By Christiana Sciaudone

Investing.com -- Markets slipped with weakness appearing among consumers in what is usually the biggest shopping season of the year.

The Conference Board’s consumer confidence gauge fell to 88.6 in December from 92.9 in September, missing economists' forecast of 97.

U.S. lawmakers passed a $900 billion stimulus bill, but any optimism on that was muted by concerns a mutant strain of Covid-19 identified in the U.K. could already be in the U.S.

Airlines were lower despite American Airlines (NASDAQ:AAL), at least, bringing back workers from furlough thanks to the stimulus bill.

Apple (NASDAQ:AAPL) was one of the biggest gainers with self-driving car plans and an Apple-designed battery, reported by Reuters

Peloton (NASDAQ:PTON) gained after announcing it would buy Precor for $420 million to boost its manufacturing presence in the U.S.

Here are three things that may move markets tomorrow:

1. Data will be released early because of the holiday-shortened week

If you like economic data, Christmas is coming a few days early with a slew of indicators set to be released in the holiday-shortened week. Personal income for November is set to drop 0.3% according to consensus, but at a slower pace than the previous 0.7% decline. Consumption is forecast to turn slightly negative. Those are both due at 8:30 AM ET (1230 GMT).

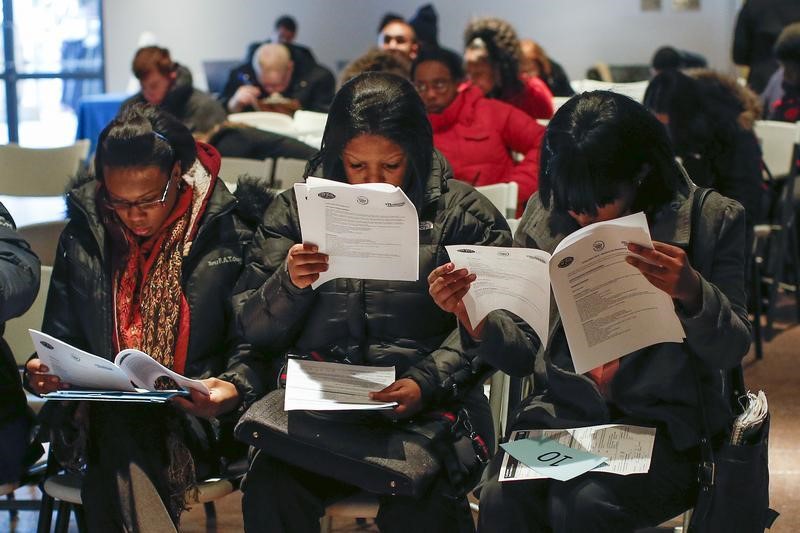

2. Jobless claims

Jobless claims are expected to stay elevated, mirroring virus case numbers. Consensus is for initial jobless claims to be 885,000, same as the prior week. That, along with durable goods orders, are also due at 8:30 AM ET. Also on tap: new home sales and the final December reading of University of Michigan sentiment.

3. Bye-bye Barr

And finally, we'll be saying goodbye to Attorney General William Barr. Wednesday will be his final day in office before he hands over the reins of the Justice Department to Deputy Attorney General Jeffrey Rosen. Look for President Trump to possibly pressure the new guy into initiating various investigations in his final weeks in office.