Investing.com — Big banks kicked off what is likely to be a very positive earnings season for stocks. Average EPS for the S&P 500 is expected to grow by +8.8% from the same period last year, with Communication Services, IT, and Health Care accounting for the larger share of growth.

Against this backdrop, now is the time to make strategic stock purchases that will drive your portfolio to new heights.

That's where our premium users who subscribed to our AI-powered list of stock picks for just under $8 a month are one step ahead of everyone else.

At the beginning of July, they received a list of top picks for the month ahead according to our AI's state-of-the-art fundamental modeling. And, even before earnings season picks up, they are already reaping the gains in picks such as:

- Wayfair (NYSE:W): +9.3% this month.

- Urban Outfitters (NASDAQ:URBN): Up 12.95% this month.

- Enphase Energy (NASDAQ:ENPH): 14.48% this month.

Just to name a few from a much larger list of fundamentally and technically solid stocks ready to explode higher after reporting results.

Subscribe now for less than $8 a month and unlock all the picks that will let you gain big on Q2 earnings season now!

But don't just take my word for it; check out these picks from our AI during the last earnings season in Q1:

- Ringcentral (NYSE:RNG): +14.6% after reporting

- Louisiana-Pacific Corporation (NYSE:LPX): +20.8% after reporting

- Applovin Corp (NASDAQ:APP): +15.1% after reporting

- Vistra Energy Corp (NYSE:VST): +9.2% after reporting

- United Therapeutics Corporation (NASDAQ:UTHR): +8.9% after reporting

- Tenet Healthcare Corporation (NYSE:THC) +13.3% after reporting

- Wayfair Inc (NYSE:W): +16.15% after reporting

These results have helped propel our strategies to beat the benchmark index since our official launch in November.

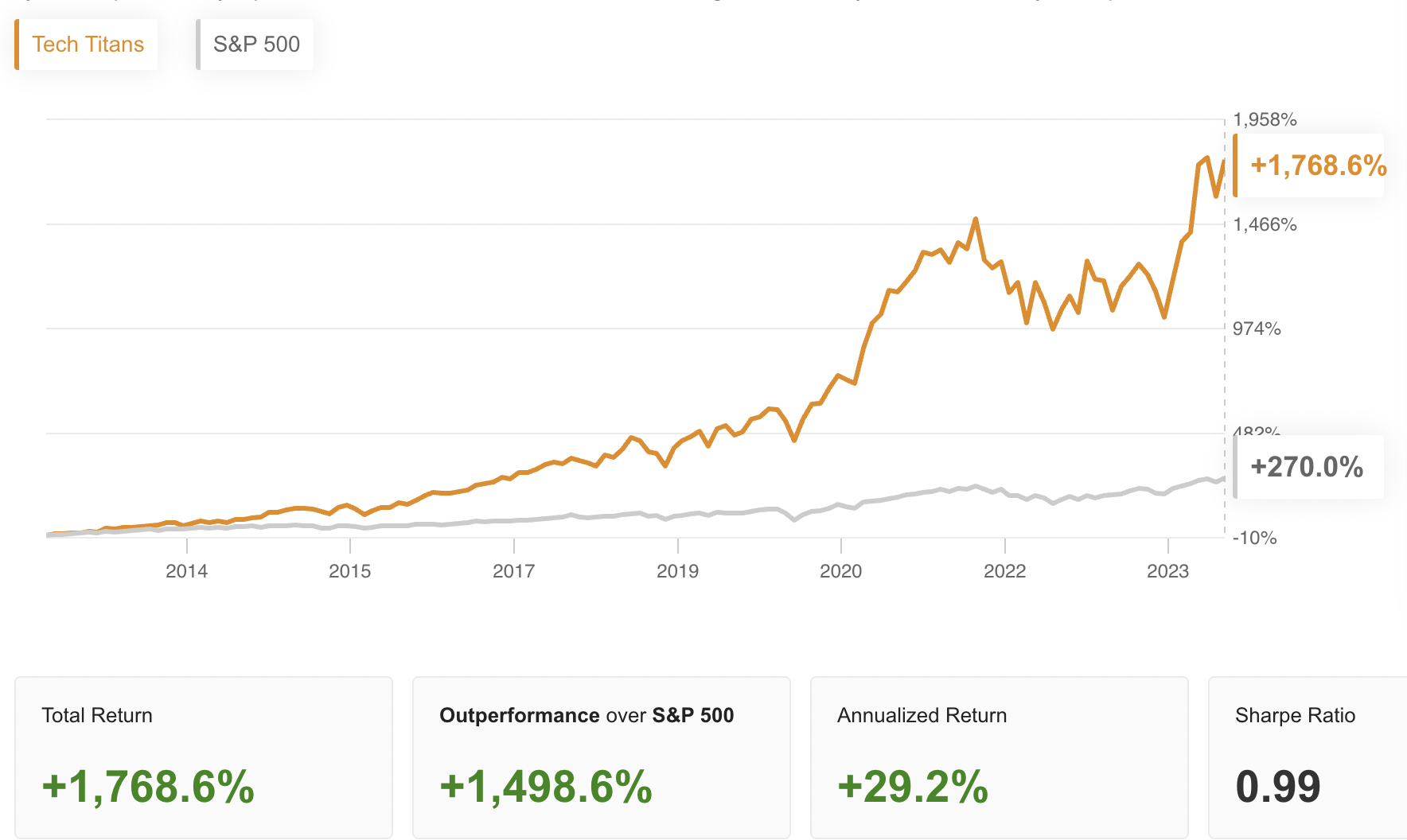

See below the real-world performance of our AI-powered strategies:

- Tech Titans: +78.01%

- Beat the S&P 500: +36.66%

- S&P 500: 31.78%

This is no backtest. This is the real-world performance unfolded right in front of our eyes.

What are you waiting for to get all our picks for Q2 earnings season? Take advantage of our exclusive summer sale and get the picks that beat the market for less than $8 a month!

In fact, our backtest suggest that investors who follow the strategies over the long run will get even better results. See below:

Source: ProPicks

This means a $100K principal in our strategy would have turned into an eye-popping $1,868,000 by now.

Amazing, right?

Take advantage of our exclusive summer sale and get an insight into the winners now for less than $8 a month!

*And since you made it all the way to the bottom of this article, we'll give you a special 10% extra discount on all our plans with the coupon code PROPICKS2024!