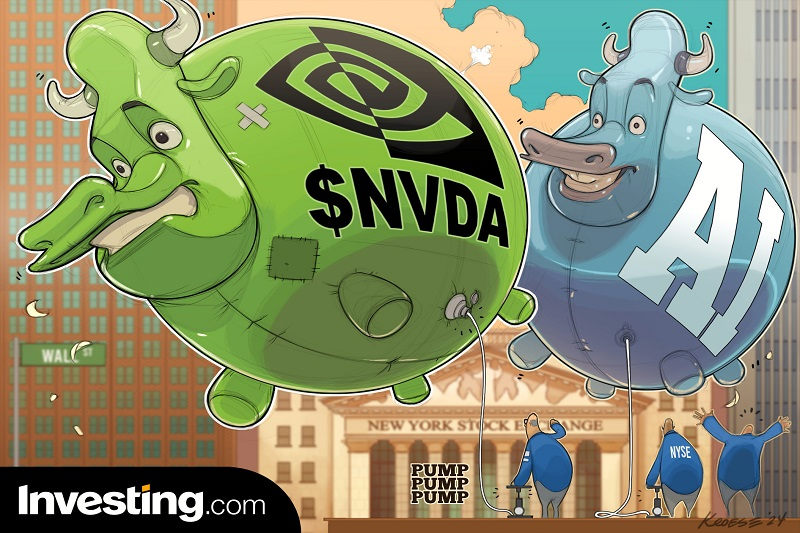

Investing.com - NVIDIA Corporation (NASDAQ:NVDA) on Tuesday became the most valuable company in the world in stock market terms, reaching a market capitalization of $3.33 trillion. However, it did not hold the crown for long.

From Thursday to midday Friday, shares of this tech giant have corrected around 6.8%, wiping out approximately $226.1 billion in market capitalization in two days. On Friday, Nvidia's shares closed at $126.57, 3.22% below the previous closing price.

With this, Nvidia has dropped back to the third position among the most valuable companies, surpassed by Apple (NASDAQ:AAPL), with a capitalization of $3.2 trillion, and Microsoft (NASDAQ:MSFT), with $3.34 trillion. Even so, Nvidia has managed to remain part of the select group of companies with a market value exceeding $3 trillion.

- Is it time to invest in Nvidia?... Or not? Find out with InvestingPro, where you will also find a wide variety of stocks and proven strategies to maximize your gains: Click here to get an EXCLUSIVE DISCOUNT on your one-year subscription.

While the last two sessions have not been bright for Nvidia, its shares still maintain a gain of approximately 4.8% since its 10-to-1 stock split two weeks ago, an event that has increased interest from investors, mainly retail. So far this year, its performance exceeds 213%.

Additionally, the company remains a major player in the market, and its shares continue to rise following new server orders from Elon Musk's AI startup.

Investors with strategic positions in the tech sector now have the opportunity to know in a timely manner whether this drop could be an opportunity to invest in Nvidia or if it would be a sell signal.

If you are an InvestingPro subscriber and follow the ProPicks strategies “Tech Titans” or “Outperform the S&P 500,” you knew months ago about Nvidia's potential. ProPicks strategies are AI-driven selections with stocks that have the highest potential to outperform market benchmarks and are updated monthly, informing investors of which stocks to buy and sell each month.

If you are not an InvestingPro subscriber, now is the right time because in a few days you will be informed about the adjustment of these strategies and will know if Nvidia still has the potential for explosive gains or if it is time to opt for other alternatives to achieve much higher than average market returns.

The potential of these strategies

Through “backtesting,” it is possible to observe that in the period between January 1, 2013, and June 1, 2024, “Outperform the S&P 500” has delivered an explosive return of 1,052.6%, surpassing the S&P 500’s return of 270% by 782.6%.

And as if that were not enough, the “Tech Titans” selection has shown a total return of 1,770.9%, a 1,500.8% higher return than the S&P 500 during this period.

How to access the strategies

The first thing you need to do is subscribe to InvestingPro. Now is the time! You can now get your subscription with up to 50% off, and if you use the coupon MEJORPRO at this link, you will get an additional 10% off on 1- and 2-year plans. This is valid only for a few days!

If you are subscribed to InvestingPro, you can also access Nvidia’s ProTips, which provide clear perspectives highlighting the company's positive and negative aspects based on extensive financial data analysis, as well as market value metrics, analysts' target prices, company valuations, and hundreds of other metrics to conduct your analysis and make the best decision.

With your access, you will know, for example, that there are analysts optimistic about Nvidia's potential. InvestingPro reports that the consensus among analysts assigns an average target price of $130.08 to Nvidia, but some assign, at the high end, a price of up to $200 per share.

Among the latest analyst updates is Melius, who reaffirmed its "Buy" rating with a target price of $160.00.

What about Microsoft and Apple?

If you are an investor in these other giants, Microsoft and Apple, it will be worth checking out the “Dominate the Index” strategy, which comprises the best Dow Jones 10 stocks, verified monthly by InvestingPro's powerful AI.

These stocks have been part of this strategy since its launch, so if you want to achieve maximum returns, this selection will tell you how to use these stocks strategically to achieve even greater benefits.

According to “backtesting,” the “Tech Titans” selection has shown a total return of 631.6%, 436.4% higher than the S&P 500.

InvestingPro: UNIQUE OPPORTUNITY

As investors, we are always looking for investment opportunities and wondering whether it is time to buy or sell a stock. But that should no longer be a concern, as by using InvestingPro's tools, you will have access to exclusive data and analysis to determine the right time to buy or sell a stock immediately.

With the MEJORPRO coupon, you will get a spectacular discount when signing up for our 1- and 2-year plans

Note to the reader: This article is not an investment recommendation. It is suggested to conduct thorough analysis using InvestingPro's tools before making any investment.