By Emma-Victoria Farr

FRANKFURT (Reuters) - Healthcare executives and investors expect an uptick in initial public offerings and corporate dealmaking in 2025, with geopolitical tensions overtaking funding challenges as the biggest risk to the sector, Jefferies' annual healthcare report showed on Tuesday.

WHY IT'S IMPORTANT

Healthcare is an active sector for M&A, with deals such as Johnson & Johnson (NYSE:JNJ)'s acquisition of heart device business Shockwave Medical (NASDAQ:SWAV) for $13.1 billion announced in April, and KKR's acquisition of a stake in health tech firm Cotiviti in February.

With deal activity globally muted in recent months, 72% of the survey's participants expect healthcare M&A levels to be higher in 2025, with around 50% of private equity respondents identifying Europe as a region of opportunity for the sector.

Now in its seventh year, the report surveys around 500 senior people from the healthcare sector, spanning institutional and private equity investors, as well as executives at healthcare companies.

MARKET RISKS

Geopolitical risks are seen as the biggest risk for healthcare investors, with 40% highlighting it as the greatest problem, up from 26% last year.

Funding and pricing cuts continue to be a concern, and were a narrow second choice by respondents as the greatest issue for the sector - or 36%, up from 33% who were worried about a lack of funding last year.

North America will continue to dominate the dealmaking landscape, viewed by 74% of respondents as the biggest market opportunity.

Continental Europe slipped, selected by 36% of respondents against 43% last year, while those who saw the UK as the biggest opportunity fell slightly to 18% from 20% in 2023.

China has recovered slightly from last year, highlighted by 16% of respondents as offering the best opportunity, up from 12% in 2023.

BY THE NUMBERS

There is confidence in companies looking to list, with 64% of respondents expecting more healthcare IPOs in 2025, in a strong signal that the equity capital markets will be making a comeback.

Of those polled, 20% expect equity financing and IPOs to dominate transactional activity – the highest number since Jefferies started the survey in 2018.

KEY QUOTE

"This year's report shows a noticeable uptick in confidence for the sector as we look ahead. This confidence is reaffirmed by the elevated investment activity across the market towards the end of this year, indicating that we have turned a corner," said Tommy Erdei, global joint head of healthcare investment banking at Jefferies.

KEY FINDINGS

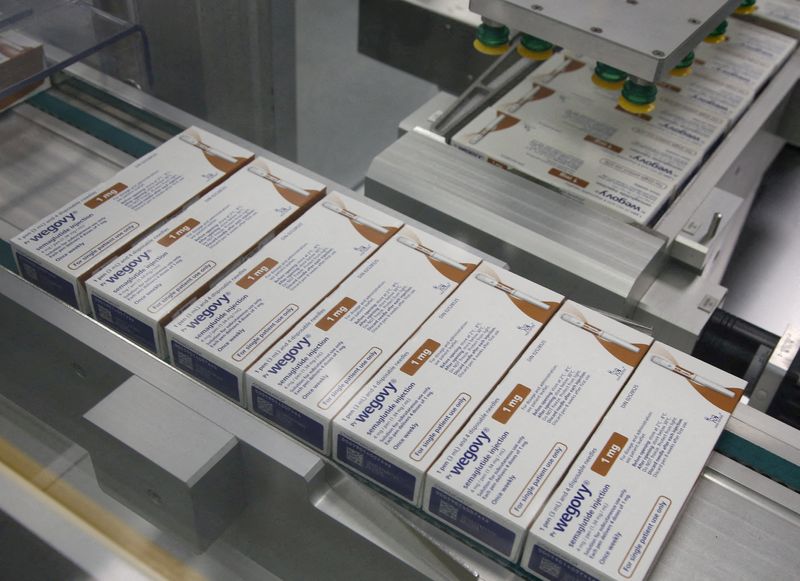

Weight loss drugs are here to stay, with 47% of respondents indicating that the impact of these treatments will be large and sustainable long term, up from just 33% last year.

CONTEXT

Earlier in November, Novo Nordisk (NYSE:NVO)'s Wegovy weight-loss drug sales beat its forecast, in an obesity drug market that some analysts forecast could be worth about $150 billion by the early 2030s. At the moment demand outweighs supply.

MARKET OUTLOOK

Respondents were optimistic on market forecasts, with two thirds of respondents believing Britain's blue chip FTSE 100 index will be higher by the end of 2025. This confidence is even more pronounced for healthcare specifically, with 73% expecting the MSCI World Healthcare Index to close higher in 2025 too.