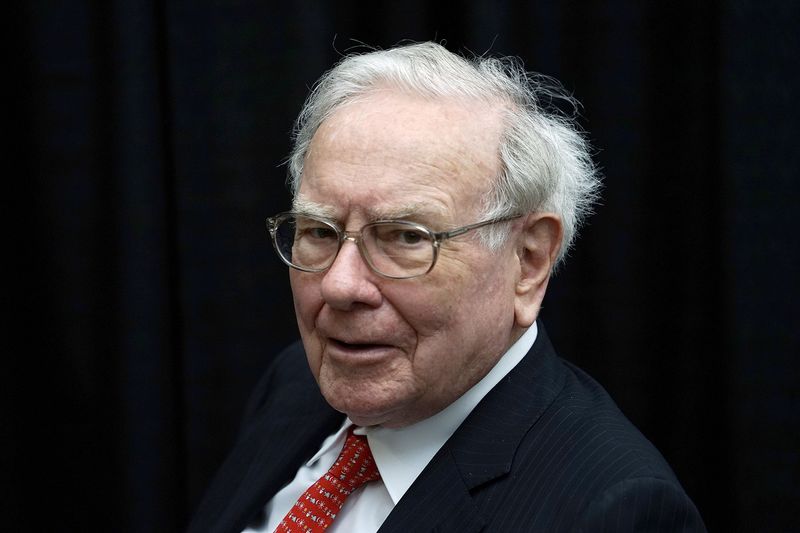

Berkshire Hathaway (NYSE:BRKa), led by Warren Buffett, significantly cut its investment in Apple (NASDAQ:AAPL), selling almost half of its shares in the tech giant.

According to its recent earnings filing, the value of Berkshire's holdings in Apple dropped to $84.2 billion by the end of the second quarter, indicating a sale of nearly 50% of its position in the company. Despite this gigantic sell-off, Apple stock remains the largest holding in Berkshire's portfolio.

Buffett hinted during the Berkshire annual meeting in May that the sales were partially motivated by tax considerations. He suggested that reducing the Apple position could be advantageous for Berkshire shareholders should capital gains taxes increase in the future.

Apple stock had a robust second quarter, surging 23% and setting a new record, buoyed by investor enthusiasm over the company's focus on artificial intelligence. This surge in stock price followed a decline in the previous quarter amid concerns that Apple was lagging in AI innovation.

At one point, Berkshire's investment in Apple represented half of its entire equity portfolio.

In addition to Apple, Buffett has been actively trimming positions in other major holdings.

Notably, he has also begun to cut its stake in Berkshire's second-largest investment, Bank of America.