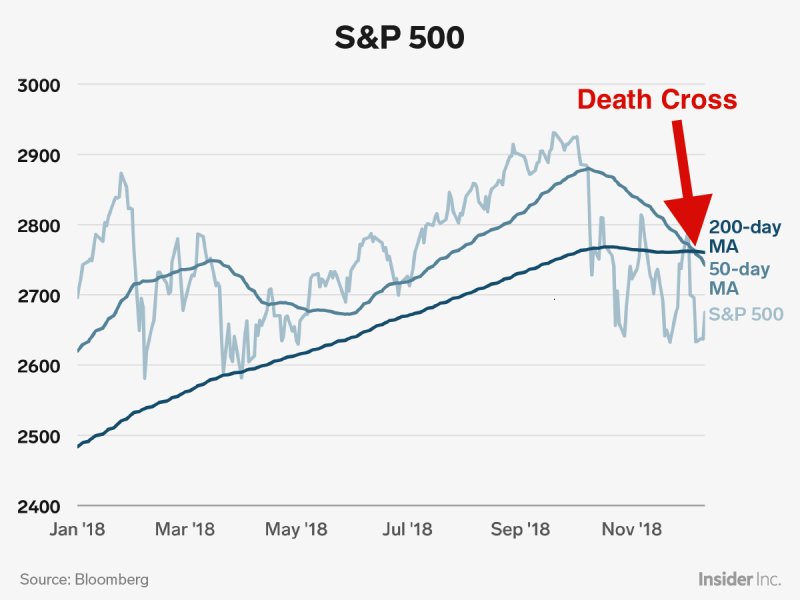

- The dreaded technical 'death cross' has formed in the S&P 500.

- A death cross occurs when the 200-day moving average falls below the 50-day moving average.

- The S&P 500 experienced a death cross earlier this month, and a new report from Bank of America (NYSE:BAC)'s technical analysts explains why this time could be especially painful for investors.

- "The effects of an S&P 500 Death Cross became amplified when the 5-period slope of the 200 day [moving average] was negative," the analysts wrote.

The stock market's recent drop has come fast and furious, with the S&P 500 plunging nearly 5% in the last week and seeing its losses total 8% in three months. The benchmark index even briefly slipped into a correction — defined by a loss of at least 10% from its recent peak. And while trade tensions appear to be thawing, giving investors some hope, there's a technical indicator that poses a threat to bullish momentum.

The 'death cross.'

A death cross forming in the S&P 500 is never a welcome development for investors. After all, the long-term technical indicator denotes short-term momentum is slowing, and is widely viewed as a bearish signal.

And this time around, the death cross could prove even more damaging, according to a new report from Bank of America's technical analysts.

The current death cross — when a security's short-term moving average falls beneath its 200-day moving average, or in popular cases the 50-day falling beneath its 200-day — which formed on December 7, features a declining 200-day moving average. That bodes particularly poorly for the market, if history is any indication.

Zooming out and examining more historical context for death crosses featuring falling 200-day moving averages paints an even grimmer picture.

The percentage of time the market rose following S&P 500 death crosses while the 200-day was in decline dropped to 25% from 59.43% for the 20-day return period, according to the report.

Furthermore, "the standard deviation of returns dropped across all return periods, implying more consistent inhibited returns after a Death Cross with a declining 200-day MA."

The analysts noted the current death cross is just the 47th-ever such formation in the S&P 500 since 1928.

Now read: