HONG KONG (Reuters) -Shares of China Evergrande New Energy Vehicle Group Ltd rose 11.1% to HK$3.92 on Monday, after the company said it planned to raise around $347 million in a share placement.

Embattled property developer China Evergrande's electric vehicle (EV) unit said on Friday it would issue about 900 million shares, or 8.3% of the enlarged capital, at HK$3 apiece through a top-up placement.

The new shares are priced at a 15% discount to their Friday's close of HK$3.53.

Evergrande, the world's most indebted developer which has been stumbling from debt-repayment deadline to deadline as it grapples with more than $300 billion in liabilities, said last month it plans to give future priority to its electric vehicles business over real estate.

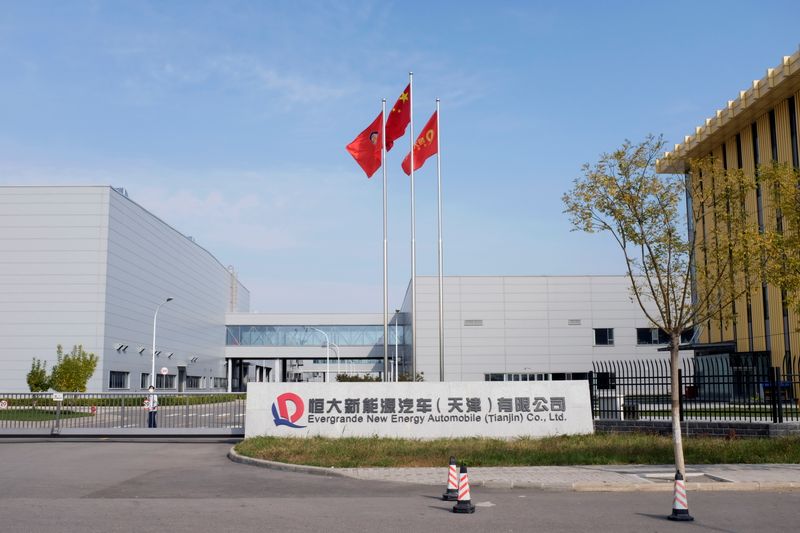

In a filing late on Friday, Evergrande New Energy Vehicle said it intends use the proceeds on the research and development and production of its new energy vehicles, paving the way for putting the cars into production.

The EV unit has already done a top-up placement earlier this month, raising HK$500 million ($64.17 million) by issuing 174.8 million shares at HK$2.86 a piece.

Evergrande's total holdings in the EV unit will drop to 58.54% from 63.84% after the new fundraising.

The unit is seeking Chinese regulatory approval to sell its inaugural Hengchi 5 sport-utility vehicles, as the embattled company vows to start making cars early next year.

Shares of Evergrande Group declined 1.1%, while Hang Seng Index eased 0.4%.

($1 = 7.7914 Hong Kong dollars)

(Reportong by Clare Jim; Editing by Tom Hogue, Ana Nicolaci da Costa and Louise Heavens)