(Bloomberg) -- A rebound in Indian equities, from their worst week in a decade as of Friday, proved to be short lived.

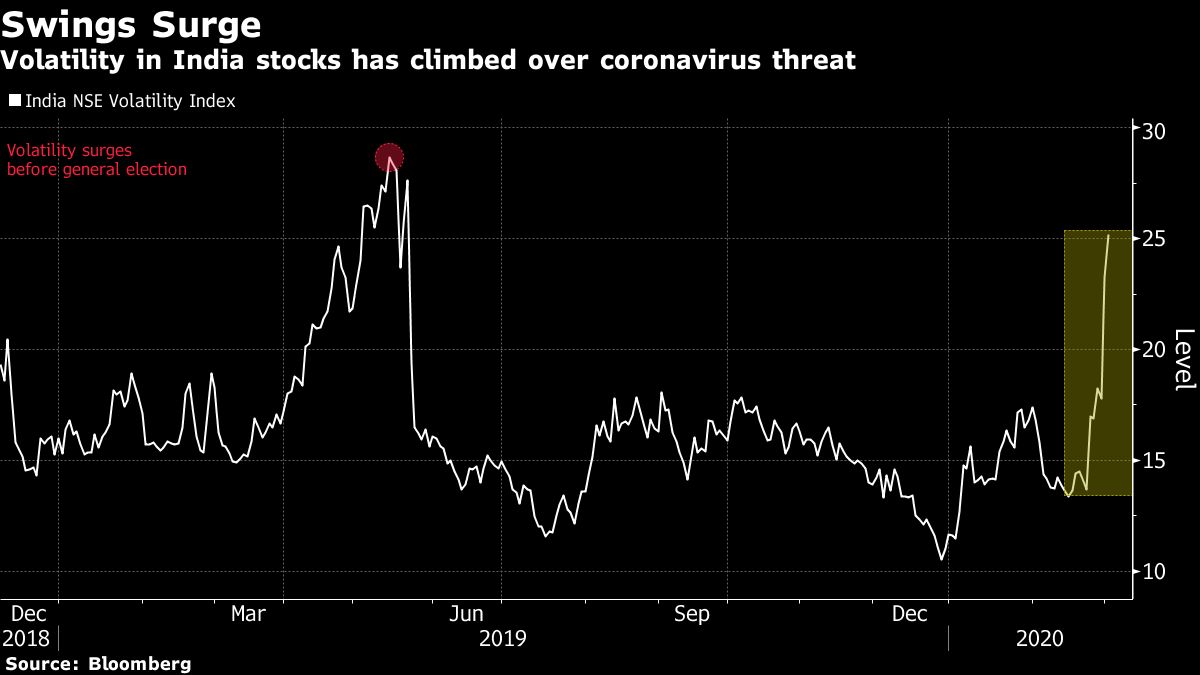

Stocks reversed gains in the last hour of the session, with the benchmark index briefly nearing the correction zone, after the health ministry reported two new coronavirus cases on Monday. The S&P BSE Sensex closed at 38,144.02, down 0.4%, after rising as much as 2.1% earlier in the day. It’s the longest stretch of losses for the gauge in more than nine months, data compiled by Bloomberg show. The NSE Nifty 50 Index fell 0.6% while the India NSE Volatility Index climbed to a nine-month high.

Two people have been diagnosed with the new coronavirus -- one in the country’s capital New Delhi and another in the southern state of Telangana, the Press Information Bureau of India reported Monday.

The nation has so far only recorded three other cases -- all from Kerala in the far south -- who have all since recovered.

Asian markets otherwise largely rebounded Monday on optimism of monetary policy support to ease the impact of the epidemic. Global central banks advocated policy support to coronavirus-hit economies as the death toll topped 3,000.

Strategist View

“Fear of the pandemic will recede only when facts start coming out,” said Umesh Mehta, Mumbai-based head of research at Samco Securities Ltd. “We expect the index to stay volatile with sessions of gains followed by selling as more details on the spread of coronavirus emerge.”

The Numbers

- Sixteen of the 19 sector indexes compiled by BSE Ltd. fell, led by a gauge of metal companies

- State Bank of India Ltd. dropped 5.1% and was the biggest drag on the Sensex while HCL Technologies Ltd. had the largest gain, increasing 2.8%

- Multi-screen movie-theater operator Inox Leisure Ltd. plunged 12%, its sharpest decline since January 2014, while peer PVR Ltd. dropped 9.6% to a five-month low

- Maruti Suzuki’s 2020 YTD Sales Rise 0.3% to 301,233 Units

- Indian Rupee Turns Sole Asia Loser After New Virus Cases Emerge

- Godrej Consumer Raised to Outperform at Credit Suisse (SIX:CSGN)

- Indian Makers of Steel-Industry Product May Win EU Duty Relief