(Bloomberg) -- Investor anxiety is visible just about everywhere in Hong Kong’s markets as recession warnings and escalating protests strain sentiment to breaking point.

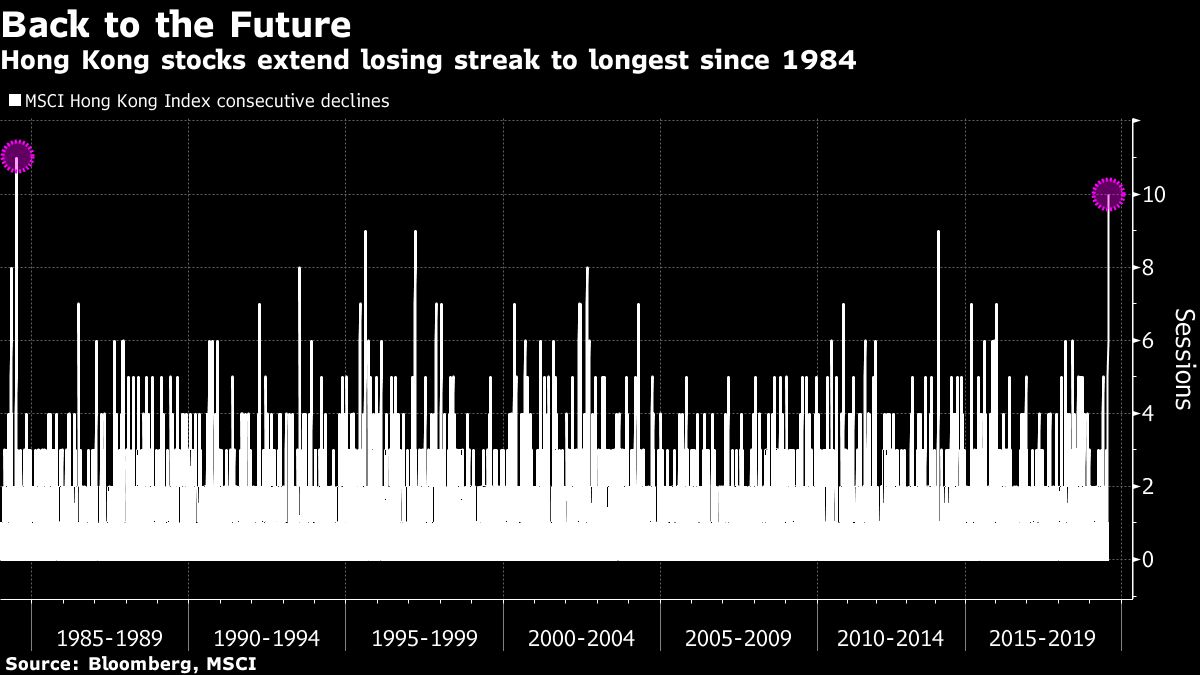

While most of the world recovered Tuesday from a yuan-induced meltdown, Hong Kong saw the biggest spike in interbank rates in more than a decade, the longest stretch of equity declines since 1984 and the wildest stock swings in four years. Bears reloaded on the local dollar in a way not seen since 2017, betting it will soon break through the weak end of its trading band.

The threat from the trade war and weeks of local unrest is already showing in the property market, as well as tourist numbers, hotel occupancy and retail sales. A weak yuan is another cause for concern, as it will damp spending from mainland visitors and pressure earnings for firms that rely on China. Profits for members of the Hang Seng Index are forecast to drop the most since the global financial crisis this year, data compiled by Bloomberg show.

“There is risk-off sentiment in general,” said Michael Liang, chief investment officer at Foundation Asset Management (HK) Ltd. “Hong Kong’s political risk is definitely a part of it. Fewer people are willing to invest in the city’s assets.”

In some of the Chinese government’s strongest comments yet on the unrest that’s gripped the Asian financial hub since June, officials on Tuesday urged Hong Kong citizens to stand up to protesters. That followed Monday’s general strike that led to traffic chaos, violence, tear gas and flight cancellations in the most disruptive day since the protests started.

The MSCI Hong Kong Index -- which unlike the more widely-used Hang Seng Index doesn’t include Chinese heavyweights -- is suffering its worst stretch of losses since 1984. That was the year U.K. Prime Minister Margaret Thatcher and Chinese Premier Zhao Ziyang signed the Sino-British Joint Declaration in Beijing, committing to some of the terms for the handover of Hong Kong in 1997.

Hong Kong’s currency, while pegged to the greenback, is also influenced by the yuan due to the city’s close economic ties with China. It fell the most in more than three-and-a-half years Monday, tracking losses across Asia. The Hong Kong dollar’s 12-month forward points briefly spiked to 163 Tuesday, in a sign that some global hedge funds may betting against the currency. That was highest level since early 2017.

The moves are affecting local borrowing costs, which underpin mortgages in one of the world’s least affordable housing markets. The rates are already facing pressure from tightening liquidity, which sent some tenors to decade-highs last month. One-month Hong Kong dollar interbank rates, known as Hibor, jumped the most since 2008 Tuesday.

Rates have remained ultra-low in Hong Kong since the financial crisis, while a huge amount of cash sloshing around in the financial system has helped fuel rallies in the stock and property markets. Now, stocks are falling and data last week showed July home sales fell 32% in value from a year earlier, while volume was down 21%.

And it could get worse: market watchers have warned home prices and retail rents may fall in the short term because of recent political unrest. A residential site was sold last month in a government tender for HK$11,842 ($1,511) per square foot -- the lowest price in more than two years. A purchasing-managers index fell to the lowest since March 2009 in July, signaling a contraction for a 16th month.

Hong Kong has a track record of resilience in the face of crises. From Asia’s financial implosion during the late 1990s to the SARS outbreak in 2003 and the global credit crunch of 2008, the city has always found a way to come out stronger.

That doesn’t mean a turnaround is near, however. The recent turmoil is making it almost impossible for investors to discern the outlook for Hong Kong assets.

“We don’t advise investors to time the market,” said Tai Hui, JPMorgan (NYSE:JPM) Asset Management chief market strategist for the Asia-Pacific region. “It is a very difficult exercise.”