By Jamie McGeever

(Reuters) - A look at the day ahead in Asian markets from Jamie McGeever, financial markets columnist.

China's central bank is expected to leave key interest rates on hold on Thursday, but the pressure to ease is growing almost by the day.

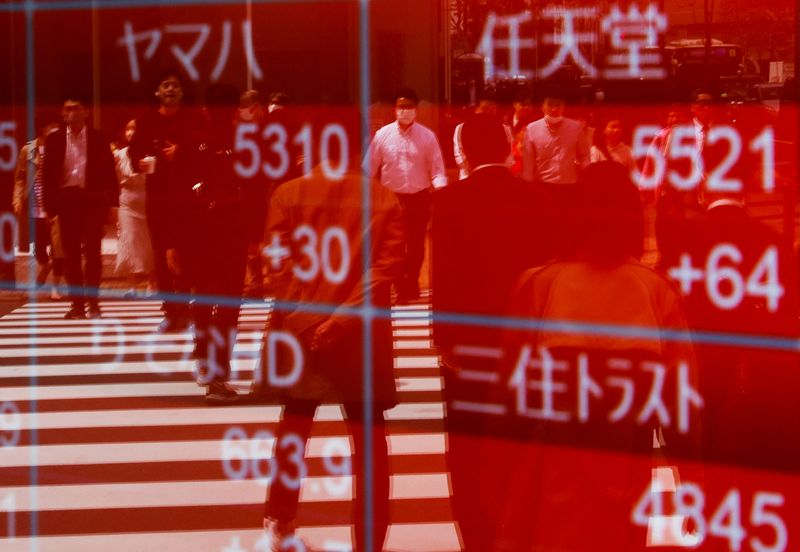

Japanese trade, Australian unemployment and Hong Kong inflation data top the regional economic calendar on Thursday, and investors will be hoping the continuing corporate earnings-fueled gains on Wall Street will drive local risk appetite.

The Dow Jones Industrials is now up eight days in a row for the first time since September 2019. It last posted a nine-day winning streak in September 2017.

Sentiment was again positive during the U.S. session on Wednesday, but that may ebb and flow depending on how investors digest the top-tier U.S. earnings and outlooks released after the closing bell, including from IBM (NYSE:IBM), Tesla (NASDAQ:TSLA) and Netflix (NASDAQ:NFLX).

The focus in Asia on Thursday turns to the People's Bank of China (PBOC).

After keeping the rate on maturing medium-term policy loans rolled over this week unchanged, all 26 analysts in a Reuters poll expect the one- and five-year benchmark loan prime rates to be left unchanged at 3.55% and 4.20%, respectively.

The clamor for further easing, however, is building and unlikely to relent - the economy is flirting with deflation, growth is weak, youth unemployment is over 20% and there is no sign of a turnaround on the horizon.

But the PBOC doesn't act impulsively. Its 10 basis point easing in June was its first rate cut in almost a year, and only the fourth since the pandemic.

The main argument against cutting rates - and it's a valid one - is the currency. The yuan is languishing near November's 15-year low against the dollar, and widening the U.S.-China yield differential will add to the downward pressure and risk triggering large-scale capital outflows.

Given all that, it's little wonder China's assets continue to trade poorly, even though the degree of underperformance is startling. Chinese blue chip shares fell for a third day on Wednesday and are basically flat for the year - significantly lagging Asian, U.S. and global benchmarks.

Meanwhile, Chinese authorities on Wednesday pledged to make the private economy "bigger, better and stronger" with a series of policy measures designed to help private business and bolster the flagging post-pandemic recovery.

The measures include protection for the property rights of private firms and entrepreneurs and steps to ensure fair market competition by breaking down market-entry barriers.

These are no doubt welcome steps for investors, but the tangible benefits will not be felt for a long time.

Elsewhere in Asia on Thursday, another steep fall in imports is expected to narrow Japan's June trade deficit to 46.7 billion yen, which would be the smallest gap in almost two years of uninterrupted monthly trade deficits.

A bullish yen signal?

Here are key developments that could provide more direction to markets on Thursday:

- China interest rate decision

- Japan trade (June)

- Australia unemployment (June)

(By Jamie McGeever; Editing by Josie Kao)