By Ross Kerber and Elizabeth Dilts

DES MOINES, Iowa/NEW YORK (Reuters) - Wells Fargo & Co (N:WFC) investors gave strong backing to the bank's directors and executives on Tuesday, indicating they are ready to give its revamped leadership time to rebuild from scandal despite a noisy annual shareholder meeting.

Wells Fargo executives said each of the bank's 12 director nominees received more than about 89 percent support from investors and about 92 percent of shares were cast in favor of the pay of Chief Executive Tim Sloan and other leaders.

The figures amounted to a relatively strong outcome, especially when compared with last year.

At the bank's 2017 meeting in Florida, the first since the sales scandal drew sustained national attention, only three of the board's 12 directors received more than 90 percent of shareholders' support and then-Chairman Stephen Sanger received just 56 percent approval.

On average, S&P 500 directors usually get around 92 percent, and pay is backed by around 89 percent of votes cast, according to pay consultant Semler Brossy.

The results signal investors are giving the new board members and other changes a chance, said Jill Fisch, a University of Pennsylvania Law School professor and corporate governance expert.

"The company has made a lot of dramatic moves, and shareholders seem to be saying they appreciate it and are going to wait to see if they are successful," Fisch said.

Though occasionally confronted by protesters and skeptics, Sloan and bank Chair Elizabeth Duke mostly stayed on their message of atonement during the 2-1/2 hour meeting.

They faced tough questioners on topics including environmental issues and their business with firearms makers at a time when other banks have reviewed or cut back on those relationships.

But they received loud applause a number of times from the audience of several hundred in the Des Moines Marriott hotel ballroom.

When California State Treasurer John Chiang rose to challenge Sloan's pay, Duke responded that "I disagree with your analysis of it. Tim's time with the company is an advantage," a comment that received louder applause than Chiang received.

Speaking before the meeting, individual investor Cherie Mortice of Des Moines said she voted for Sloan and other directors, saying it was worth giving the bank a chance to recover.

"I think he's kind of hoping to restore trust. I'm really hopeful," she said.

None of three shareholder measures on the bank's proxy received a majority of support, bank executives said.

The event came days after Wells Fargo said it would pay regulators $1 billion to settle matters related to mortgage and auto lending abuses.

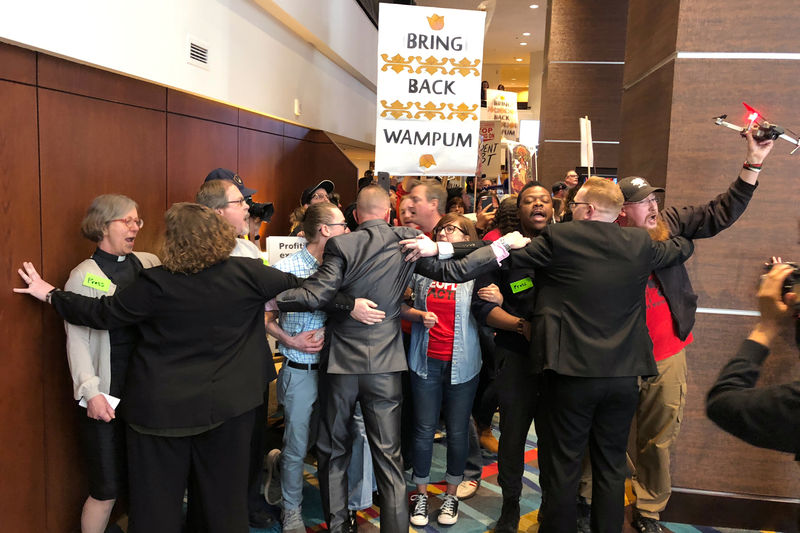

About 100 protesters marched into the lobby of the hotel before the meeting, holding signs for various causes.

In 2016 the bank admitted employees had opened potentially millions of sham accounts, triggering a leadership revamp.

The Federal Reserve in February ordered Wells Fargo to halt growth until governance and controls improve.

Wells Fargo, though based in San Francisco, has held the meeting in other locations in recent years.

Tuesday's meeting at moments laid bare divisions in Iowa over one of the state’s largest private employers. State leaders, including Senate Majority Leader Jack Whitver, a Republican, spoke to welcome executives.

Others questioned whether Sloan and others were right for the task of reform.

"If I ran my farm the way Wells Fargo ran their business, I'd be kicked out of Marshall County. I'd be a failure," said one speaker, who identified himself as a retired Iowa farmer.

Wells Fargo's home mortgage and home equity businesses have about 14,500 workers in and around Des Moines.

Wells Fargo shares ended down 0.2 percent at $52.51 on Tuesday.