By Ross Kerber

BOSTON (Reuters) - A 2016 Nobel Prize winner said executive pay plans have grown too complex and cited the overuse of consultants, remarks that pay specialists on Tuesday said echoed the complaints of many investors about ever-more detailed compensation statements.

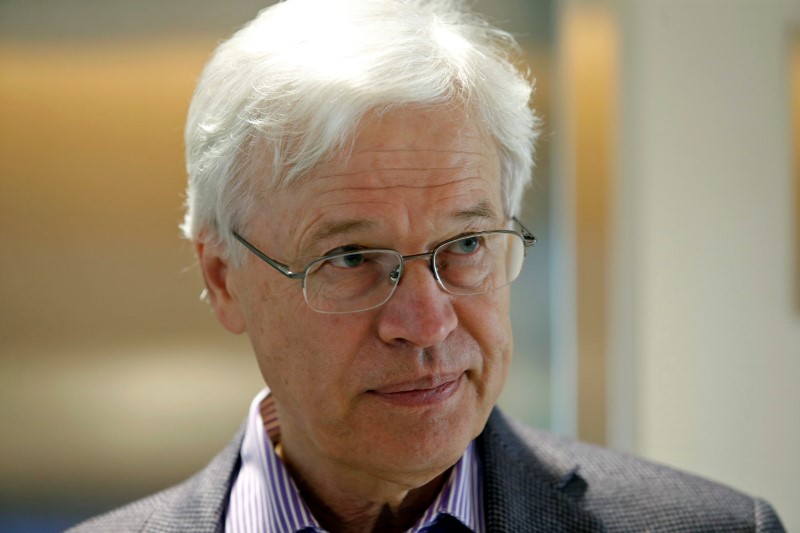

Finland's Bengt Holmstrom, a co-winner of the Nobel Economics Prize for his work on contract theory, said that too many pay plans include contingencies or long-term performance goals that make them unwieldy.

"They have got to get to something simpler," the Massachusetts Institute of Technology professor said of corporate boards. He was speaking at a press conference the school held on Monday after the latest Nobel Prize winners were announced.

Holmstrom's work addresses a host of questions from how best to reward executives to whether schools and prisons should be privately owned.

Asked what changes he would like to see made to pay packages, Holmstrom said, "Robust plans that don't change every year."

At telecommunications network provider Nokia Corp (HE:NOKIA) where Holmstrom was a board member for 13 years until 2012, "executive compensation went from reasonable to absolutely dreadful, and dreadful because of all the consultants," he said.

In his later years on the board, "it was not Nokia really deciding itself anymore what to do," he said.

A Nokia spokeswoman declined to comment.

Executive pay has soared while income for typical U.S. workers has stagnated. Median total compensation for S&P 500 chief executives in 2015 reached $10.4 million, according to pay consulting firm Equilar, up from $8.9 million in 2011.

While the gap between executive and worker pay has drawn political criticism, investors overwhelmingly approve most CEO pay packages in advisory votes. Shareholders complain instead about how unwieldy pay has become, said specialists including Marc Hodak, who advises companies and private equity firms on compensation.

Pay plans that take up 20 pages of corporate proxy statements could often be boiled down to four pages, he said in an interview on Tuesday.

Hodak blamed the plethora of rules which limit board discretion in order to make pay decisions transparent for reviewers like Institutional Shareholder Services.

"The problem is, governance critics don't like subjectivity," he said.

David Kokell, ISS' head of U.S. compensation research, said in an interview on Tuesday that many of the measures were necessary. "If it's just based on a subjective assessment, it's hard for the investor to evaluate how closely payouts are linked to actual performance."