(Bloomberg) -- In the world of passive investing, betting on equity swings is one of most lucrative trades on Wall Street once again -- but now it’s for long wagers.

Securities linked to volatility are the best performers among U.S. exchange-traded products this year. While in 2017 it was those wagering on calmer days that did the best, now it’s the ones that gain with the VIX index that are rallying the most.

With the S&P 500 Index posting its first quarterly slide since 2015, the Cboe Volatility Index has rebounded from record lows hit in 2017. Two leveraged securities tracking futures linked to the gauge of equity turmoil -- the ProShares Ultra VIX Short-Term Futures (ticker UVXY) and VelocityShares Daily 2x VIX Short Term ETN (TVIX) -- have more than doubled this year, while the iPath S&P 500 VIX Short-Term Futures ETN (VXX) has gained about 86 percent.

On the other hand, one of 2017’s best performers that’s tied inversely to volatility has become this year’s worst, after losing 91 percent.

At the same time, the popularity of volatility trading via VIX contracts has been waning, with the number of futures and options outstanding falling to levels not seen since 2016. Goldman Sachs Group Inc (NYSE:GS). has urged investors to boost protection, saying that traders are more exposed to stock swings after the expiration of many S&P 500 hedges. The VIX fell 4.4 percent at 8:20 a.m. in New York after surging 18 percent on Monday.

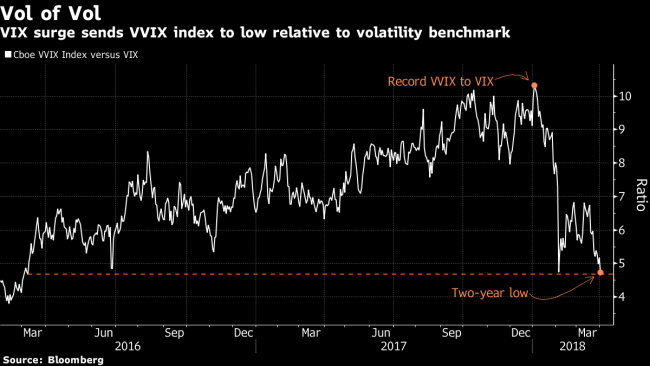

For those looking into VIX contracts to bet on the future of stock swings, now may be a good time. While the volatility measure has doubled this year, a gauge tracking the cost of its options has climbed much less. The Cboe VVIX Index is now at its lowest level since 2016 relative to the VIX, indicating that contracts on the volatility benchmark are on the cheap side.

(Updates with VIX in fifth paragraph.)