In the decade spanning from 2013 to now, tech stocks have led the pack in terms of delivering returns to investors, helping push the broader market towards a series of all-time highs with double- and sometimes even triple-digit yearly gains.

During this period, being heavily invested in growth has been the fastest route towards building wealth in the stock market. However, those who navigated the pandemic-induced crash of 2020 and the bear market of 2022 are well aware that indiscriminate investment in such stocks does not always ensure success.

That's why finding the top tech stocks in the market is one of the greatest keys to success - particularly as the market expects the Fed to start lowering interest rates.

But amidst the cacophony generated by a multitude of news and data, how does one skillfully navigate through it all?

And this is where our flagship Tech Titans Strategy can prove a game-changer.

Using state-of-the-art predictive AI models, ProPicks cuts through the noise to deliver you only the cream of the crop in tech stock-picking for under $9 a month!

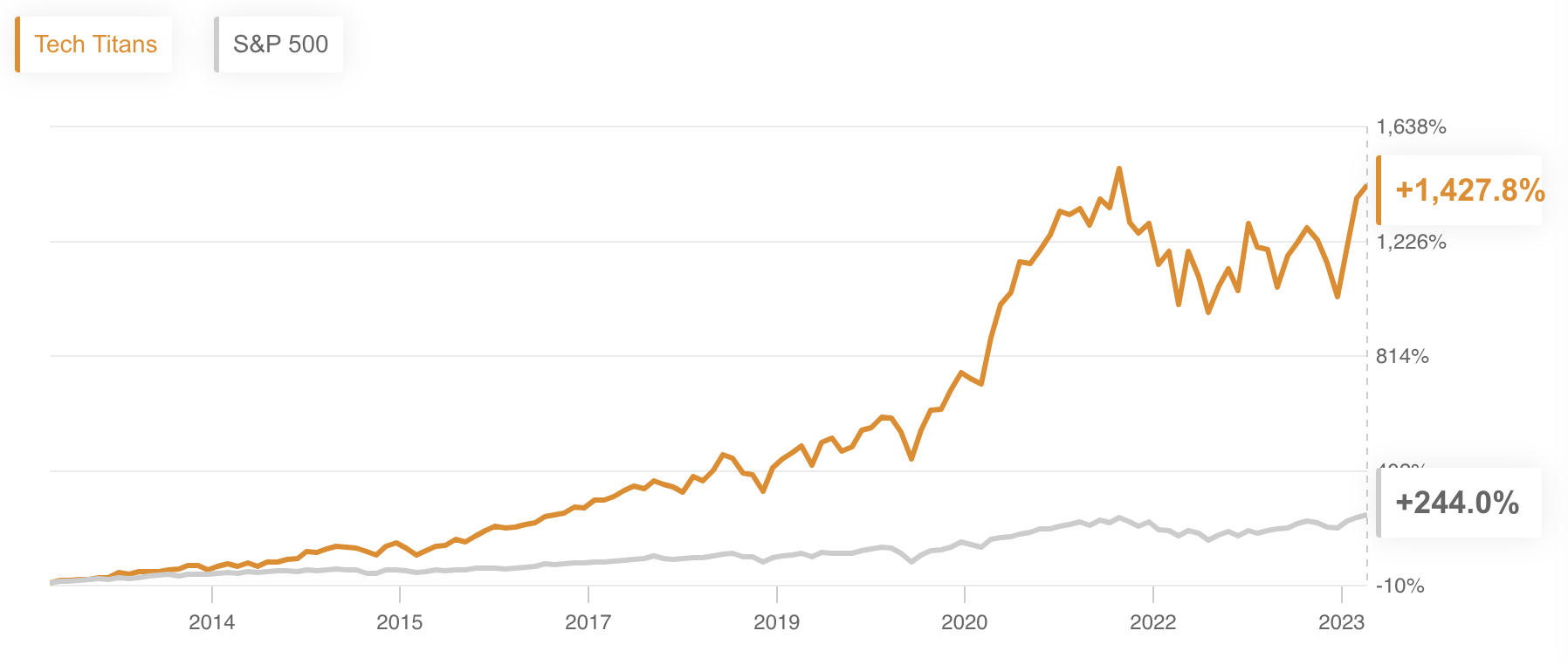

In fact, historical data shows that our strategy would have crushed the S&P 500 over the last decade by an impressive 1,183%, as shown in the chart below:

Source: InvestingPro ProPicks

Featuring current industry leaders, as well as rapidly emerging businesses, each boasting impressive metrics and innovations, our 'Tech Titans' strategy explores the most exciting tech opportunities in the market, highlighting 15 companies on the cutting edge of the sector.

Let's take a deeper look at two of the stocks highlighted within the strategy as of now, namely Allegro MicroSystems, and Photronics , which are covered below in detail.

InvestingPro users can see the full strategy - along with the other five ProPicks strategies - on our ProPicks gallery page.

*Readers of this article get an extra 10% off our annual and 2-year Pro plans with codes PROPICKS2024 and PROPICKS20242.

1. Allegro MicroSystems (ALGM)

- InvestingPro Health Label: Great

- InvestingPro Fair Value: Fairly valued (10.0% Upside)

- Forward P/E Ratio: 26.8x

- Dividend Yield: 0.0%

Allegro Microsystems (NASDAQ:ALGM) designs, develops, manufactures, and markets sensor integrated circuits (ICs) and application-specific analog power ICs for motion control and energy-efficient systems.

The company sells its products to original equipment manufacturers and suppliers primarily in the automotive and industrial markets through its direct sales force, third-party distributors, independent sales representatives, and consignment.

Shares are up 18.6% in the past month and up 1.7% year to date.

What do Wall Street analysts say?

According to analysts surveyed by InvestingPro, Allegro MicroSystems is Fairly Valued with 18.4% Upside.

Most recently, in February, Wolfe Research upgraded Allegro MicroSystems from Peerperform to Outperform with a price target of $35.00.

Key recent news

Earlier this month, Allegro MicroSystems reported Q3 earnings of $0.32 per share on revenue of $254.98 million. Analysts were looking for $0.29 earnings on revenue of $254.95M.

2. Photronics (PLAB)

- InvestingPro Health Label: Excellent

- InvestingPro Fair Value: Fairly valued (21.3% Upside)

- Forward P/E Ratio: 15.6x

- Dividend Yield: 0.0%

Photronics (NASDAQ:PLAB) specializes in the manufacture and sale of photomask products and services. Photomasks, integral in the production of integrated circuits and flat panel displays (FPDs), are essential tools used to transfer circuit patterns onto semiconductor wafers, FPD substrates, and a variety of electrical and optical components.

Shares are up 6.8% in the past month and down 0.4% year to date.

What do Wall Street analysts say?

According to analysts surveyed by InvestingPro, Photronics is Fairly Valued with 2.5% Upside.

Key recent news

Earlier today, Photronics reported Q1 earnings of $0.48 per share on revenue of $216.33M. Analysts were looking for $0.49 earnings on revenue of $220M.

The company also provided its guidance for Q2/24, expecting EPS of $0.50-$0.58, versus the consensus of $0.56, and revenue of $226-236M, versus the consensus of $230M.

Join the elite circle of ProPicks users and start outperforming the market today. Remember, it's not just about the stocks you pick; it's about picking the right tool for the job. And with ProPicks, you're always one step ahead.

Subscribe here and never miss a bull market again!