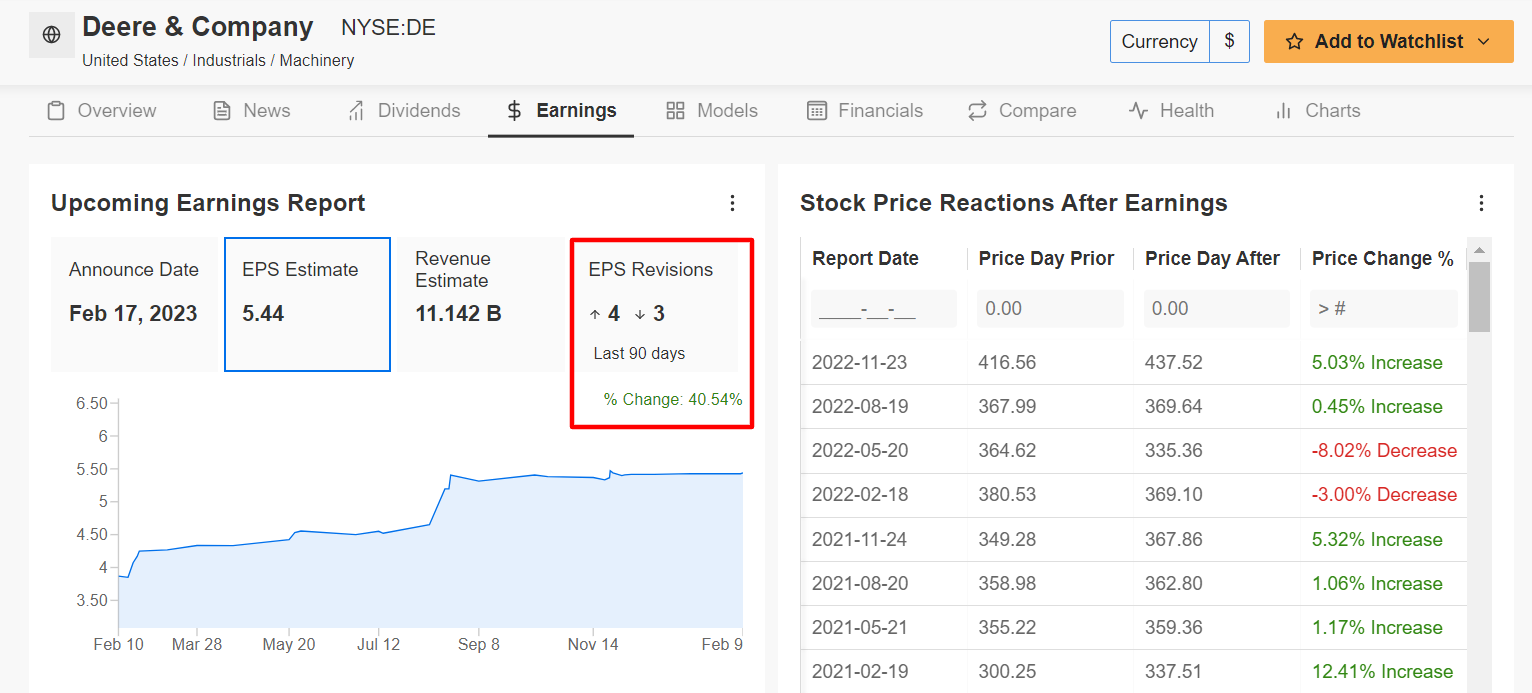

Stock To Buy: Deere & Company

I expect Deere's (NYSE:DE) stock to march higher in the week ahead as the agriculture-and-heavy machinery equipment maker’s fiscal first-quarter earnings will surprise to the upside in my view, thanks to improving industry demand trends and a favorable fundamental outlook.

Deere’s Q1 update is due ahead of Friday's opening bell and results are once again likely to benefit from positive global farm fundamentals and increased U.S. infrastructure investment.

As per moves in the options market, traders are pricing in a swing of about 4% in either direction for DE stock following the release.

Source: InvestingPro

Consensus estimates call for profit of $5.44 per share, as per InvestingPro, soaring 86.3% from EPS of $2.92 in the year-ago period. According to InvestingPro, EPS estimates have been revised upward 4 times in the 90 days prior to the earnings release, with analysts growing increasingly bullish on the tractor maker’s future prospects.

Meanwhile, Deere’s revenue is forecast to rise 30.6% year-over-year to $11.14 billion, reflecting robust demand for its wide range of agricultural, mining, and construction equipment.

Looking ahead, I believe the agriculture giant will provide solid guidance for the rest of the year, given the promising outlook for farm and mining machinery sales.

DE stock ended Friday’s session at $417.79, less than 7% away from a record high of $448.40 reached on November 23, 2022. At current levels, the Moline, Illinois-based heavy equipment maker has a market cap of $124.1 billion.

Shares are up 6.5% in the last 12 months, easily outperforming the S&P 500’s 7.4% decline over the same timeframe, thanks to the ongoing recovery in the farming and mining industries and amid newfound confidence in the resilience of the global economy.

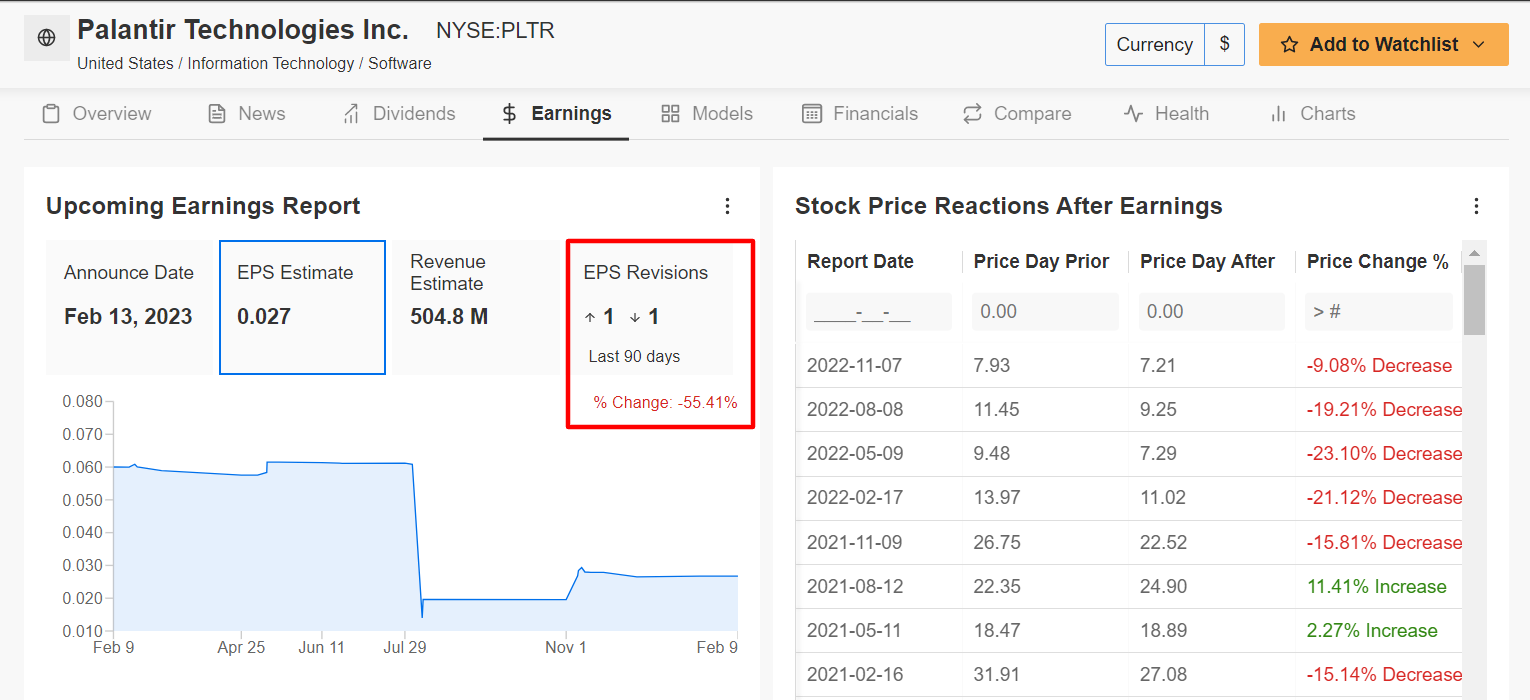

Stock To Sell: Palantir Technologies

I believe Palantir's (NYSE:PLTR) stock will suffer a difficult week, with a potential breakdown to a new record low on the horizon, as the out-of-favor data-mining specialist’s fourth quarter financial results will likely reveal another slowdown in both profit and revenue growth.

Market participants expect a sizable swing in PLTR shares following the update - which is due before the U.S. market open on Monday - with a possible implied move of roughly 13% in either direction, according to the options market.

Consensus calls for the data-analytics software company to post earnings of $0.02 per share, as per Investing.com, the same as in the year-ago period. Palantir has missed Wall Street’s profit estimates in the last four quarters, reflecting the negative impact of various headwinds on its business.

As could be expected, an InvestingPro survey of analyst earnings revisions points to mounting pessimism ahead of the report, with analysts slashing their EPS estimates by 55% from their initial expectations over the last 90 days.

Q4 revenue is forecast to increase 16.6% from the year-ago period to $504.8 million. If confirmed, that would mark the slowest annualized sales growth rate in Palantir’s history as the once high-flying software company struggles to deal with worsening fundamentals and a tough macroeconomic environment.

As such, Palantir’s revenue and free cash flow guidance could disappoint, given slowing demand trends for its data-analytics software tools. The gloomy outlook will add to lingering skepticism that Palantir will hit its goal of generating sustainable top-line revenue growth of 30% or more through 2025.

PLTR stock - which fell to an all-time low of $5.84 on Jan. 24 - closed at $7.51 on Friday. At current valuations, the Denver, Colorado-based big-data firm has a market cap of $15.6 billion.

Shares, which have bounced back to start the new year along with the tech-heavy Nasdaq, are up 17% thus far in 2023. Notwithstanding the recent turnaround, the stock remains over 80% below its January 2021 all-time high of $45.

Disclosure: At the time of writing, I am short on the S&P 500 and Nasdaq 100 via the ProShares Short S&P 500 ETF (SH) and ProShares Short QQQ ETF (PSQ). I am long on the Energy Select Sector SPDR ETF (NYSE:XLE). I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.