(Bloomberg) -- From JPMorgan Chase & Co. (NYSE:JPM) to Morgan Stanley (NYSE:MS), strategists are turning more bearish on US stocks. Their peers at Deutsche Bank AG (NYSE:DB) aren’t having it.

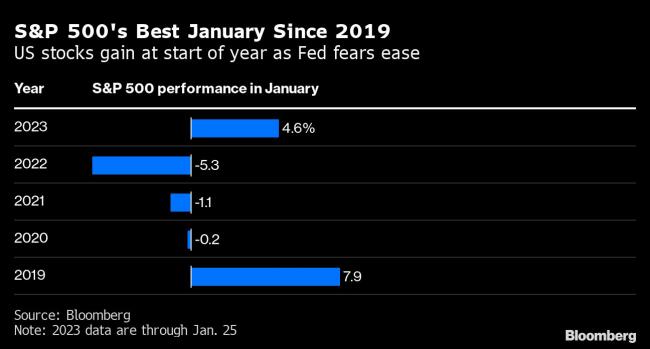

A team led by Binky Chadha is maintaining its view that the S&P 500 can rise to 4,500 points by the end of the first quarter, about 12% above current levels, before slumping amid an economic contraction. That’s even as the benchmark is headed for its best January since 2019.

“We view the rally as having further to go,” the strategists wrote in a note dated Jan. 25. “While a number of leading indicators have fallen steeply, raising the alarm, there are several reasons for a continued pushing out of the timing of a potential recession.”

Among those are strong household and corporate balance sheets, hesitancy to fire employees and excess savings accumulated at the start of the pandemic, they said.

“I wouldn’t necessarily describe it as a bullish view on fundamentals. The basic driver of the rally in our view is a positioning squeeze,” Chadha said in a separate interview on Bloomberg TV on Wednesday.

America First Becomes America Last in Great Market Reversal

Deutsche Bank’s short-term outlook for a strong rally in US stocks is becoming increasingly isolated. JPMorgan’s Marko Kolanovic warned that the new year rally in equities will clash with an economic slowdown. Morgan Stanley’s Michael Wilson also expects a challenging 2023 as the US economy suffers through an earnings recession before stocks rally in 2024.

Strategists are increasingly preferring alternative regions for cheaper valuations and exposure to China’s reopening.

Chadha’s team expects the S&P 500 to fall significantly when the recession begins before rebounding to 4,500 by the end of the year. The strategist said the S&P 500 can slide to as low as 3,250 — down 19% from Wednesday’s close.

“A very important aspect of the recession playbook to keep in mind if you’re thinking out 12 months is that equities pretty robustly bottom about halfway through” the year, he said on Bloomberg TV. “They will come all the way back in the fourth quarter.”

The Deutsche Bank (ETR:DBKGn) team called the first-quarter rally back in November, although their 2022 year-end target didn’t pan out, with the benchmark ending the year at 3,839.50 versus their forecast of 4,750 points.