By Bansari Mayur Kamdar and Medha Singh

(Reuters) -Semiconductor stocks fell globally on Tuesday as an expected visit by U.S. House of Representatives Speaker Nancy Pelosi to Taiwan fueled a fresh escalation in tensions between Washington and Beijing.

China views the visit by Pelosi, a long-time critic of Beijing, as sending an encouraging signal to the pro-independence camp in Taiwan and has repeatedly warned against it.

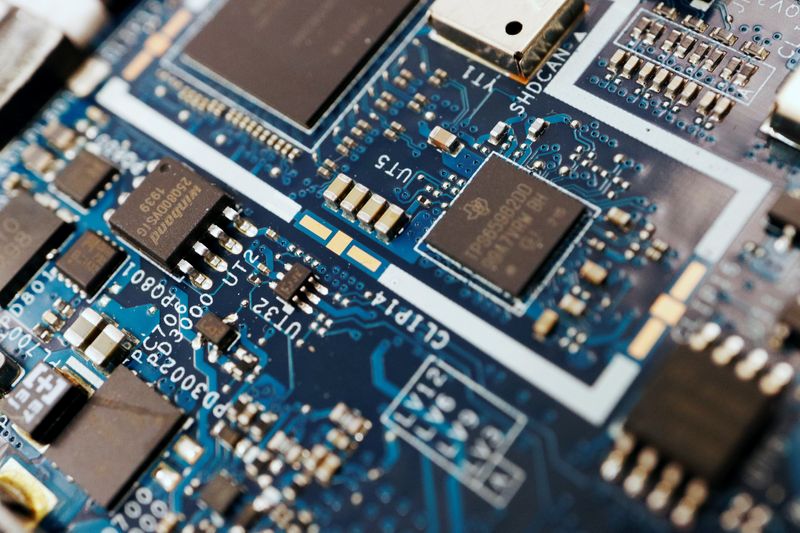

Taiwan is home to the world's biggest contract manufacturer of semiconductors, Taiwan Semiconductor Manufacturing Co Ltd (TSMC), and peer United Microelectronics Corp (UMC). Shares of the companies fell 2.4% and 3%, respectively.

Taiwanese stocks dropped 1.6%, marking their biggest percentage decline in three weeks, while Chinese stocks posted their biggest fall in more than two months on mounting geopolitical tensions.

"Chip stocks are really exposed to Asia. Some of them, especially chip equipment companies, have 70% of their sales in that region so it's a big deal for them," said Jack DeGan, chief investment officer at Harbor Advisory.

U.S. chip stocks including Nvidia (NASDAQ:NVDA) Corp, Intel Corp (NASDAQ:INTC), Qualcomm (NASDAQ:QCOM) and Micron Technology Inc (NASDAQ:MU) fell between 0.7% and 1.9%.

The Philadelphia SE Semiconductor index shed 1.1%.

In Europe, Infineon (OTC:IFNNY) declined 1%, while Dutch firms ASML, ASMI and BESI fell between 2% and 3%.

"The longer term impact is unlikely to be significant unless the situation escalates, which wouldn't be my expectation right now," said Andrea Cicione, head of strategy at TS Lombard in London.

Chinese warplanes were reportedly buzzing the line dividing the Taiwan Strait on Tuesday shortly before the expected arrival of Pelosi.

Shares of Xi'an Tian He Defense Technology Co, a Chinese defense equipment manufacturer, jumped 20%.