Investing.com — While we still have arguably the most important name in the current market, NVIDIA (NASDAQ:NVDA), lined up to report on August 28, the picture for the Q2 earnings season is already clear: despite big tech's overall disappointing performance, more companies are surpassing EPS estimates than ever in the previous seasons.

In fact, a solid 78% of the S&P 500 companies that reported so far have beaten analyst estimates—the highest rate since 2021.

Against this backdrop, investors who focused solely on overextended AI plays and big tech may have missed out on one of the year's greatest opportunities: "the great value comeback."

Luckily, that's NOT the case for our premium users, who, for less than $8 a month, received a plethora of winning earnings season names, among which the following ten double-digit compounders in the value spectrum. See below:

- Charter Communications (NASDAQ:CHTR): +19.72%

- Eli Lilly and Company (NYSE:LLY): +15.48%

- Expedia (NASDAQ:EXPE): +14.80%

- F5 Networks (NASDAQ:FFIV): +14%

- Pool Corporation (NASDAQ:POOL): +13.64%

- Molina Healthcare (NYSE:MOH): +12.99%

- PayPal Holdings (NASDAQ:PYPL): +11.60%

- Enphase Energy (NASDAQ:ENPH): +11.60%

- Frontdoor (NASDAQ:FTDR): +11.50%

- YETI Holdings (NYSE:YETI): +10.60%

(*percentages refer to the two trading days that followed the report)

Among several others!

Our state-of-the-art AI tool picked these stocks over the three monthly updates that encompassed the Q2 earnings season, all of them BEFORE they reported earnings.

Now, given the highly positive financial backdrop presented by these companies, several of them are likely to continue to gain in the months ahead, especially if the economy continues to avoid a recession.

However, others may just have passed their prime and have now become hard sells.

Want to find out which? See here which stocks stayed in our August list and which have been removed.

Unlike other models, our AI identifies undervalued names before they become too expensive. Instead of relying solely on momentum models, our approach integrates decades of comprehensive stock market fundamental and technical analysis of a multitude of data sets.

But hold on, there's even more:

Among the companies that reported inside one of our strategies, nearly 30% rallied by more than 5% afterward, with more than 20% rallying by 10% or more.

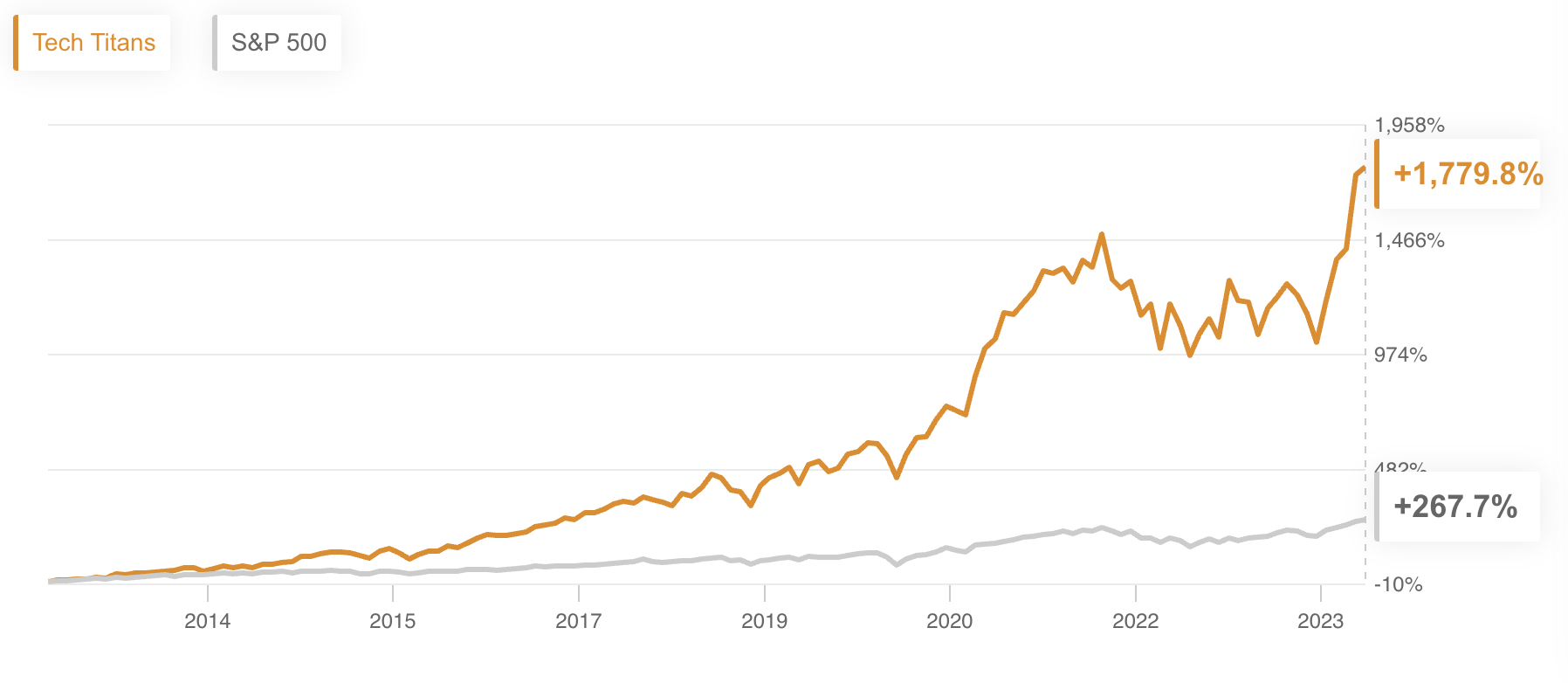

These results have propelled our strategies to significantly outperform the market since our official launch in November last year (as of today's premarket figures):

- Tech Titans: +75.61%

- Top Value: 37.86%

- S&P 500: 28.52%

These numbers are no backtest; they represent real-world performance, unfolded in real time to our users' benefit.

In fact, our backtest suggests that going for the long run will give you even heftier gains. See chart below for reference:

Source: ProPicks

This means a $100K principal in our strategy would have turned into an eye-popping $1,879,800K by now.

Will you risk going another month without the super-human power of AI data processing?

For less than $8 a month, that decision has never been easier.